SPK Price Falls 50% from ATH as Market Sentiment Shifts Bearish

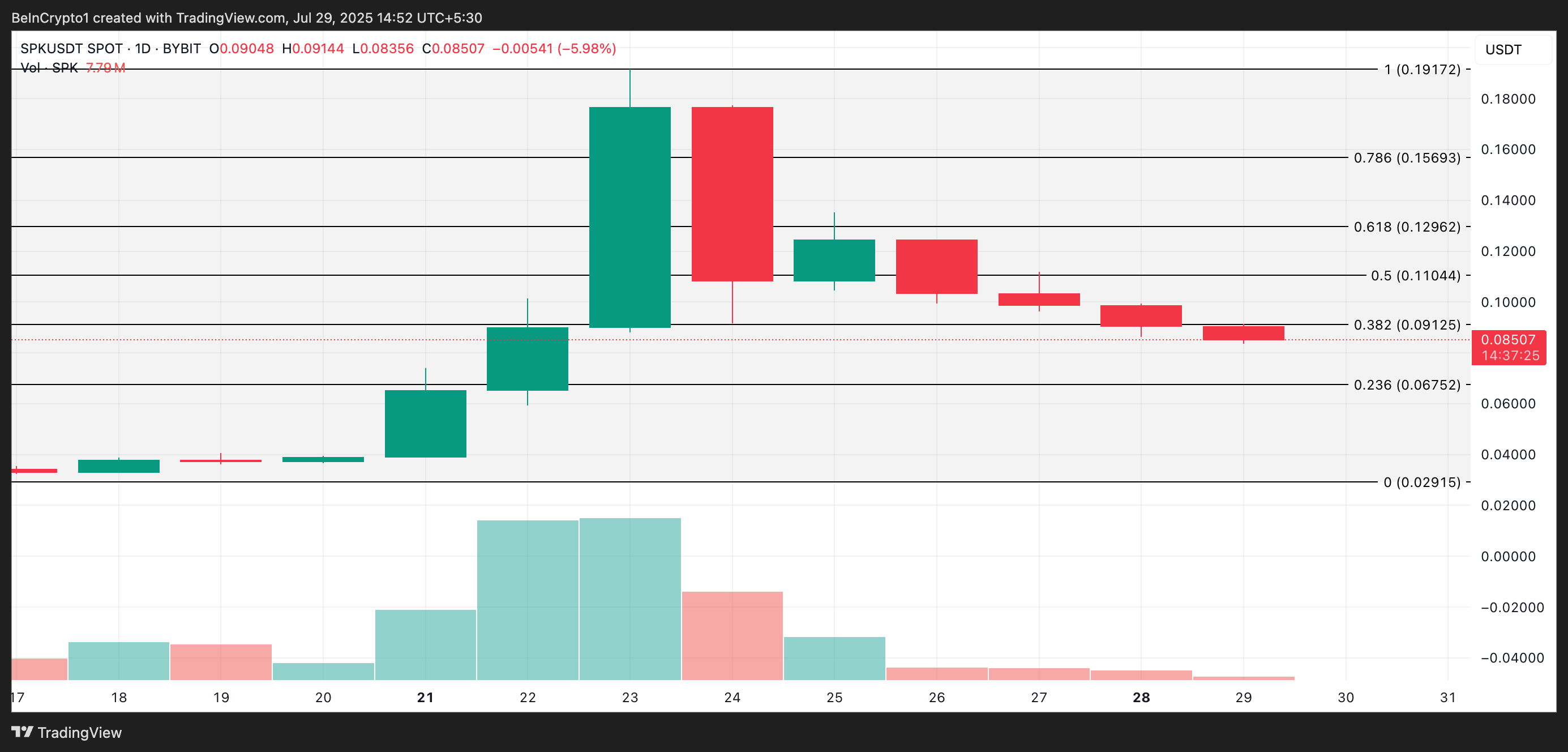

Since reached a summit of $ 0.19 on July 23, SPK has seen its price dive by 50% in the middle of an intense profit activity.

