GameStop Boosts BTC Treasury Amid $2.7B Bond Issuance

The cryptocurrency market is in fullness with the news that GameStop has lifted an additional $ 450 million thanks to a convertible bond offer. This capital is likely to be used to acquire more Bitcoin (BTC).

In addition to games, other public companies, such as Metaplanet, the H100 AB group, Nano Labs and others, make movements to include bitcoin on their balance sheets.

According to the SEC files, with this last issue of bonds, Gamesop increased the total funds raised in mid-June 2025 to 2.7 billion dollars. Zero interest bonds, which mature in 2032, are convertible into stocks at a price of 32.5% higher than the average of June 12.

This could create important opportunities for GameStop to diversify its assets, including Bitcoin. This decision is a competitor close to the BTC accumulation race, Procap, recently claimed to have exceeded Gamesop in BTC Holdings.

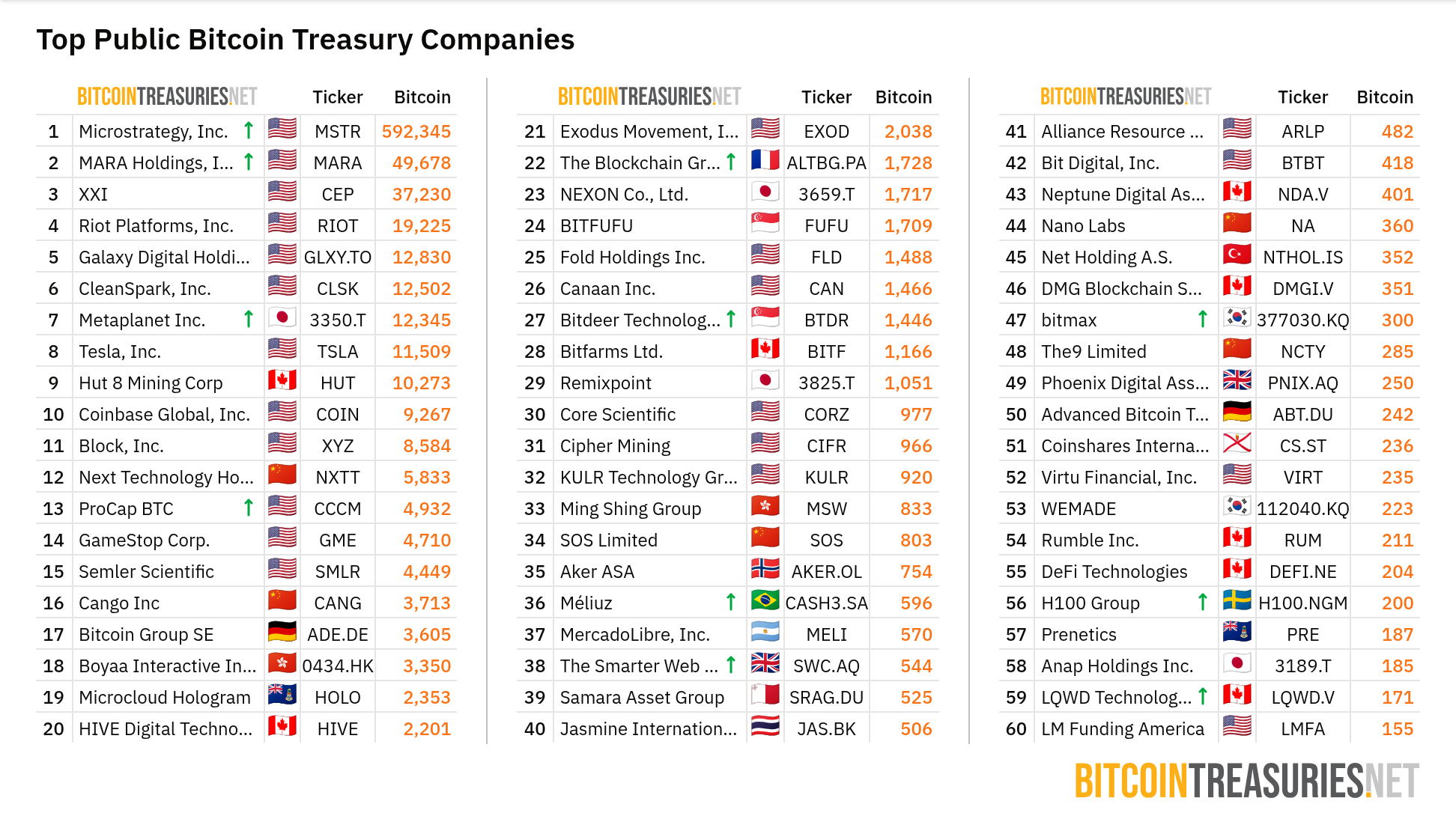

Currently, BitcoinTheries data show GameStop holding approximately 4,710 BTC, ranking 14th. Asia’s “strategy”, Metaplanet, has 7th position with 12,345 BTC after recently purchased 1,234 additional BTC at an average price of $ 107,557.

“Supercycle would not be a GameStop -free Supercycle” User X said.

Bitcoin as the future of corporate treasury bills

In addition to GameStop, Metaplanet and Procap, many other public companies intensify their efforts to acquire and hold BTC.

Mega Matrix, a listed company in the United States, recently announced the purchase of 12 BTC. The H100 AB group increased its assets to 200.21 BTC. Sixty-six capital added 18.2 BTC and plans to remove more capital to buy additional amounts. Meanwhile, Unitronix, a real -active asset tokenization company (RWA), is committed to investing $ 2 million in Bitcoin.

Nano Labs raised 600 BTC thanks to a program of $ 500 million. Kaj Labs has invested $ 160 million in Bitcoin to support IA infrastructure.

The participation of the strategy sparked a wave of Bitcoin investment among other companies. Bitcointheries data indicate that the strategy currently contains the most BTC, 592 345 BTC, followed by Mara Holdings with 49,678 BTC. The involvement of these main companies shows that this model can improve the value of shareholders.

However, the risks of price volatility and dry regulations may have an impact on their plans. With the ICC of July 2025 which should be announced soon, Gamesop decisions and other companies will be essential in training the future of bitcoin in corporate treasury bills.

Non-liability clause

All the information contained on our website is published in good faith and for general purposes only. Any action that the reader undertakes on the information found on our website is strictly at their own risk.