Strike Hits $13, Spark Eyes $0.075

This week marks a turning point for two less known but quickly emerging tokens, Strike (Strk) and Spark (SPK). In just 24 hours, the two tokens attended dramatic rallies, reinforced by strong technical thrusts and updates of a strategic ecosystem. With retail merchants and whales accumulate, strike prices and sparks flash signs of invisible dynamism in recent weeks. If you plan to jump on the train, join me while I explore potential short-term targets.

Price analysis (STRK):

The exercise price increased by 90.48% of jaws in the last 24 hours, from a hollow of $ 5.48 to a peak of $ 15.06. At the time of the press, Strk changes hands at $ 13.59. The rally comes to the back of a decisive break above the resistance of $ 10.12, a level which was unexplored for weeks. Now, the price has even exceeded the level of fibonacci extension of 200% to $ 13.18.

Bollinger strips on the 4 -hour graph indicate aggressive expansion, confirming increased volatility, while the RSI increased greater than 73.

Basically speaking, Strike’s passage to the governance led by the community and its talks with major exchanges like Kucoin and Bitget have renewed market confidence. The immediate resistance of Strk is at $ 16.027, while key supports are placed at $ 12.568 and $ 10.12. A break over $ 16 could open a way to retests $ 18 in the short term.

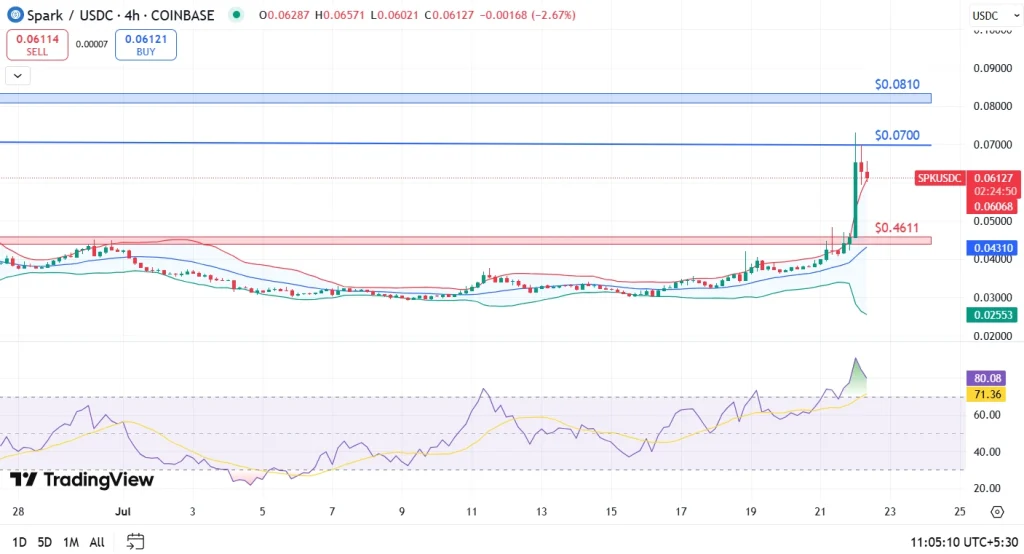

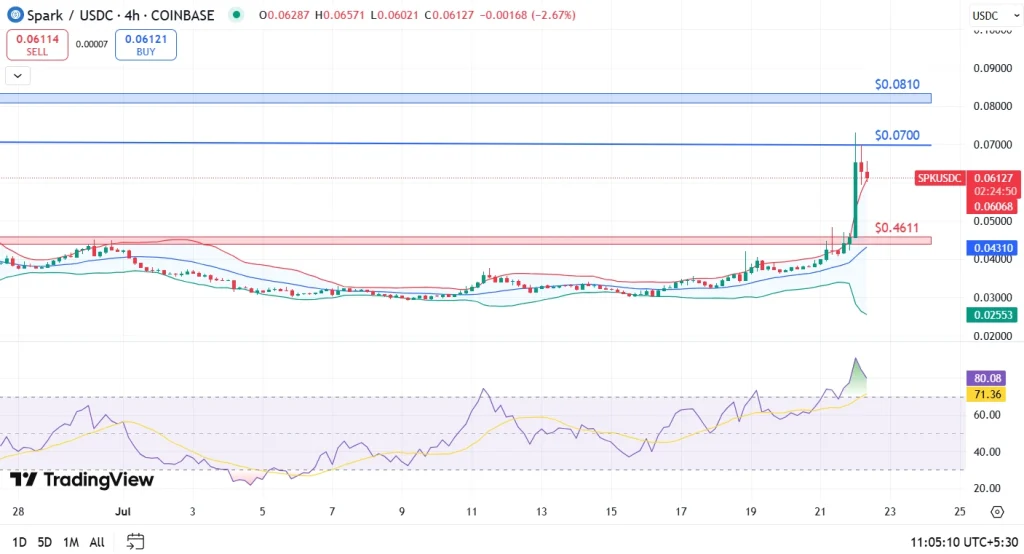

Spark price analysis (SPK):

Spark’s price jumped 43.93% in one day, now negotiating $ 0.06148, double in a week. He broke properly above the Fibonacci crucial resistance at $ 0.0,0615, with RSI-7 reaching an extreme 91.53.

The 24 -hour volume increased from $ 392.66% to $ 502 million, the climbing token of a minimum of $ 0.04091 to a summit of $ 0.07,155. This escape was triggered by high purchase pressure, confirming a decisive market change.

If Spark supports more than $ 0.0615, the next key resistance is at $ 0.075, followed by a medium -term target near its summit of $ 0.1257. However, caution is notified due to potential short -term withdrawals from exaggerated areas.

Faq

Both are in exaggerated areas and short -term inscriptions are risky without withdrawals.

A change in protocol governance and a list of talks with major exchanges fueled the bullish feeling.

If the momentum and the volume are maintained, $ 0.1257 can be achievable in the medium term.