The net slowdown occurs while the bullish feeling around the token continues to weaken, which increases the possibility of new short -term losses.

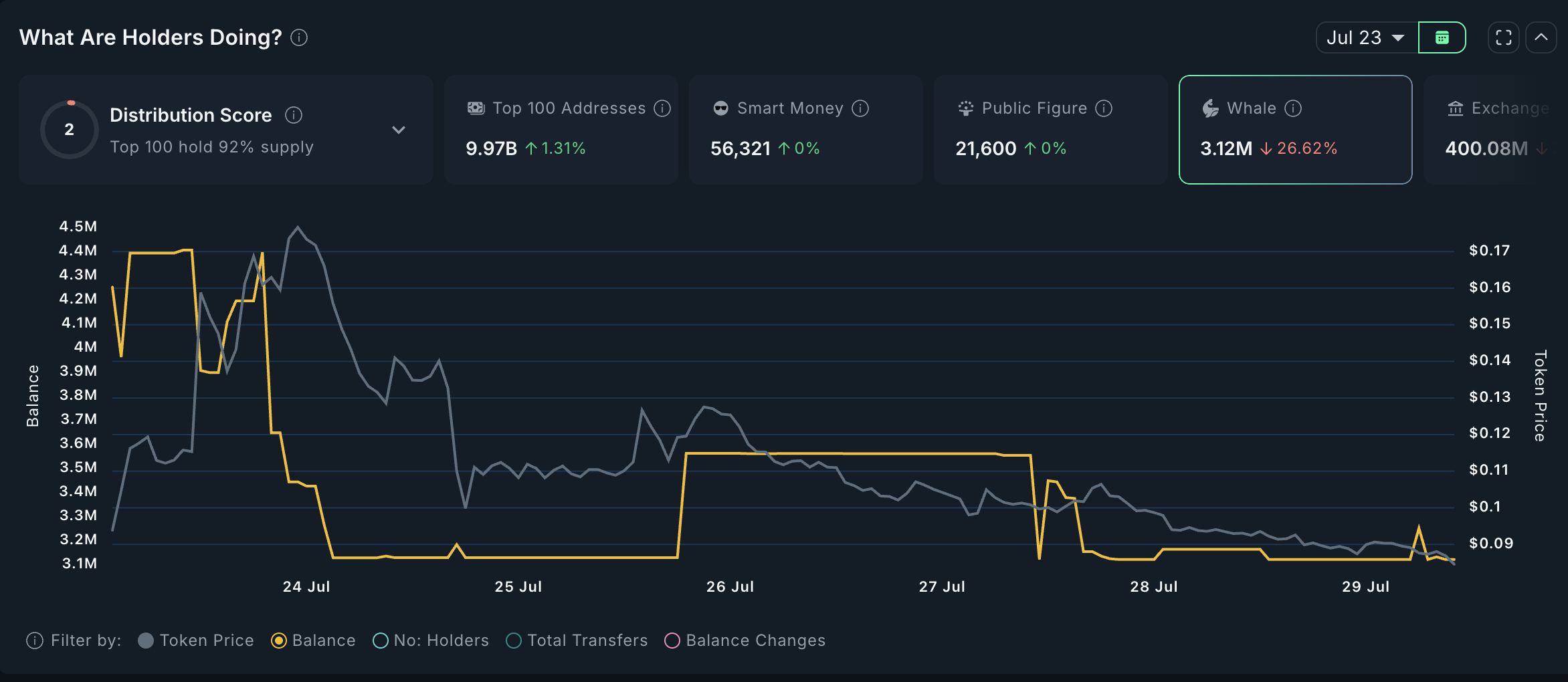

Spk Whales Retreat, the bears take over

Data on the Nansen chain reveal that major holders – gatekeepers worth more than a million dollars – have regularly reduced their SPK exposure. Since July 23, token sales through these whale wallets have dropped by 27%, highlighting retirement by the main stakeholders.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

The impact could be even more pronounced if short -term holders – many of whom are generally quick to leave in the first sign of weakness – to follow.

