Stablecoins Now Central to Cross-Border Payments: Fireblocks

According to the newly published Fireblocks report, global financial institutions actively adopt stoves as strategic tools for cross -border payments, market expansion and operational efficiency.

The Fireblocks report is based on an online survey of 295 respondents. With almost half of the organizations interviewed already using stablecoins and others in the test phases, the data reveal a clear change: the stablecoins go from the periphery to the heart of global finance.

Stablecoins enter the financial core

According to the “State of Stablecoins 2025” report of Fireblocks, 49% of world organizations used stablescoins for payments, while 41% are in the test phase or plan to implement them.

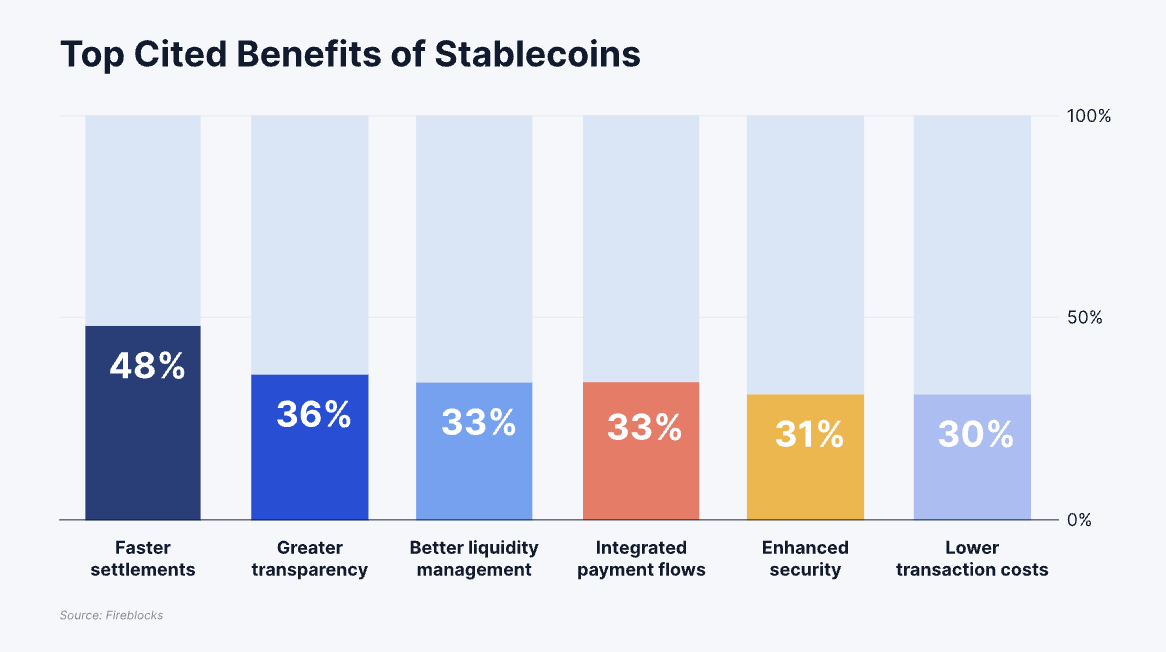

The biggest advantage of Stablecoins is the speed of the instant settlement, that 48% of managers by far appreciate cost savings. B2B cross -border payments are the best use case, in particular in Latin America, where 71% of organizations prioritize use.

“Stablecoins emerge as strategic growth catalysts to develop in new markets and meet the growing demand for customers. Banks use them to regain the cross -border volume lost while maintaining existing infrastructure, while fintech and payment gateways aim to reach income and margin gains. ” The report indicated.

Market expansion is the main engine of Asia, while North America considers regulations as an opportunity. With its Mica regulatory framework, Europe promotes clarity and security, reducing compliance problems to 18%.

This shows that stablecoins are not only a trend but have become a necessary solution.

