Will February Mark the Start of 2025 Altcoin Season?

On Monday, the cryptography market experienced what was presented as the largest event in history, destroying more than $ 2 billion in posts. In the midst of the calls for the familiar “Altcoin season”, analysts are divided that the month of February is the month or if the cryptographic markets must wait until April.

The arguments and projections refer to past market accidents, such as those in 2020 and 2022, and how the sector reacted.

Analysts weigh on the cryptography market recovery calendar

Beincryptto reported a historic liquidation event of $ 2 billion on Monday, caused by the prices of US President Donald Trump. In this case, the president has concluded an agreement with Canada and Mexico, which prompted a certain level of recovery on the market.

However, analysts are not convinced that a full -fledged market resumption is there, even if others call an Altcoin season.

Mathew Hyland, a blockchain analyst, shared his ideas on the slowdown in the market, stressing that the recovery will take time. He stressed that although Bitcoin (BTC) did not decompose, altcoins suffered considerably, which led to the historic liquidation event. He says that indicates the extent of damage suffered by the Altcoin market.

According to Hyland, although the massive liquidation event meant the bottom of the market, it is not yet ripe for a rebound.

“Since it was the greatest event of liquidation in the history of cryptography, this probably means that the bottom is the bottom. However, in 2020 and 2022, it took more than two months for the Complete recovery takes place, “said Hyland.

The controversial analyst also pointed out that the sum heights for most Altcoins may not return for at least two months, if not more. Based on these perspectives, Hyland warns traders to temper their expectations, adding that even V recovery as in 2020 took weeks with several hollows along the way.

Another technical analyst, Cryptocon, echoed Hyland’s feelings. He described the event as a major shaking for suspended merchants. Although the analyst acknowledges that the cycle is on the right track, he did not suggest imminent recovery.

“What happened to a good performing good February?” Always incoming, the cycle is on the right track. It is clear that some entities do not want people to have altcoins of their bottom at 100x for the entire bull market, “said the analyst.

Cryptocon’s prospects align with several other analysts, including Rover, which argue that the trajectory remains intact. In an article on X, Cryptorover stressed that Altcoins would soon go “parabolic”.

Arguments for the Altcoin season in February

Meanwhile, like Cryptocon, the feeling of February remains positive among other analysts, notably Merlijn The Trader. In a related article, the analyst provides that February will point out the start of a Altcoin SeasOn and, therefore, the resumption of the market. The analyst quotes historical data suggesting that Altcoin rallies have always started in February, and this cycle should not be different.

“The Altcoin season begins in February! History does not lie, and the graphics either, ”said Merlijin in a post.

Others indicate that the domination of Bitcoin as a key indicator, noting that the top is almost for this metric, preparing the way for an Altcoin season. Likewise, Coinvo, analyst, reiterated the feeling.

“The Altcoin season has always started in February, and this cycle will not be different,” said Coinvo.

Another crypto analyst, Devkhabib, offered a contrasting perspective, highlighting February a good month for Bitcoin. The analyst identified the level of $ 91,000 as a crucial support floor for the Bitcoin price. He stressed that the prize bounced strongly, expressing optimism about the future of the market.

“$ 91,000 seems to be a solid support for the BTC when we have rebounded directly. Hopefully we will continue to go above $ 94,000 so that the market can recover a little. February is generally green, and I think we will always get a haus ass. A bad start takes a good end, ”said the analyst.

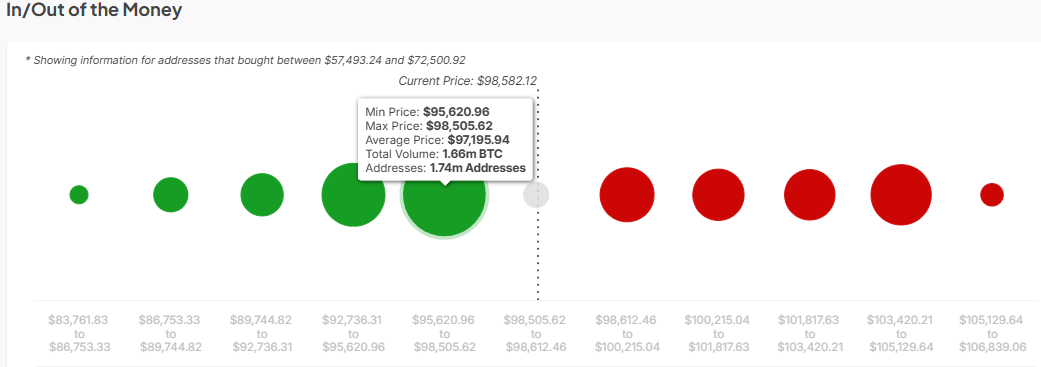

In addition, according to intotheblock data, the beach between $ 95,620 and $ 98,505 represents significant support for the Bitcoin price

Any effort of the Bears to push the price below this level would be filled by buying a pressure at around 1.74 million addresses which bought BTC at an average price of $ 97,195.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.