With an increased conviction already eroding, a new wave of distribution of “paper” investors could worsen the sale, pushing SPK more deeply in the correction territory.

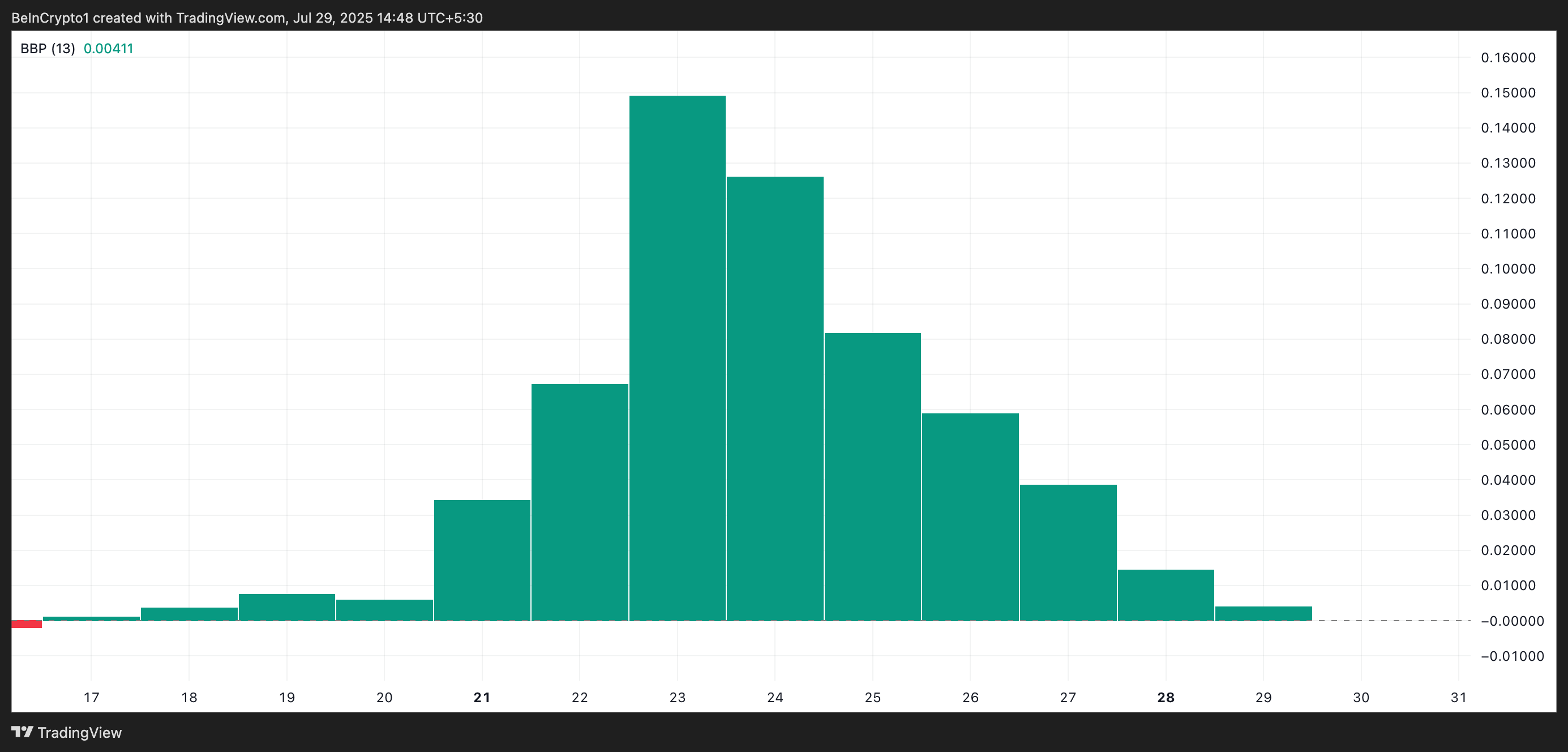

Confirming the downward trend more, the SPK elder rays index shows a constant weakening of the bullish momentum. Since the start of the drop in prices, the indicator has printed the green bars – generally a sign of strength of the buyer.

