Ethereum Price Fails Key Breach; Investors Sell $1.3 Billion ETH

Ethereum (ETH), the second largest cryptocurrency by market capitalization, has faced persistent challenges throughout the year.

Despite multiple attempts to regain momentum, Ethereum has fallen below $3,000 at times, reflecting an inability to sustain the recovery. This lack of upward movement has caused caution among investors, leading many to sell their holdings to secure profits.

Ethereum investors are running out of patience

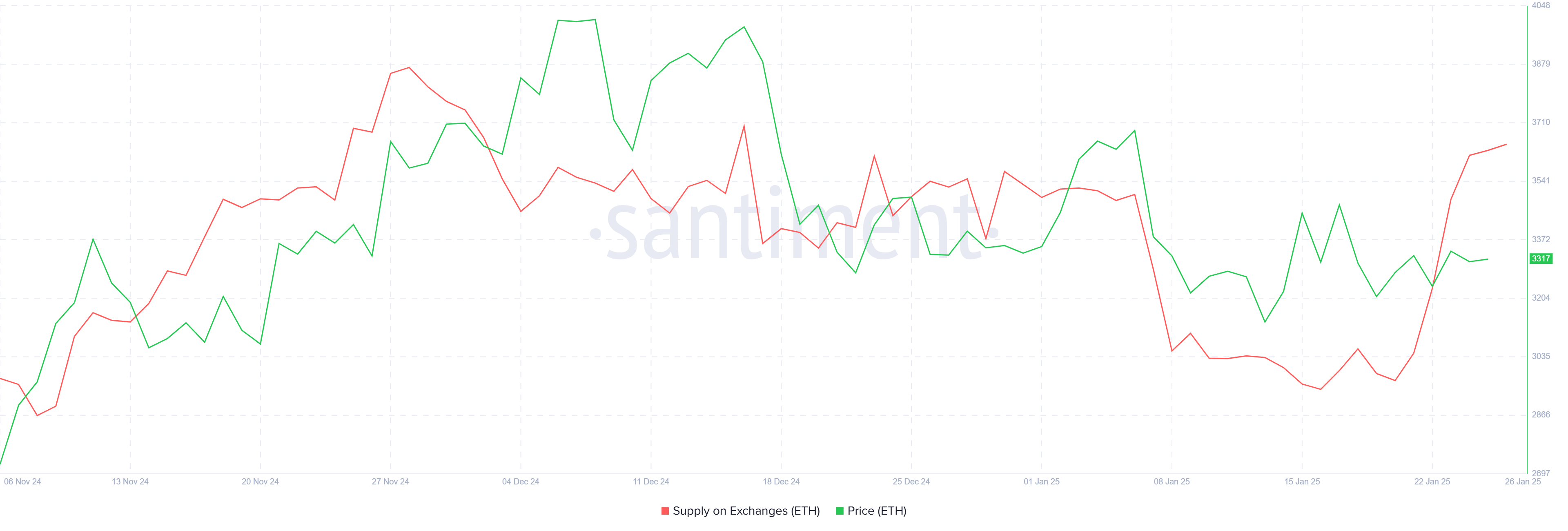

Investor sentiment towards Ethereum has changed significantly as holders have decided to dump their assets amid growing skepticism. Over the past week, over 410,000 ETH, worth over $1.3 billion, was sold. This surge in sales is evident in the increased supply of ETH on exchanges, a clear signal that investors are capitalizing on recent price action rather than holding on to long-term gains.

This increase in selling pressure highlights the loss of confidence among market participants, who do not seem convinced of Ethereum’s ability to sustain a significant recovery. The lack of a strong price rise has further fueled uncertainty, leading to a shift towards profit-taking behavior.

