Another Red August for XLM? Data Signals a Repeat of Its Historical Pattern

Stellar’s native token XLM tends to go down regularly since it has reached a local cycle peak of $ 0.52 on July 18.

Now about $ 0.39, Altcoin lost 14% of its value in just over two weeks, while the lowering feeling brings together the pace before a month historically difficult for the token.

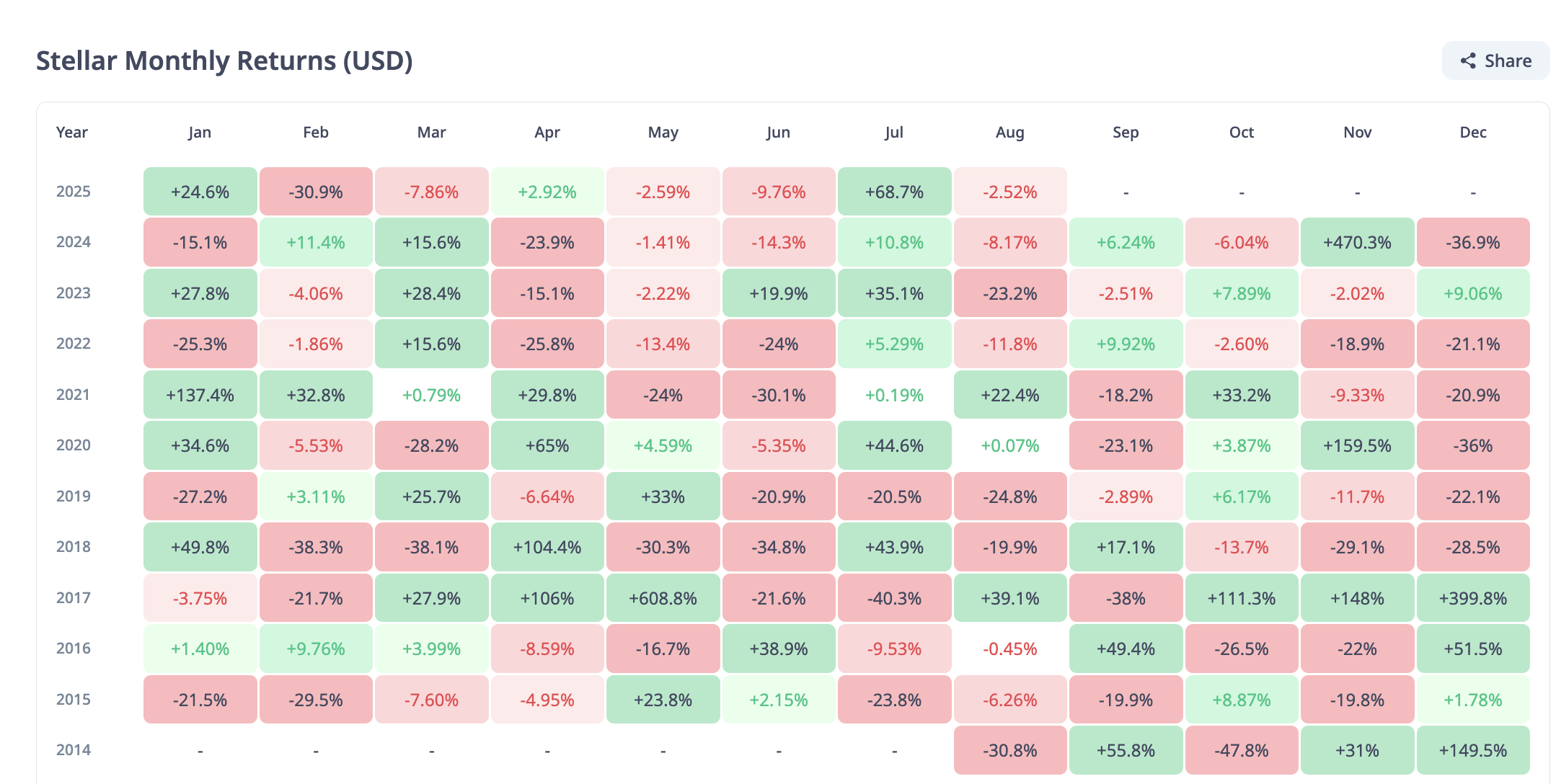

The returns of the August XLM curse with the assembly of sales signals

An examination of XLM monthly yields reveals a worrying model. August only delivered a positive monthly fence twice – in 2017 and 2021. All other August ended in the red.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

This assessment is now believing with weakening the technical indicators, preparing the way for a potential continuing tendency as a new month begins.

The readings of the graph of a day XLM / USD show that the two -digit drop in the value of the token has increased its price below its exponential mobile average of 20 days (EMA). This key mobile average forms a dynamic resistance above XLM at $ 0.40 at the time of the press.

The 20 -day EMA measures the average price of an asset in the last 20 days of negotiation, which gives weight to recent prices. When the price is negotiated above EMA, it signals a short-term bullish impulse and suggests that buyers control.

Convoresly, when the price of an asset breaks below its 20 -day EMA, it represents a change in the feeling of the short -term market of the lowerier to the lower. It reflects the increase in the side of the sale, especially when accompanied by other lowered indicators.

