Solana’s Death Cross Triggers 28% Crash; Recovery Is Difficult

Solana was faced with a sharp decline, plunging to a low multi-house in the middle of wider weakness on the market. The downward trend of Altcoin, exacerbated by recent technical indicators, has made an uncertain recovery.

The future action of Solana prices depends largely on Bitcoin’s performance, because a potential BTC rebound could support the ground turnaround.

Solana investors need a boost

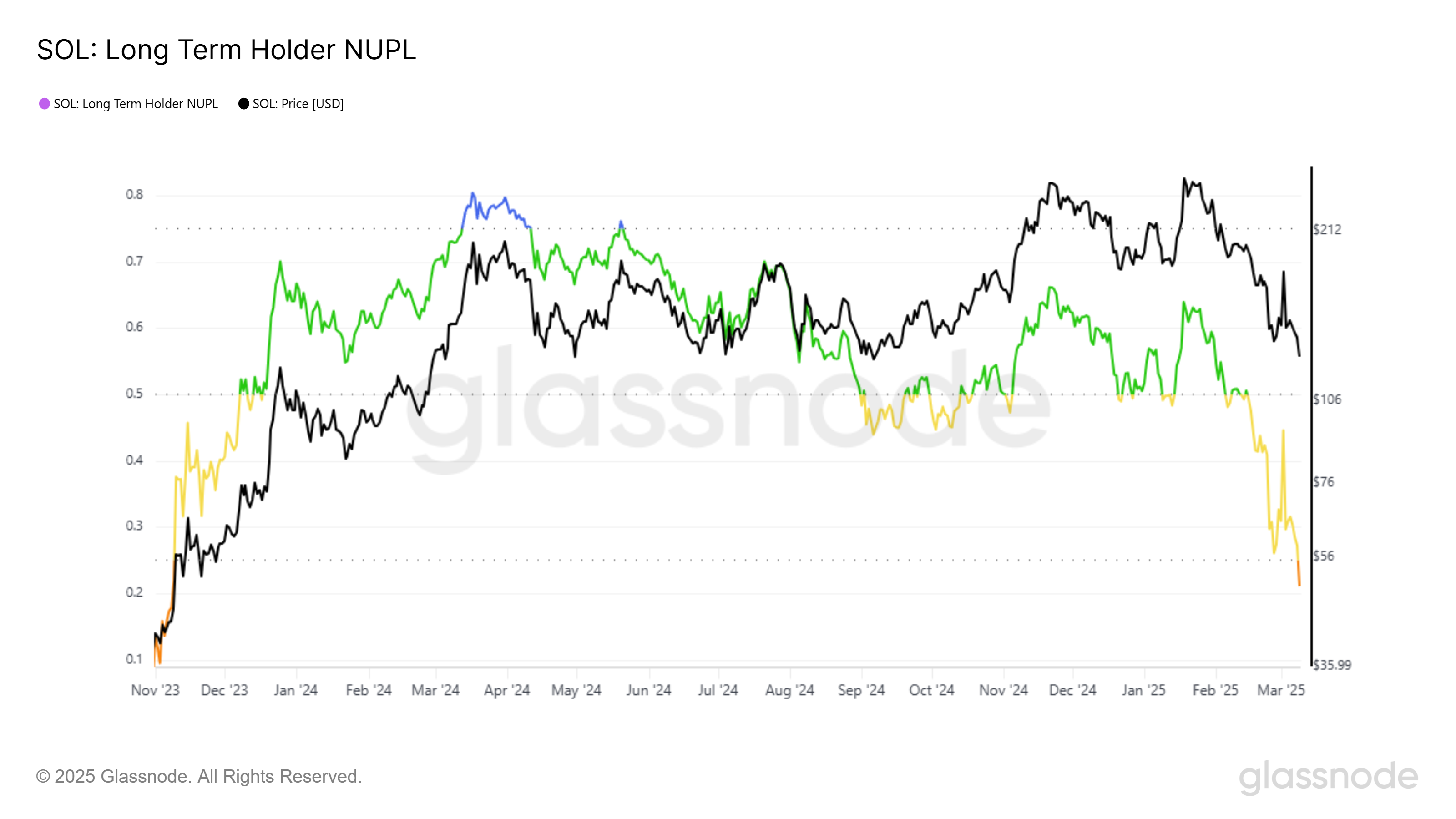

The long -term holder of Solana, the unpaid benefit / loss (LTH NUPL), has entered the fear area, signaling increased market distress. Currently seated at a 16 -month hollow, this indicator reflects the impact of the larger market on the ground investors. As long -term holders undergo an increase in losses, the significant sales pressure potential is increasing, which poses an additional risk of drop.

The feeling among these investors could extend to retail traders if fear intensifies. A mass sale could amplify the down pressure, which makes it more difficult for soil to recover. Unless Bitcoin stabilizes and market conditions are improving, investors’ confidence in Solana should remain small in the short term.

