IP Token Leads Crypto Market with 20% Weekly Gain

The Story IP token has become the most efficient asset today. This is in the middle of the decline in commercial activity during today’s session. Altcoin climbed 3% and extended its bullish sequence that started on July 11.

The price of IP has now earned more than 20% in last week, continuing to surpass even if the wider market faces downward pressure.

IP is climbing and $ 5 million in spots say it’s just starting to start

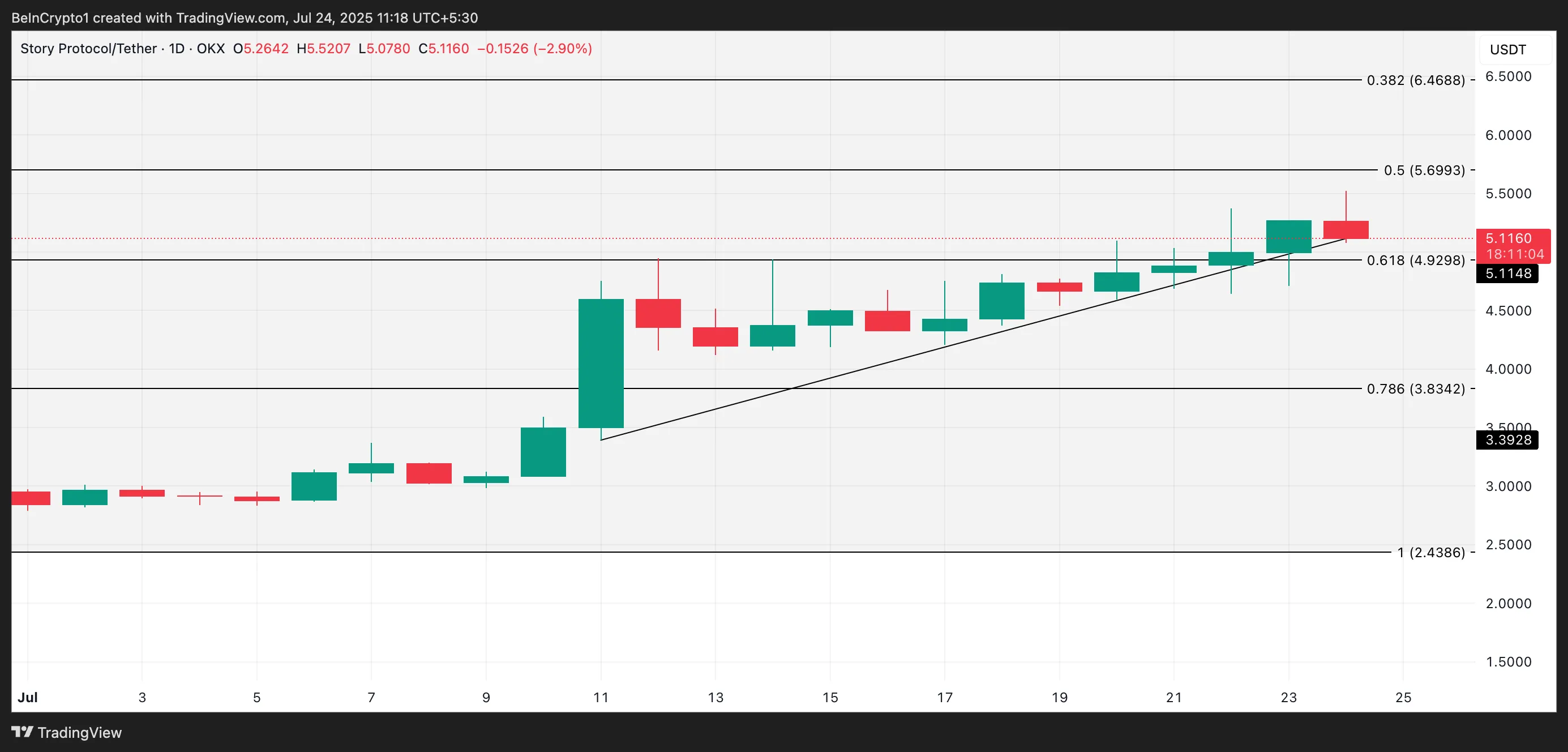

The native token of Story, IP, is currently negotiated at $ 5.11, holding a company above a key technical support which supported its rally.

An examination of the graph of an IP / USD day shows that the token has systematically exchanged above a line of ascending trend since July 11. This trend line is an optimistic training that emerges when higher stockings are formed over time, signaling a strong and sustained purchase interest.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

This trend acted as a dynamic support. It continues to feed the price increase in IP despite the slight weakness of the market recorded during the last trading sessions.

