Sonic (S) Jumps 50% in 7 Days, Market Cap Hits $2.5 Billion

Sonic (s) is currently experiencing a strong bullish dynamic, with its price increased by almost 15% in the last 24 hours and 53% in the last seven days. Its market capitalization now amounts to $ 2.6 billion, reflecting growing interest in investors and increased commercial activity.

Technical indicators show that Sonic’s ADX is 51.6, confirming the strength of the current trend. His RSI of 78.4 suggests that the purchase of pressure remains intense, although excessive conditions can lead to short -term withdrawals. Sonic could test resistance levels at $ 0.849 and potentially $ 1.06.

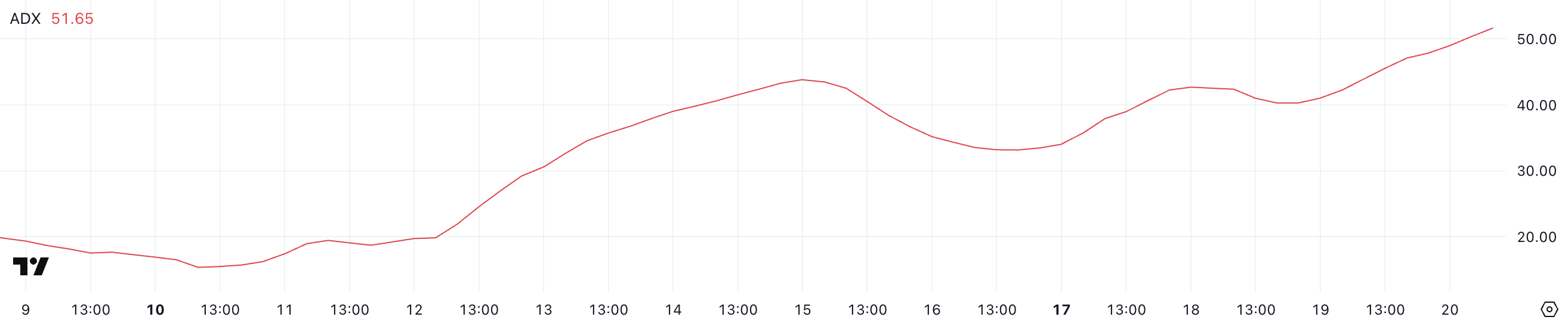

Sonic Adx shows that the current upward trend is strong

Sonic, formerly Fantom (FMT), ADX is currently 51.6, showing a significant increase compared to 34 only three days ago and an even more spectacular increase of 19.8 eight days ago.

The increasing ADX indicates a strengthening trend, reflecting an increasing dynamic of the market. This rapid ascending movement suggests that Sonic is experiencing increased volatility and directional resistance, which could be indicative of increased purchasing interest or intensified market activity.

Given the current upward trend, this increase in ADX could be interpreted as a confirmation from the current bullish impetus, indicating that the price movement is gaining strength and can continue in the same direction.

The average directional index (ADX) is a momentum indicator used to measure the resistance of a trend, whatever its direction. This does not indicate if the trend is optimistic or downward, only its intensity.

As a rule, an ADX below 20 suggests a weak or non -existent trend. Between 20 and 40 indicates an increasing trend, while values greater than 40 mean a strong trend. With Sonic ADX at 51.6, the market shows a powerful trend, supporting the current upward trend.

This high sound momentum could lead to an additional price appreciation because it suggests sustained purchase pressure. However, merchants should monitor potential overexxation or inversion signals as the trend matures.

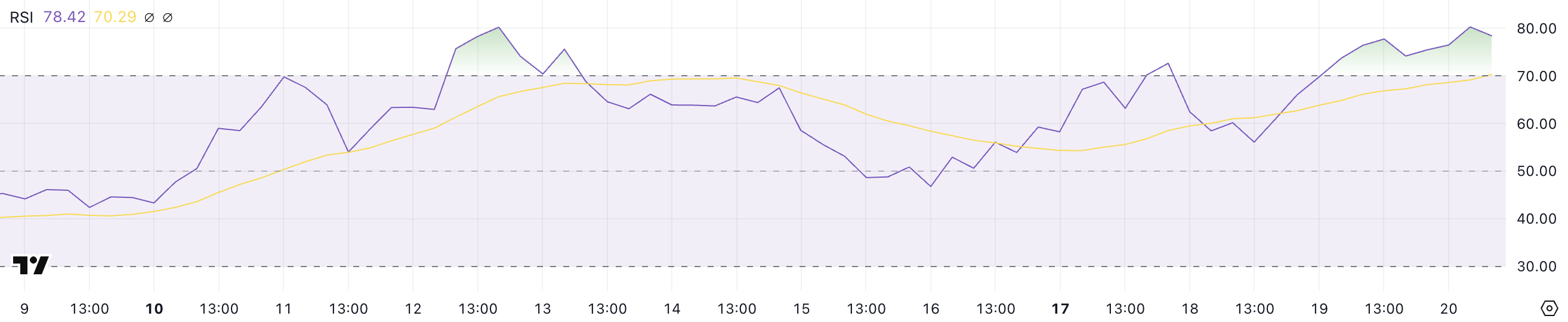

S RSI has been over -going for more than a day

The Sonic RSI is currently at 78.4, a significant increase compared to 56 only two days ago. He stayed above 70 for more than one day, indicating a strong ascending dynamic.

The rapid increase in RSI reflects an increased purchase activity, which suggests that the bullish feeling intensifies. An RSI above 70 generally signals excessive conditions, which implies that the asset can be overvalued in the short term.

Given the current upward trend, this high RSI could arouse continuous interest in purchase; However, this also increases the possibility of a decline or a consolidation of prices because traders can start to benefit from benefits.

The relative resistance index (RSI) is a momentum oscillator which measures the speed and variation of price movements. It varies from 0 to 100 and helps to identify the conditions of overcouting or occurrence.

Generally, an RSI above 70 suggests that the asset is exaggerated and could be due for a correction, while a RSI less than 30 indicates occurrence conditions, potentially signaling an opportunity to purchase. With the Sonic RSI at 78.4, the asset is clearly in the exaggerated territory, which could lead to short -term withdrawal or consolidation while traders capitalize on recent gains.

However, in strong ascending trends, RSI can remain exaggerated for an extended period. This suggests that the sound bruise can continue before any significant correction occurs.

Will Sonic exceed $ 1 in February?

The EMA lines of Sonic recently formed two golden crosses, signaling a strong bullish momentum. A golden cross occurs when a short -term EMA crosses an EMA in the longer term, generally indicating the start of an upward trend. If this bullish momentum continues, Sonic could test the resistance at $ 0.849.

If it crosses this level, the next price target for Sonic would be $ 1.06. This would mark its highest price since the end of December 2024. This would confirm the upward rise in progress and could arouse more purchase interest, pushing higher sound prices as optimistic feeling is strengthening.

However, if the trend is reversed, Sonic could face significant risk of decline. The first levels of assistance are at $ 0.65 and $ 0.58, which, if they were raped, could open the door to additional drops.

In this downward scenario, Sonic could drop as low as $ 0.47. In the worst case, it could reach $ 0.37, representing a correction of more than 50%.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.