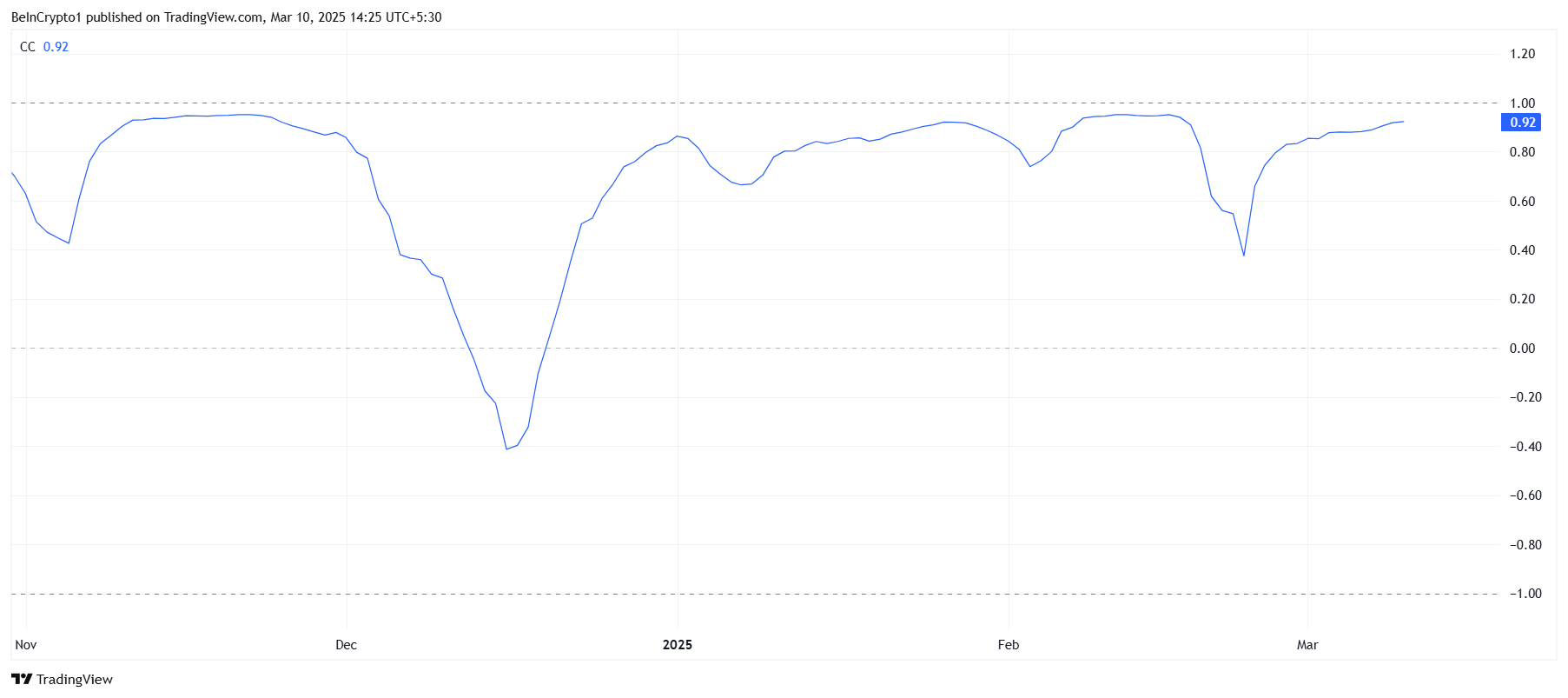

Solana maintains a strong correlation with Bitcoin, currently 0.92. While a high correlation generally signals an optimistic alignment, in the case of soil, it is a bearish indicator. Bitcoin is struggling to hold over $ 80,000, which means that any other BTC weakness could lead Solana next to it.

If Bitcoin does not resume the momentum, Solana’s price could face additional losses. Altcoin dependence on BTC’s stability adds to its vulnerability. Until Bitcoin takes up the main levels of support, the macro floor momentum will probably be down, extending its downward trend.

Sol Price takes a blow

The Solana price has dropped 28% in the last 24 hours, trading at $ 128. The decline results from the overall market stock market and the formation of the death of the soil graph last week. This technical model suggests a continuous drop unless a high purchase pressure emerges.

Currently, Sol has more than $ 120, trying to stabilize. However, if the wider market conditions do not improve, the Altcoin risks are directed below its key support at $ 128. A failure to maintain this level could accelerate losses, causing deeper corrections.

On the other hand, if investors take advantage of the lower price and accumulate, soil could recover $ 137 as a support. A successful escape beyond this level would open the door to a potential rally around $ 155, actually invalidating the lower prospects. The feeling of the market and the trajectory of Bitcoin remain essential for the resumption of Solana.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.