BlackRock’s IBIT Dominates Bitcoin ETF Inflows as BTC Surges

On Monday, the Bitcoini chief of money reached an intrajournual summit of $ 108,952, because a renewal of purchase interest has pushed the higher asset. The rally triggered a significant activity through the ETF supported by BTC.

The FNB Bitcoin recorded a combined net entrance exceeding $ 400 million for the day, the BlackRock Ibit leading the charge. Today, the King Coin has recorded a modest gain of 1%, with a chain showing growing skepticism among leverage traders.

ETF Flows Surge on Bitcoin Rally

Bitcoin climbed to an intra -day summit of $ 109,952 on Monday, because a renewal of the interests of investors led a wave of purchase pressure.

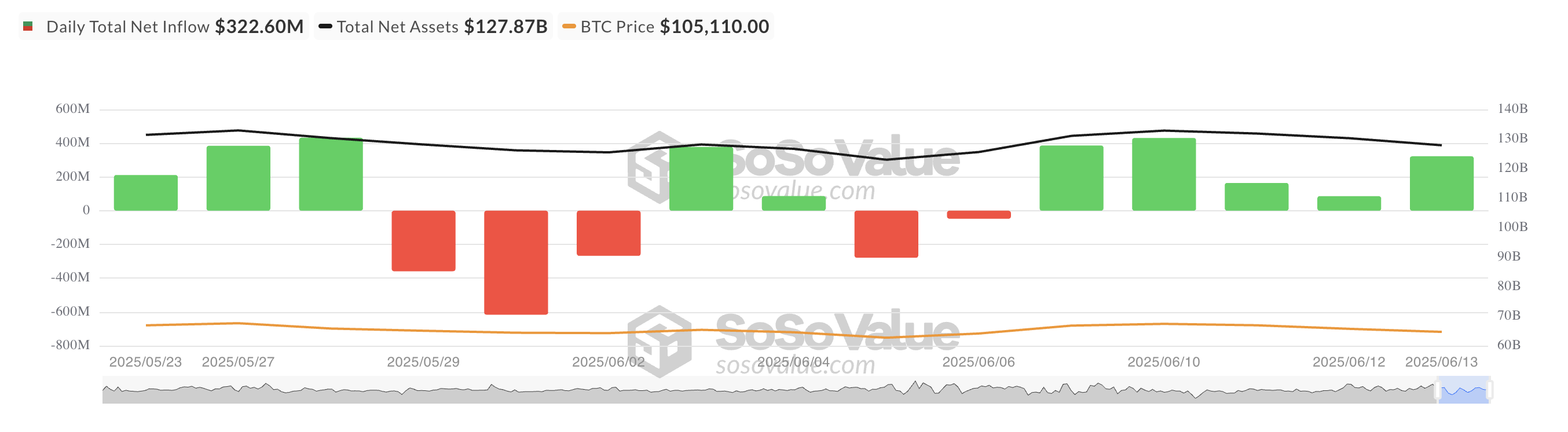

This resurgence of the momentum has contributed to fueling a peak in the entrances to the BTC ETFs, listed in the United States, which experienced a net capital injection of 408.59 million dollars, their largest day entry since June 10.

Total Bitcoin Net Afflux Spot ETF. Source: Sosovalue

Ishares Bitcoin Trust of BlackRock (Ibit) led the ETF pack in net entries, affirming its domination among investment vehicles in institutional quality cryptography. According to Sosovalue, the entrances to the Monday fund amounted to approximately $ 267 million, bringing its total historical entry to $ 50.03 billion.

This strong influx suggests that institutional investors remain largely insensitive to short -term volatility and continue to consider the BTC as a precious portfolio cover.

BTC is stable, but traders shake for the decline

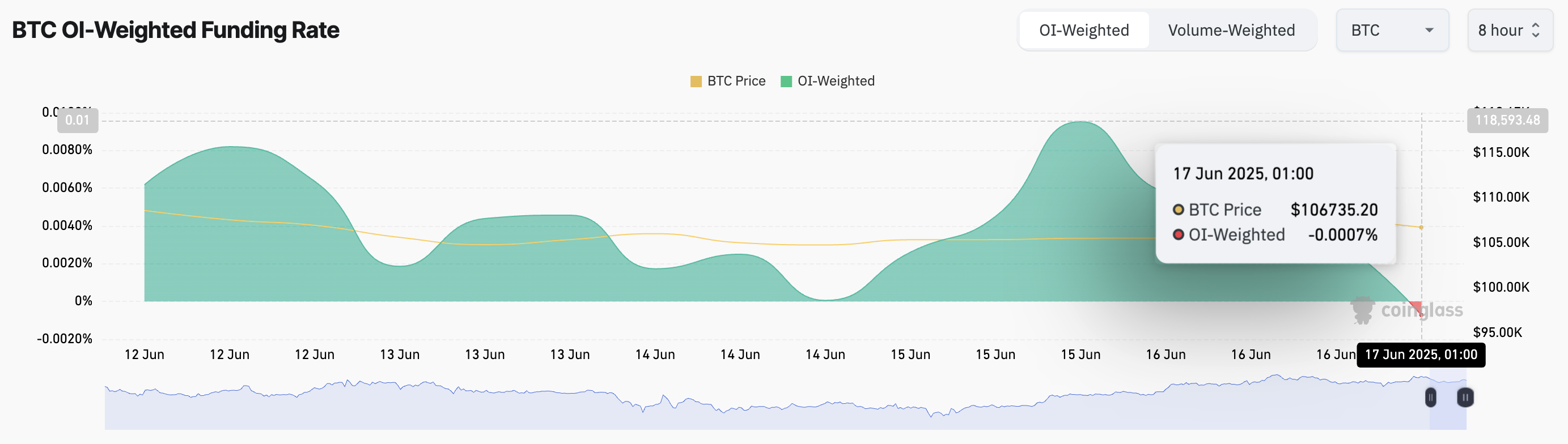

While BTC is up 1% modest today, the derivative market flashes warning signals. The funding rates have again reversed negative, reflecting a renewed lowering feeling among perpetual term traders. According to CorciLass, this is currently 0.0007%.