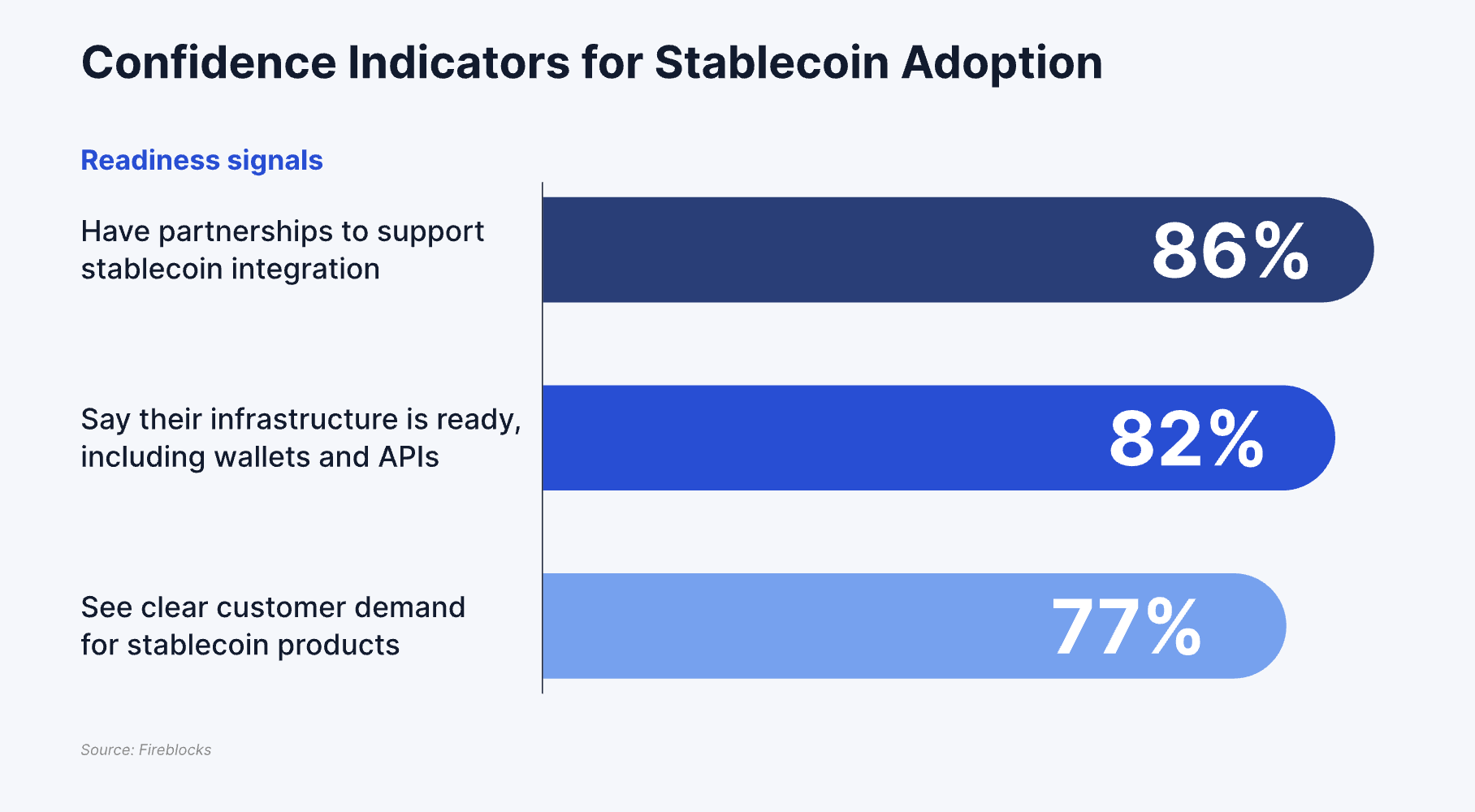

The infrastructure to support Stablecoins is also ready, 86% of organizations believing that portfolios, APIs and conformity tools meet their needs. Security is highlighted, 36% of managers claiming that improving security will lead to broader adoption.

Strategic engines such as income growth and customer satisfaction replace cost savings, suggesting that stablecoins are a financial modernization tool that will help organizations to compete in the digital age.

The StableCoin market is expected to exceed 2 dollars billions over the next three years, with major players such as Visa and Mastercard joining the mixture.

Long -term optimistic potential for the USDC

Meanwhile, Jon Ma, founder of Artemis, a Crypto data platform for institutions, provides that the market value of the USDC could exceed $ 370 billion by 2029. He maintains that with an annual growth rate of 30%, the global stabbing offer could reach $ 1.2 billion of dollars, with USDC holding a market share of 28.5%.

The USDC, issued by Circle, is currently the second largest stablecoin with a market capitalization of around 61 billion dollars. Given its recent growth in market capitalization, the long -term projections of the USDC are quite optimistic.

This is aligned with the recent state of the Stablescoin market. As Beincrypto reported, the total stablecoin offer exceeded $ 250 billion by mid-2010, with a dominant market share USDT and USDC. This growth reflects the demand for payments and opens up opportunities to institutions to optimize cross -border transaction costs, previously limited by traditional banking systems.

In addition, the Circle Payment Network (CPN) is expected to deal with $ 570 billion in B2B payments by 2029, generating significant income and strengthening the position of the USDC.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.