Hyperliquid (HYPE) Might Hit $20 Amid Potential Golden Cross

The hyperliquid (hype) shows solid technical signals on several indicators, the token increasing by more than 15% in the last 24 hours. The platform continues to demonstrate impressive market performance, generating $ 47 million in the past 30 days and surpassing the main blockchain networks like Ethereum and Solana.

Technical indicators suggest potential golden cross training, which means that the beateering could test $ 21 or even $ 25.80 in the coming period.

Hyperliquid income place him among the main crypto protocols

Hyperliquidal is currently one of the most successful protocols in the crypto. In the past 30 days, he generated an impressive $ 47 million in fresh and Recently rehurt $ 1 billion in Perps volume.

Although it places it behind the main players such as Jito, Pumpfun and Pancakeswap in terms of monthly income, Hyperliquid has exceeded important applications and channels, including Solana, Ethereum, Raydium and Phantom.

What makes the success of hyperliquidal particularly remarkable is that, unlike most other high -performance protocols that work on established blockchain networks such as BNB, Solana or Ethereum, Hyperliquid works like its own independent chain.

With the exception of Tron, practically all other major protocols are based on parents’ blockchains, while the hyperliquid has reached its substantial income figures as an autonomous entity.

Despite this impressive performance and the unique positioning, the media threshing has experienced a considerable drop price recently, negotiating below the $ 20 threshold for sixteen consecutive days, creating a significant disconnection between the operational success of the protocol and its market assessment.

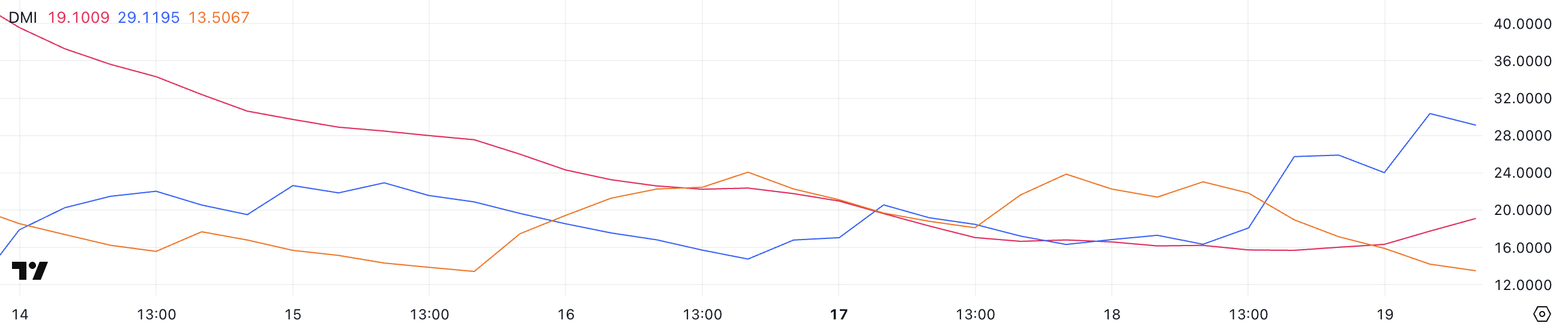

Hype DMI shows that buyers control

The Hype DMI graph (Directional movement index) shows promising momentum offsets, with the ADX (average directional index) going from 15.7 to 19, suggesting a reinforcement trend conviction.

More significantly, the + DI (positive directional indicator) increased from 18 to 29.1, while the -Di (negative directional indicator) decreased from 21.8 to 13.5. This crossing model, where + di moving above -DI, generally signals a potential optimistic inversion.

The growing propagation between these indicators and the rise up of ADX suggests that the purchase of pressure overcomes the sale pressure, potentially preparing the way for a media threshing to break over its recent negotiation range of less than $ 20.

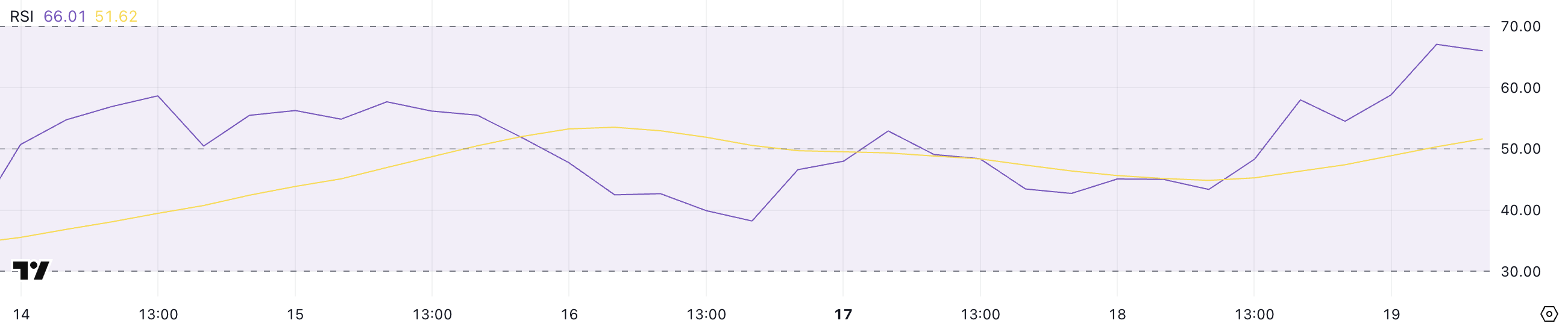

The relative resistance index (RSI) is a momentum oscillator which measures the speed and variation of price movements. Readings greater than 70 are generally considered to be a surrahat and less than 30 are considered to be.

The Hype RSI climbing from 54.5 to 66 indicates an increasing bullish momentum which has not yet reached extreme levels. This increase suggests strengthening the buyer’s interests while remaining below the overcrowding threshold of 70.

The fact that the threshing media has not reached the over -racket levels since December 2024 implies that there could still be room for the appreciation of prices before any potential decline.

With the DMI indicators, this RSI reading strengthens the possibility of a continuous rise in the price of the media in the short term.

Will hyperliquid are increasing above $ 20 this week?

The exponential mobile medium lines (EMA) converge on potential golden cross training, which occurs when a short -term mobile average crosses an average in the longer term.

This technical model generally signals a strong change of bullish momentum which could propel media threshing to test its immediate level of resistance at $ 17. If buyers succeed in crossing this threshold, the path will open so that the media threshing climbed to the $ 21 bar.

In the scenarios where the exceptional purchase pressure is materialized, the hyperliquid could extend its gains to question the significant level of resistance to $ 25.80, which represents a substantial recovery of its recent negotiation range of less than $ 20.

Conversely, if the planned upward trend does not materialize and the bearish feeling prevails, the media threshing could undergo renewed low pressure, forcing it to test the level of critical support at $ 12.43.

The importance of this support cannot be overestimated, because a violation below this floor could trigger an accelerated sale, potentially pushing media under the psychologically significant level of $ 12 for the first time since December 2024.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.