State Of Solana’s Blockchain RWAs Projects, Kamino Lend’s Integration of Tokenized Equities Impact for DeFi

Solana’s call stems from its high flow, its transaction costs near zero and its robust developer ecosystem. Technical innovations such as the standard and rapidly blocking finality of the token-2022 allow transparent compliance tools, the distribution of yields and composable challenge integrations. These features return Solana both to the accommodation of a wide range of RWAS, token treasure tokens with ONCHAIN actions and tokenized products. Its infrastructure is increasingly adapted to the needs of asset transmitters, regulators and users, paving the way for the adoption of RWA on an institutional scale and community levels.

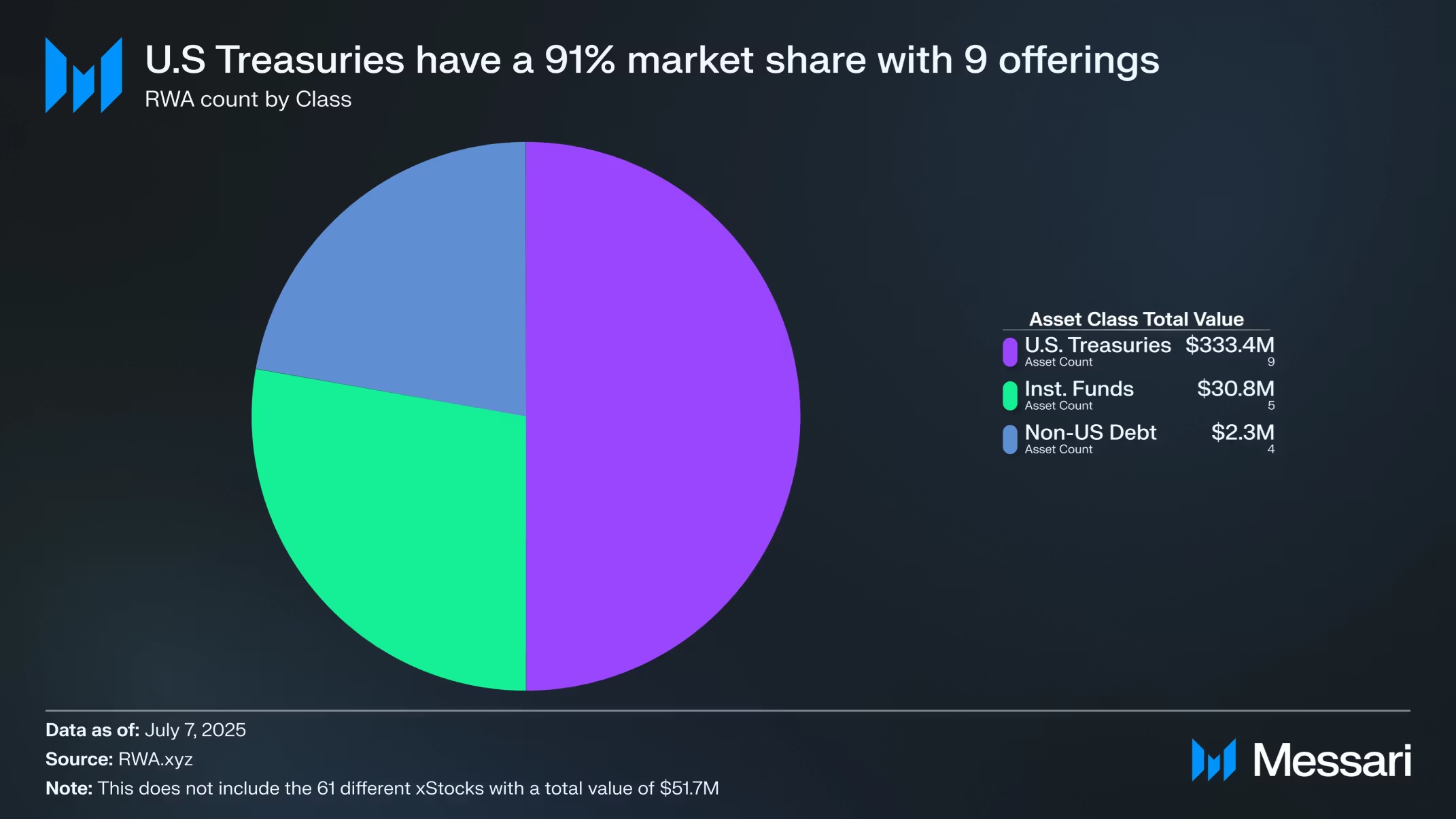

Rwa on Solana exist in four basic categories: (1) The active ingredients bearing the yield, including US Treasury bills, institutional funds and private credit protocols such as Ondo Finance, Franklin Templeton and Maple; (2) Tokenized public actions, with the future launches of the Superstate, Kraken and Ondo world markets; (3) Uninformed assets such as Tokenized real estate and collectibles of platforms like Parcl and Baxus; and (4) suppliers of emerging infrastructure like R3 and secure that underlie compliance and interoperability. Thanks to this lens, we assess Solana’s trajectory as an increasing center for ONCHAIN RWAS and what it means for the future of world capital markets.