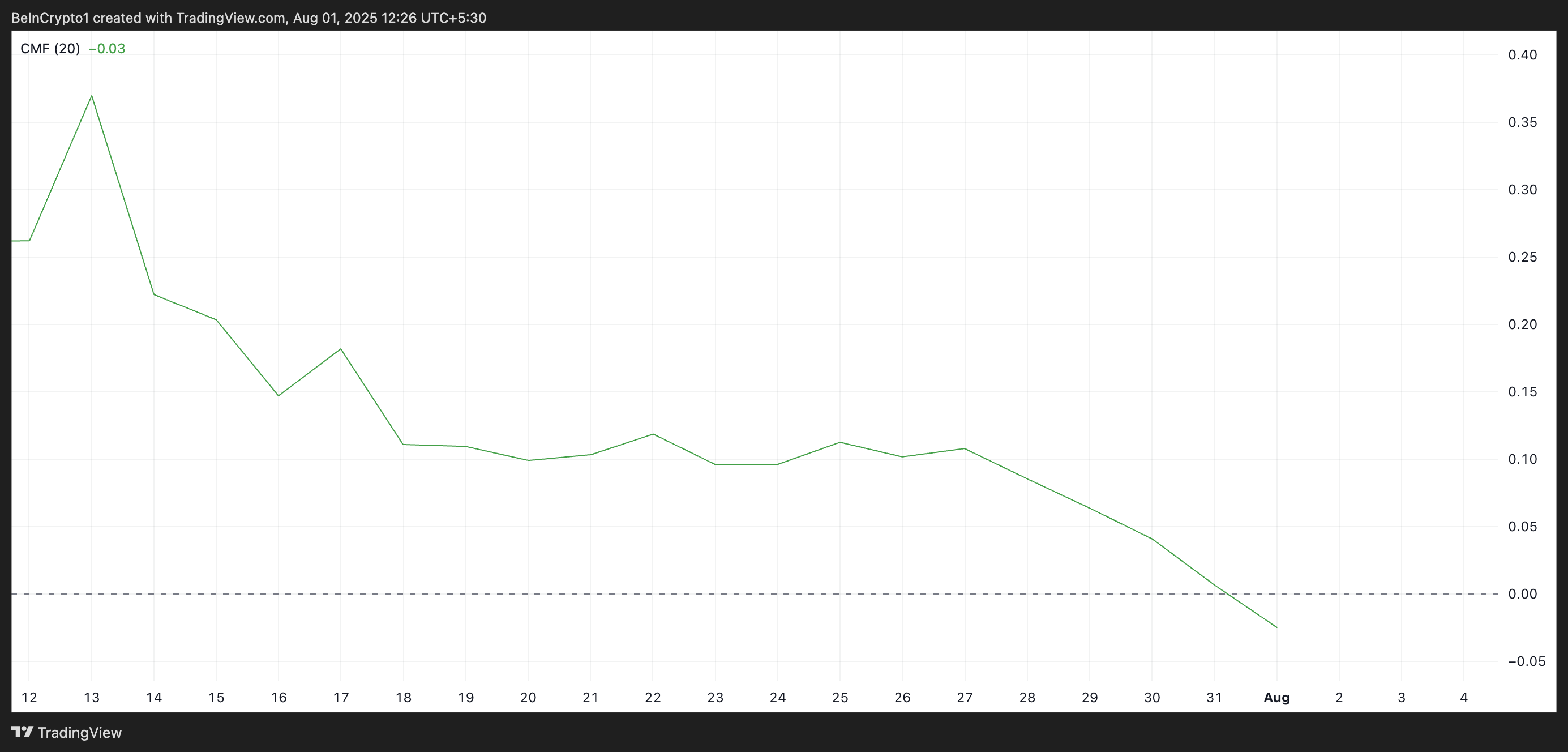

Adding to this downward perspective, the Silver Silver Flow of XLM (CMF) slipped under the zero line – another red flag which refers to a sustained drop in August. Reading the CMF is at -0.03 at the time of the press, indicating a net output of the occasional XLM markets.

The CMF indicator measures how money moves in and out of the market of an asset. When its value is positive, buyers dominate the market and capital take place in the assets.

Conversely, a negative CMF reflects the distribution – which means that the sales pressure is stronger and the money leaves the asset. This trend suggests that the fall in the continuous prices of XLM is not simply the result of short -term volatility but is supported by real market weakness.

Will he break down to $ 0.32 or bounce over $ 0.41?

XLM is currently negotiated at $ 0.39 at the time of the press. The weakening of demand for Altcoin and its historically mediocre performance suggest that it could enter a larger short -term decrease trend for another year. With price dynamics and capital flow indicators flashing the red, the feeling firmly bows in favor of bears.

If capital entries continue to weaken, the XLM price could drop to $ 0.36. If this level does not hold, the downward trend can improve at $ 0.32 as low.

However, a reversal is always possible if buyers’ request is starting to recover. A sustained increase in accumulation could grow XLM over its 20-day EMA. If this escape is held, the token can recover $ 0.41, opening the door to a short -term bullish reversal.

The position another red August for XLM? Data signals A repetition of its historic model appeared first on Beincrypto.