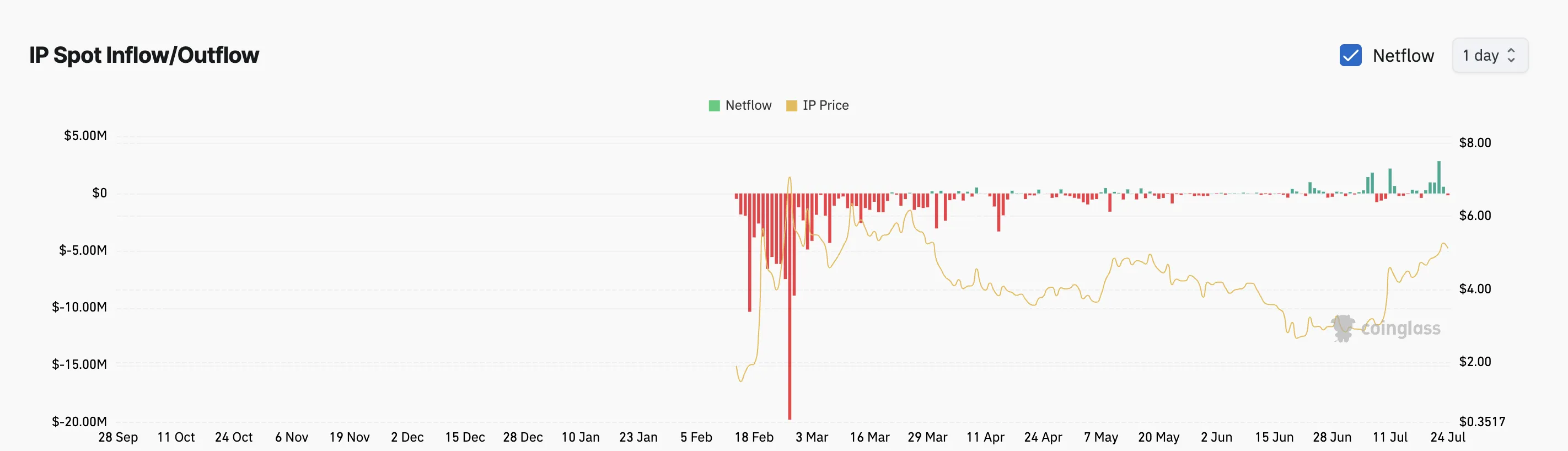

In addition, the ad hoc entries in the intellectual property have remained stable in recent days, a sign of interest and conviction of supported investors. According to CorciLass, despite the tendency to profit on a market scale, the IP has recorded consistent net entries in the last four days, exceeding $ 5 million.

When an asset sees occasional net entries like this, more capital enter the asset thanks to cash purchases than the exit. This indicates the demand and confidence of growing investors from the short -term perspectives of the IP.

Although today has seen a modest net output of $ 157,000 from the IP points market while some traders lock the profits, the overall feeling around the token remains strongly positive.

The long -term merchants bet large on the IP rally

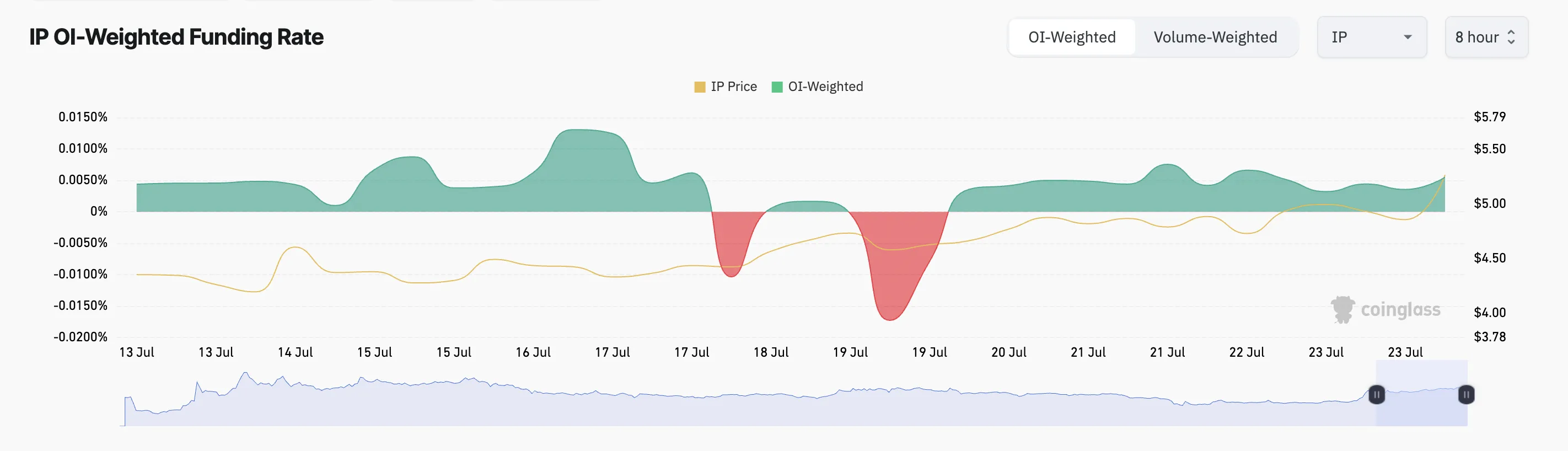

The positive activity on the chain strengthens expectations for more short -term increases, and this feeling is also shared between IP -term traders. This is reflected by the IP financing rate, which has remained positive since July 20.

When writing these lines, metric is 0.0055%

The funding rate is a periodic cost exchanged between long and short traders in perpetual term markets. It maintains the prices of contracts lined up on cash prices.

A positive financing rate means that traders pay a bonus to have long positions, indicating the bullish feeling of the market.

The IP’s positive financing rate shows that its long -term merchants are strongly leaning towards long positions. This strengthens the Altcoin rally and signals confidence in an increase in prices.

IP erases $ 4.92 per wall; The momentum could run up to March

The rally during IP pushed him over long-term resistance to $ 4.92, a price ceiling with which he had trouble for months. If this level becomes solid support soil, the token could rely on its recent earnings and rally at $ 5.59, one last seen in March.

However, the weakening of the request could see IP retrace its steps. The token could potentially test the level of $ 4.92, and the non-compliance on this floor can open the door to a deeper correction to $ 3.83.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.