Register For TEKEDIA Mini-MBA Edition 18 (September 15 – December 6, 2025)) Today for early reductions. An annual for access to Blurara.com.

Tekedia Ai in Masterclass Business open registration.

Join Tekedia Capital Syndicate and co-INivest in large world startups.

Register become a better CEO or director with CEO program and director of Tekedia.

Compatible assets

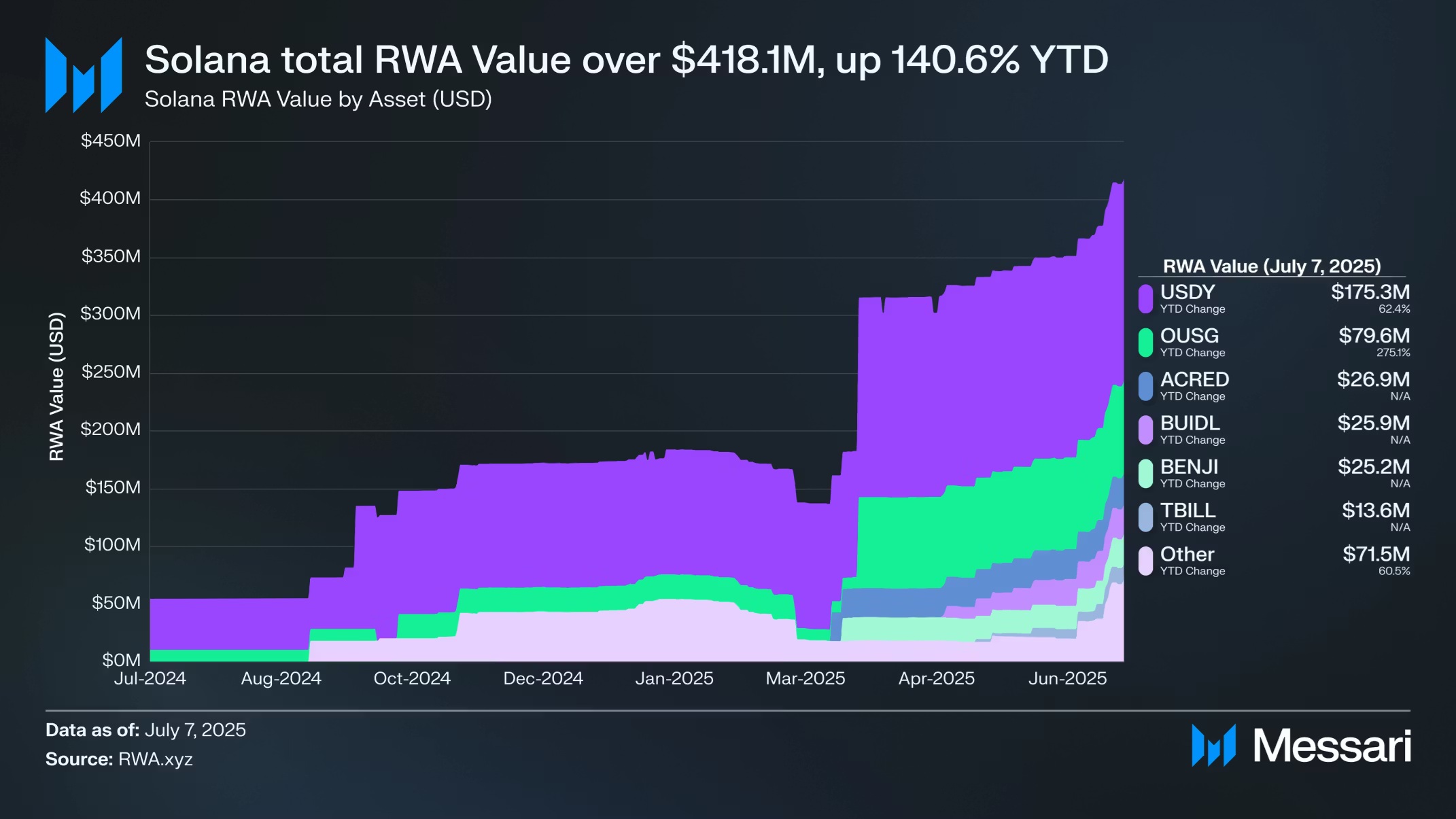

Rwa for yields are the most significant and fastest segment of the Solana RWA landscape, capturing the vast majority of Rwa Value Rwa Non Stablecoin (USD). These assets, ranging from US Treasury bills to tokenized to institutional funds and private credits, offer onchain investors a direct exposure to yield flows outside the chain, often with improved composibility and 24/7 accessibility compared to their tradfi counterparts.

