VIRTUAL Token Price Surge Sparks Institutional Interest

While the wider market of cryptography had trouble finding a direction in April, Virtual jostled the tendency to record significant gains. Altcoin climbed 183% in last month, standing out from the rare tokens to record substantial gains on a dull market.

Virtual is up 22% in the last 24 hours, making it the most efficient cryptographic asset today. It is about to continue its gathering, in particular as institutional interest is developing.

Intelligent money feeds the virtual rally

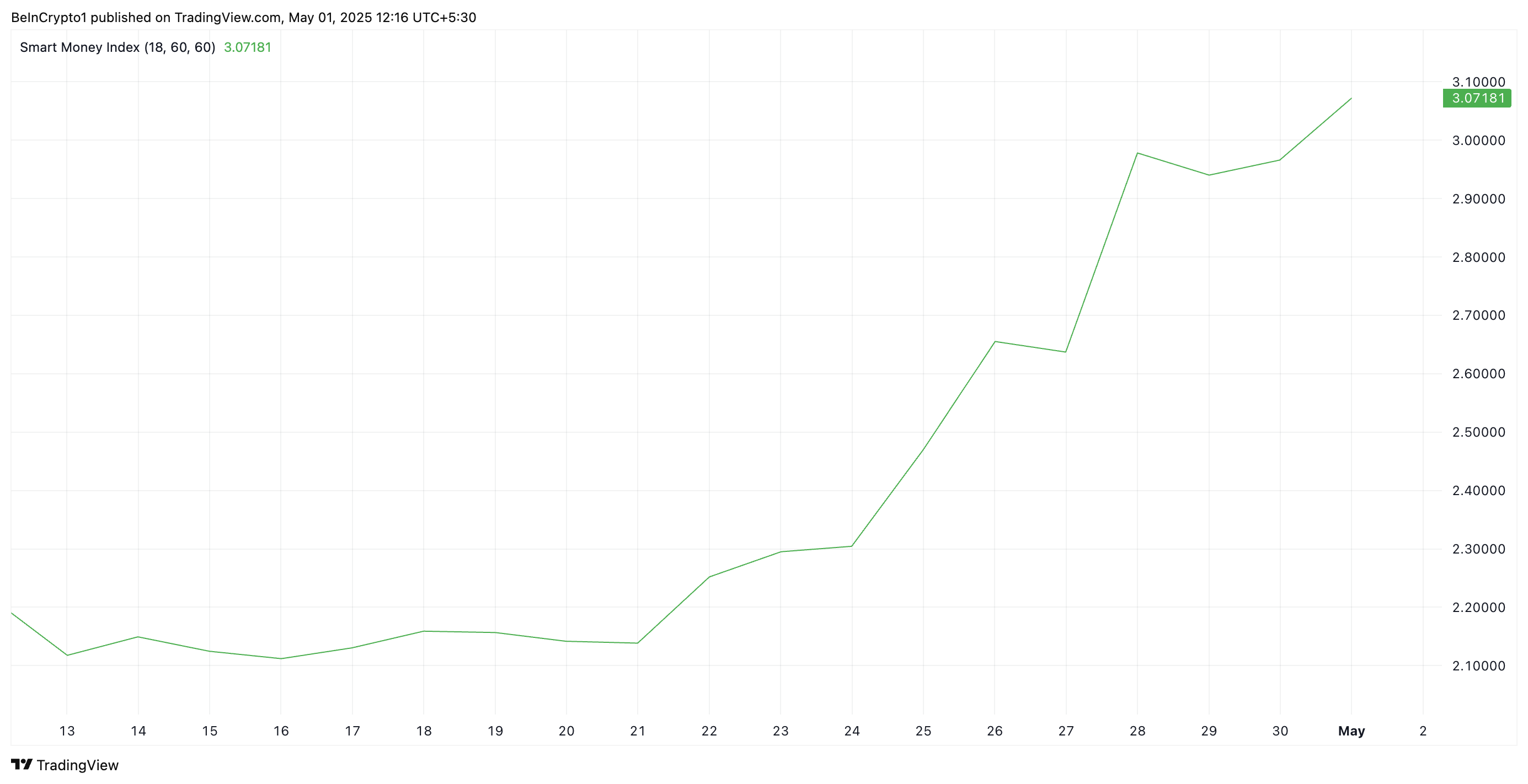

Virtual has launched its upward trend on April 22 and has always marked new daily summits since then. As its prices go up, there has been a corresponding increase in its intelligent monetary index (SMI), which is currently 3.07.

The SMI indicator follows the commercial activity of institutional investors, often called “smart currency”. He analyzes the movements of intraday prices, focusing on the first and last hours of negotiation.

When the SMI increases with the price of an asset, the main investors accumulate positions, reflecting growing confidence in the upward momentum. The current increase in Virtual SMI suggests that institutional players actively accumulate the token, probably positioning for new gains.