The financing rate is a periodic payment exchanged between traders on perpetual term markets to maintain prices of contracts aligned on the cash market. When the funding rate is negative, short traders pay long merchants, indicating that the bearish feeling dominates the market.

If that persists, it could exacerbate the pressure downwards on the price of the room.

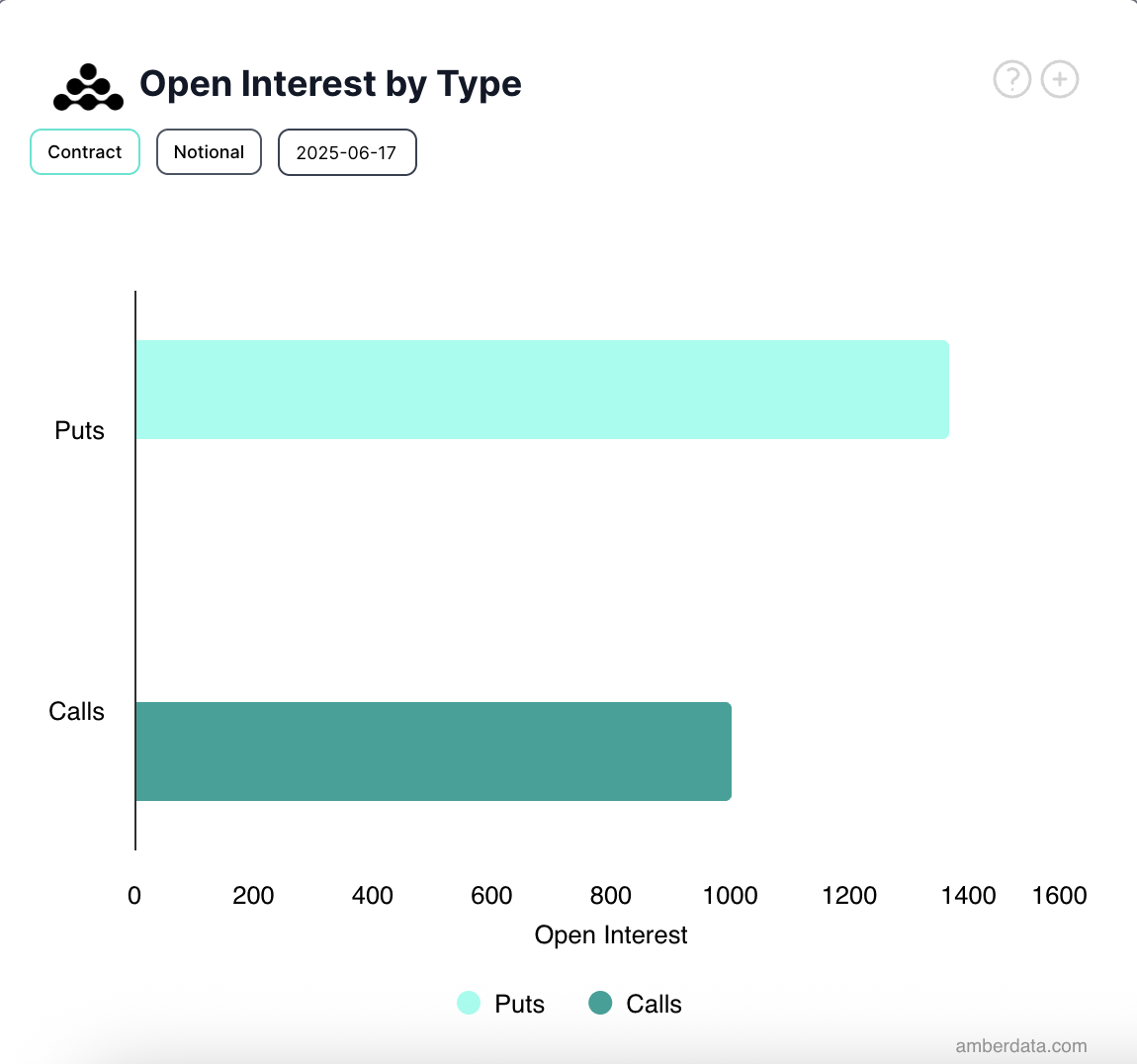

Meanwhile, optional traders also lean the defensive. Deribit data shows increased demand for calling contracts today, which suggests that investors are looking for downward protection in the middle of increasing uncertainty.

While the ETF entries indicate strong institutional demand, the underlying market signals suggest that traders are working carefully. The financing rates becoming negative and put options that gain ground, investors can compete in short -term volatility despite the optimistic account of the entries.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.