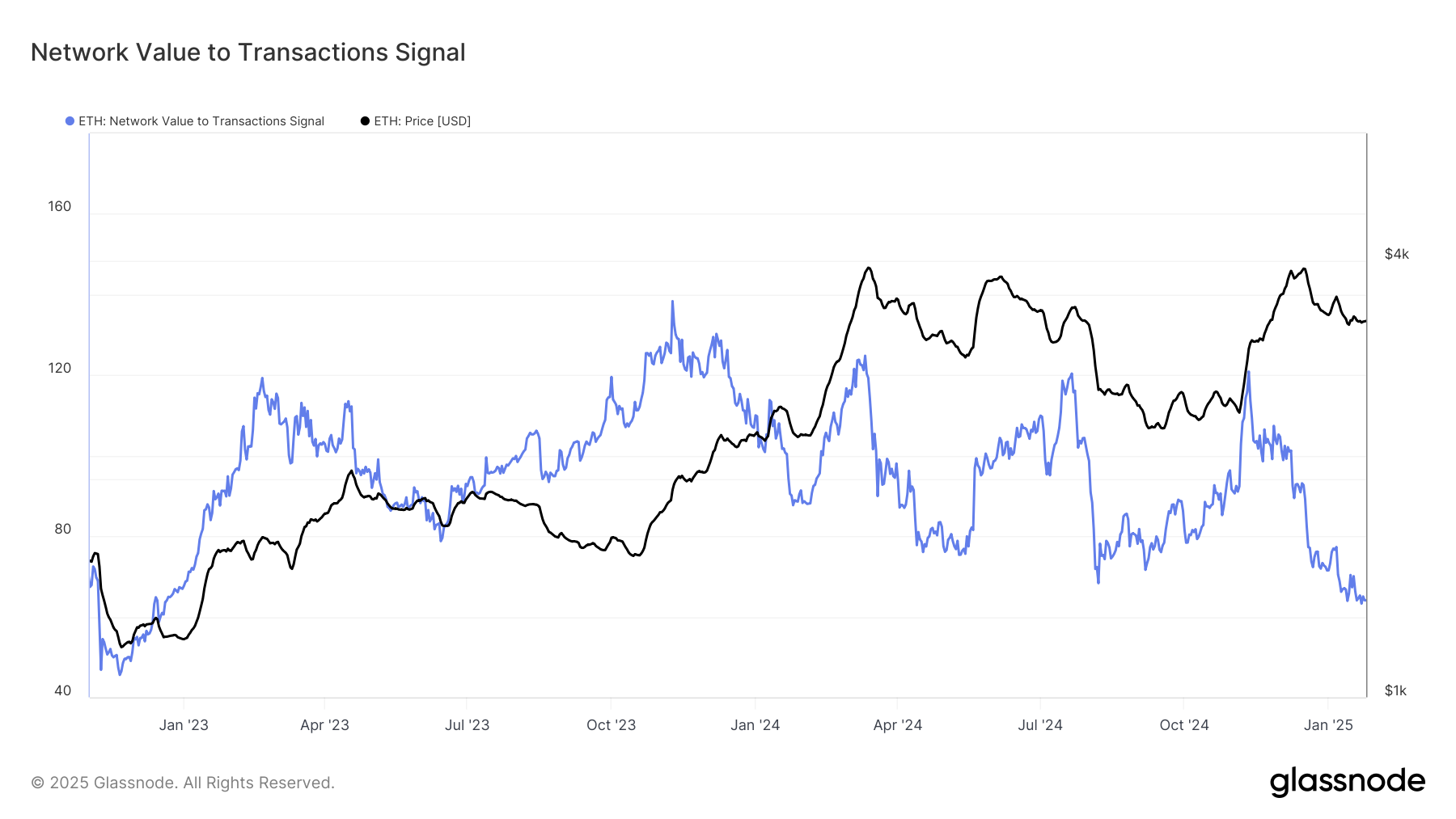

Ethereum’s macroeconomic dynamics present a mixed outlook. The Network Value to Transaction (NVT) signal, a key metric for assessing valuation, fell to a 25-month low. This suggests that Ethereum is currently undervalued, historically indicating recovery and rally potential in the medium to long term.

The undervaluation shown by the NVT signal could prevent Ethereum from experiencing sharp corrections, offering some hope of a reversal in sentiment. If this undervalued status sparks renewed interest, ETH could have a chance to stabilize and break through its current barriers.

ETH Price Prediction: Crippling Barriers

Ethereum price is currently holding above the support level at $3,303, following an unsuccessful attempt to breach the $3,530 barrier. Last week, the cryptocurrency fell to $3,131, highlighting its continued struggle to maintain bullish momentum.

Given current conditions, Ethereum will likely continue to consolidate below the $3,530 resistance level. If ETH fails to overcome this critical barrier, it could fall back to $3,131, further weakening market confidence.

On the other hand, a successful breach of $3,530 could mark a turning point for Ethereum. Such a move would likely push the price towards $3,711, restoring investor confidence and invalidating the bearish outlook. However, sustained buying pressure and favorable market conditions will be key to realizing this scenario.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to providing accurate and unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decision. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.