American Treasury Tokenized

Tokenized treasury bills offer digital packaging for the most liquid and reliable yield instruments in the world and have become a fundamental pillar for the management of onchain assets, the stablecoin guarantee and DAO cash operations. Solana’s tokenized treasure market has gone from a small base to encompass a range of products from native and transversal active ingredients.

Finance Ondo – Ousg & Usdy (Treasury and Yield Tokens)

OUG and USDY represent the double approach to Ondo Finance for US Treasury bills.

- Ousg, introduced in January 2023, is an initially structured tokenized fund around the Buidl fund of Blackrock. It is mainly intended for accredited investors. In July 2025, Ousg was the second largest asset bearing the yield by market capitalization in Solana, with seven holders and a market capitalization of $ 79.6 million.

- USDY, launched in August 2023, is a token supported by treasury bills and banking deposits, designed to operate as a stable yield with wide accessibility. USDY appreciates the price as the interest accumulates. The token is transferable between the channels using Layerzero, which makes it highly composable in the DEFI applications. In July 2025, USDY was the largest RWA bearing the yield by market capitalization in Solana, with 6,978 holders and a market capitalization of $ 175.3 million.

The integration of Kamino Lend of token actions changes the situation to define

Kamino Finance, a decentralized Solana based Loan protocol, has integrated tokenized actions (XSTOCK) into its Kamino Lend platform, allowing users to borrow from active ingredients like Spyx (S&P 500), NVDAX (NVIDIA), MSTRX (microstrategy) and others directly on the chain. This integration, fueled by the Oracle XSTOCKS in Chainlink and the sustained finances, marks an important step in the mixture of traditional finances (tradfi) with DEFI, allowing trading and 24/7 loans without intermediaries.

Users can deploy these tokenized actions as guarantee to borrow assets such as USDCpotentially by taking advantage of their positions. However, this feature is not available for users in limited courts such as the United States, the United Kingdom and the EU due to regulatory constraints. The initiative has been highlighted as a pioneering movement in DEFI, with trading volumes for assets like MSTRX showing a major activity, such as $ 3.4 million in a 24 -hour negotiation volume, recently reported.

Tokenized actions make it possible to use traditional financial assets in DEFI Protocols, allowing users to borrow against shares without selling them. This creates new liquidity options, potentially increase the effectiveness of capital for investors who can take advantage of their assets for loans (for example, borrow USDC against NVDAX) while retaining exposure to pricing.

Unlike traditional markets with defined negotiation hours, tokenized actions on Kamino Lend operate on the chain, allowing trade and 24 hours a day. This could attract users in search of flexibility, in particular on the volatile markets where active MSTRX have shown high trading volumes (for example, $ 3.4 million in 24 hours).

By integrating familiar assets such as Spyx (S&P 500), Kamino Lend Reduces the entrance barrier for tradfi investors, which potentially leads to the traditional adoption of DEFI. This could extend the total locked value (TVL) in Solana -based protocols, which have already seen Kamino Lend TVL develop considerably after its launch. The loan against token actions introduces a lever effect, amplifying potential yields but also risks. Users could cope with liquidations if the collateral values drop, a risk increased by the volatility of assets like NVDAX or MSTRX.

This requires robust risk management and reliable oracles (for example, the Oracle XSTOCKS of ChainLink) to ensure specific prices. Tokenized actions can be used in complex DEFI strategies, such as the yield of agriculture or guaranteed loans, creating new financial products. This could reshape the way investors interact with actions, going beyond traditional strategies “buy and hold”.

Kamino Lend’s tokenized actions are not available in the courts such as the United States, the United Kingdom and the EU due to strict securities regulations. This creates a ditch where users in authorized regions (for example, certain parts of Asia or Latam) have access to innovative financial tools, while others are excluded, strengthening a fragmented global financial system.

DEFI platforms and Kamino require technical knowledge and cryptographic portfolios, which can exclude less informed or sub-banking populations. Even in authorized regions, only those who have access to solara -based assets and stabbed can participate, expanding the gap between cryptographic users and traditional investors.

The ability to borrow against high value tokenized actions benefits users with important assets, potentially concentrating wealth among those already invested in assets like NVDAX or SPYX. Small retail investors can find it difficult to participate on a large scale, exacerbating financial inequalities. Sophisticated users with DEFI expertise can navigate the risks of leverage and volatility, while less experienced users can undergo losses due to liquidations or market swings.

While Kamino Lend operates on decentralized principles, dependence on oracles (chain-link) and asset issuers (sustained funding) introduces centralization points. Users of regions with less confidence in centralized entities can hesitate to commit, by creating a trust of trust. The integration of Kamino Lend of token actions changes the game for deffi, offering new ways to unlock liquidity and merger traditional and decentralized finances.

However, he also underlines a gap – regulator, economical and technical – which limits access and advantages to certain users and regions. As the challenge evolves, the fight against these disparities through clearer regulations, user education and wider accessibility will be crucial to ensure fair participation.