However, their sizes have gradually shrunk at each negotiation session. This contraction indicates a regular drop in the PURP PROCESS OF SPK, which confirms the retirement of the market.

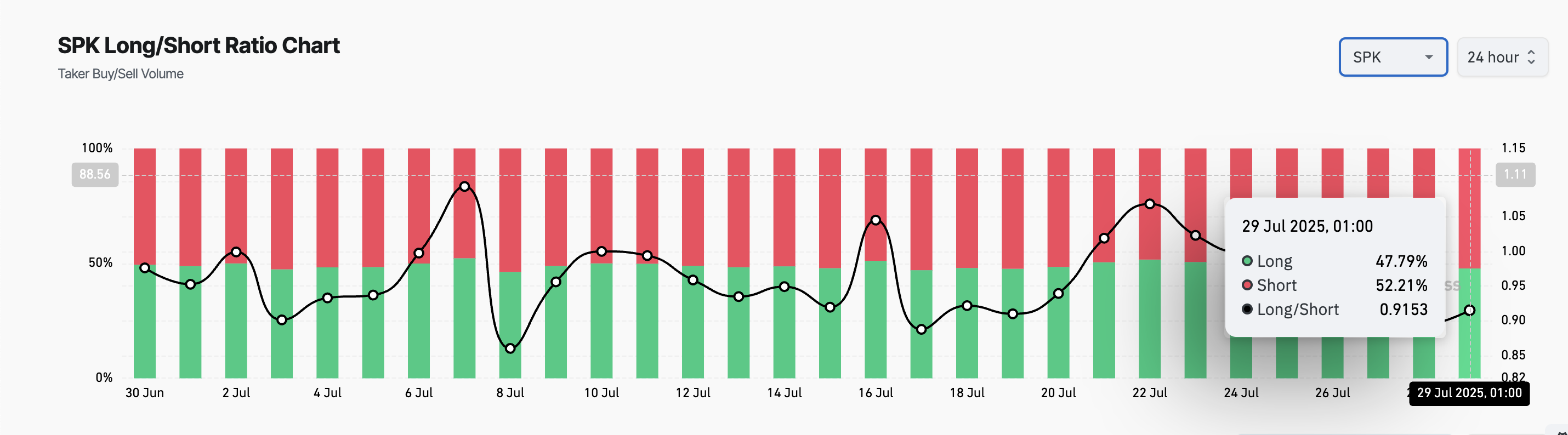

In addition, the lowering feeling is reflected in the token in the long term market by its long / short ratio. At the time of the press, the report is 0.91, indicating a growing preference for short positions on long.

The long metric / short measures the proportion of upward positions (long) to lower (short) positions on the long -term market of an asset. When the report is higher than one, there are more long positions than the shorts. This suggests a bullish feeling, most traders expecting the value of the asset to increase.

On the other hand, a long / short ratio less than 1 means that more traders bet on the price of the assets to decrease than those who expect it to increase.

In the case of SPK, the current ratio of 0.91 suggests that traders are positioning themselves more and more for more decline, confirming the pessimistic prospects observed in market sales.

SPK bears tighten grip as the volume falls

At the time of the press, SPK is negotiated at $ 0.085, which allowed 7% of its value in the past 24 hours. In the middle of the broader drop in activity on the cryptography market, the Altcoin trading volume plunged more than 30% during this period.

When the price of an asset and the volume of trading drop, it signals to weaken market interest and discolor the momentum. This combination suggests a lack of confidence of buyers in the SPK and refers to a potential for decline.

In this case, the SPK value could drop to $ 0.067.

However, a peak of demand could trigger a break greater than $ 0.091.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.