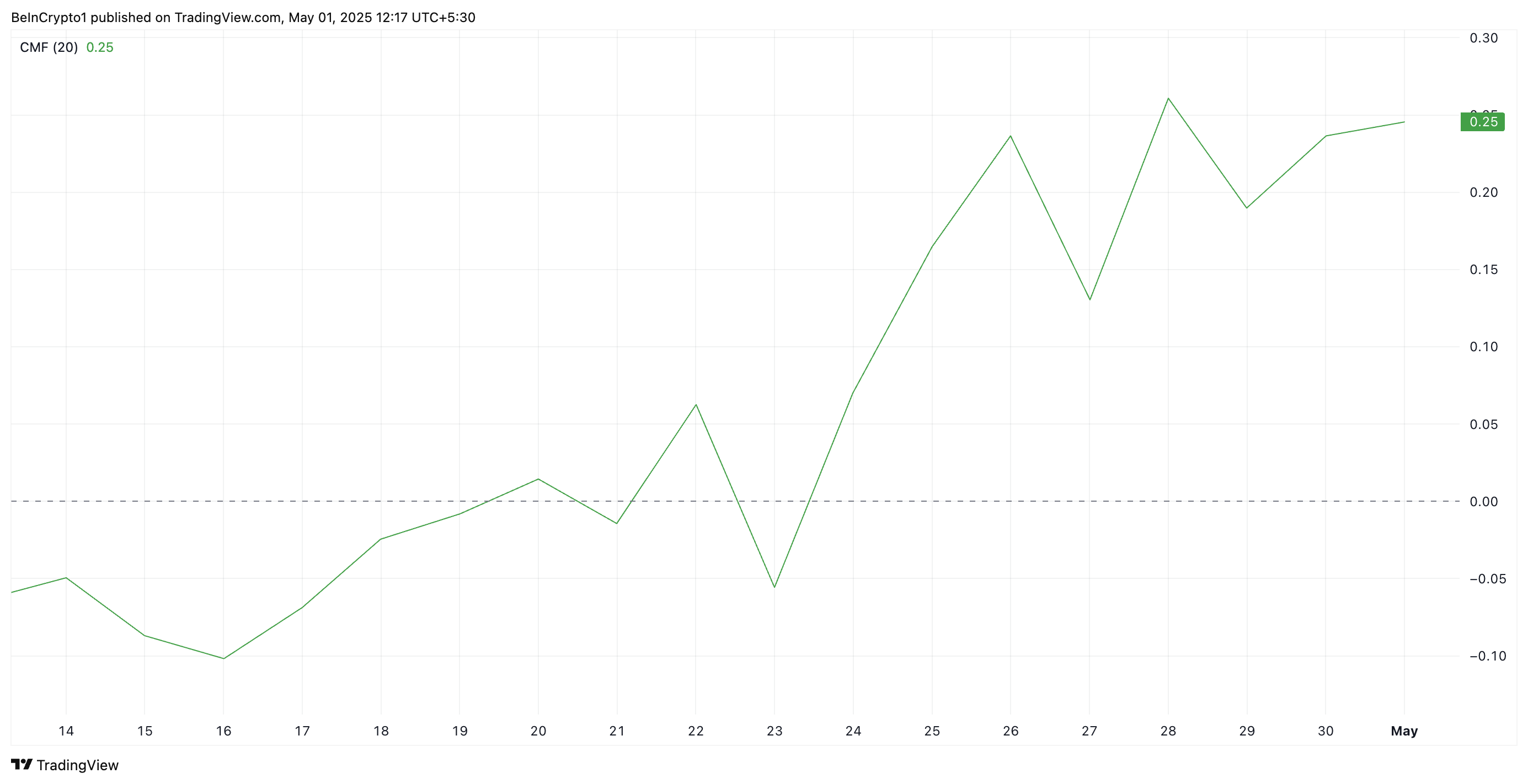

The token monetary monetary flow (CMF) is supporting the upward perspectives. When writing these lines, this momentum indicator is 0.25 and remains in an upward trend.

The CMF indicator measures the silver flow in and outside an asset. A growing CMF like this reflects increased capital entries and a positive feeling among traders.

Consequently, the reading of Virtual CMF strengthens its prices overvoltage and refers to the potential of a continuous short -term rally.

The action of the price of Virtual is referring to a greater increase

The virtual three -digit rally since April 22 has exchanged it in an ascending parallel channel. This scheme is formed when the price of an asset systematically makes higher highs and higher stockings, moving in two lines of trend parallel to the height.

It signals an upward trend, which suggests that the price of the asset can continue to increase as long as it remains in the chain. If demand is strengthened and virtual ascents, remaining in the channel, it could exchange at $ 2.26.

However, a resurgence of for -profit activity will prevent this upward projection. If sales begin, the virtual token could lose recent gains, disintegrate at $ 1.55 and fall to $ 0.96.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.