SPX Price Gains Strength as Golden Cross Looms

The price of SPX6900 (SPX) jumped almost 30% in the last 24 hours, pushing its market capitalization nearly $ 1.3 billion and solidifying its position as one of the largest coins. This rapid increase has also led SPX RSI to its highest level since January 19, signaling high purchase pressure but approaching the exaggerated territory.

Meanwhile, Smart Money Activity shows a net influx of $ 35,096, suggesting growing interests of influential traders. The fact that SPX continues its trend at $ 1.8 or a correction depends on key resistance and support levels in the coming days.

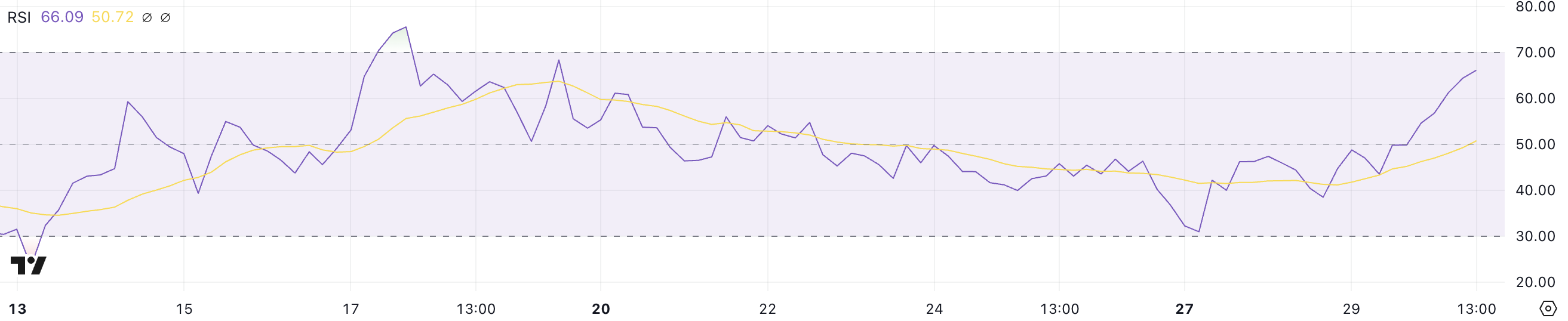

SPX RSI rises without crossing the Surachat threshold

SPX6900 RSI increased from 43.5 to 66 in a single day after its recent price increase of 30%. This overvoltage also placed SPX in 6th place among the largest coins on the market. The RSI (relative resistance index) is a momentum indicator which measures the speed and extent of the price movements on a scale of 0 to 100.

Readings less than 30 indicate that an asset is occurring, while levels above 70 suggest that it is exaggerated. An increasing RSI reflects the increase in the bullish momentum, while an RSI has decreased signals weakening the force or potential prices.

SPX6900 RSI is now at 66, its highest level since January 19, reporting high purchase pressure. Although he has not yet reached the overcrowding threshold of 70, he approaches a level where traders can start monitoring potential exhaustion.

If RSI continues to increase the 70 beyond, SPX Price could see more upwards but can also become vulnerable to a decline. However, if RSI stabilizes near this level, this could indicate a sustained bullish momentum, allowing the upward trend to continue.

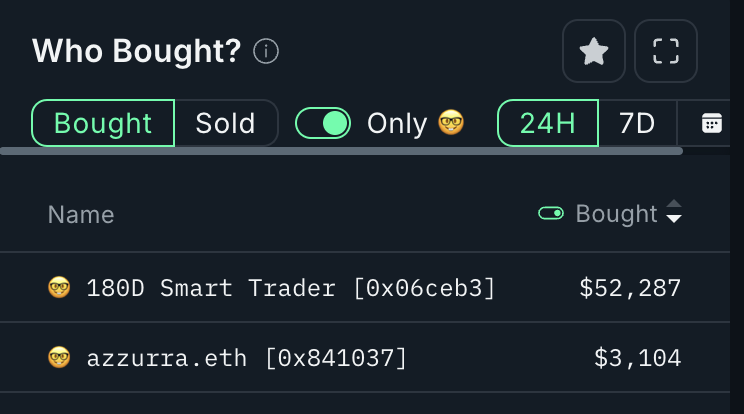

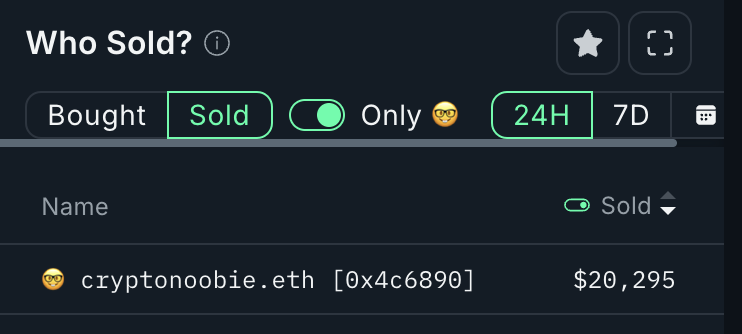

Smart Money records $ 35,000 net flow in SPX

In the past 24 hours, two smart monetary addresses have accumulated SPX, with a purchase $ 3,104 and the other buying $ 52,287. Meanwhile, another smart monetary address sold for $ 20,295 SPX.

The follow -up of these portfolios is crucial because intelligent money refers to institutional or high net merchants with a history of profitable realization. Their purchase or sale activity can provide information on the feeling of the market and the potential price orientation, because they often act in front of wider retail traders.

Recent intelligent money entries suggest growing interest in SPX, as the total volume of purchase exceeded the sales volume. While a portfolio has unloaded SPX, the largest accumulation signals the confidence of key players.

If this trend continues, it could indicate growing demand, supporting the appreciation of SPX prices. However, if the sales pressure increases among intelligent silver portfolios, this could suggest a change of feeling, which leads to a reversal.

Price prediction SPX: Will it test $ 1.5 soon?

The SPX prices graph indicates that its EMA lines are about to form a golden cross, a bullish signal that could strengthen the momentum upwards. If this crossing occurs, SPX could test resistance at $ 1.55, and an escape above this level could push the price to $ 1.8.

A golden cross generally suggests a change of trend, strengthening the confidence of buyers and attracting more interest. The next sessions will be crucial to determine whether the SPX price can maintain its recent earnings and continue its upward trajectory.

However, if the current media threw fades and the purchase pressure is weakening, the SPX price could reverse its trend and test the support at $ 1.23.

A break below this level could speed up the sale, potentially leading to the price at $ 0.96. If this scenario takes place, SPX may lose its place among the best pieces of memes in Fartcoin, Floki and WIF.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.