Stellar Price Rises 10% This Week on Nasdaq ETF News: What to Expect Next

The stellary price (XLM) is up 10% this week compared to the support area of $ 0.260 and almost 2% increased by intraday, as confirmed by Nasdaq to add XLM with other assets of the reference index via a new dry deposit this week, where its decision is during the end of the year.

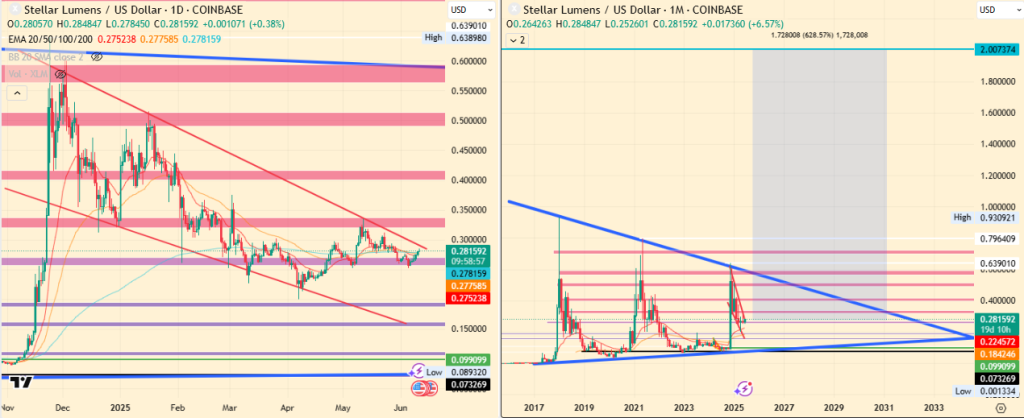

In the midst of an optimistic cryptography sector, recent news added the hope for the long -term price action of XLM. At the time of Wednesday’s editorial staff, he approaches the upper border of his corner fall, which raises expectations for XLM to reach the summit of Q4 2024, on a successful border violation.

This optimism is not only on the technical table, in fact that its fundamental principles also increase, with its market capitalization of Stablecoin and its TVL doping significantly. All these points in favor of the bulls and refer to a renewal of the interests of investors and to a quantity of prices upwards.

Consequently, the XLM price could be on the verge of a massive optimistic movement, with several triggers likely to feed an increase in bulls.

Can the XLM price benefit from the approval rating of 90% of “hashdex nasdaq crypto index US”?

Stellar’s price gain comes while chatter around the progress of the Altcoin season. In particular, investors also note an increase in the opportunities to approve the main ETF Crypto applications by the SEC in the coming months.

According to Bloomberg ETF analyst, Eric Balchunas, who shared the new chances of approval, where baskets / indexes, Litecoin and Solana have the highest chances of 90%.

This is extremely optimistic for XLM, although it does not have an individual FNB as a soil and LTC. Thus, so that XLM and others are increasing, in the coming months are very crucial.

XLM Price biases Haussier is supported by measures on chain

According to Defillama, Stellar TVL recently reached a new ATH of $ 97.5 million, which strongly suggests that more users are engaged with the network.

In addition, the market capitalization of the stables increased sharply, going to $ 680 million at the start of the current week. These clearly indicate an upward perspective.

The stellar plan to lead in payments would pump the XLM price

In a recent interview, the CEO of XLM, Dennel Dixon, stressed that the Stellar Development Foundation, under its direction, focuses on the positioning of XLM as a leader in payment solutions.

In the interview, she also referred to the vision of the Jed McCaleb founder to allow money to move as easily as email, allowing users to carry out transactions with just a finger, regardless of their location.

The vision like these may have influenced clues like the Nasdaq to recognize the crypto like XLM and give it a piece of exhibition ETF, they deserve.

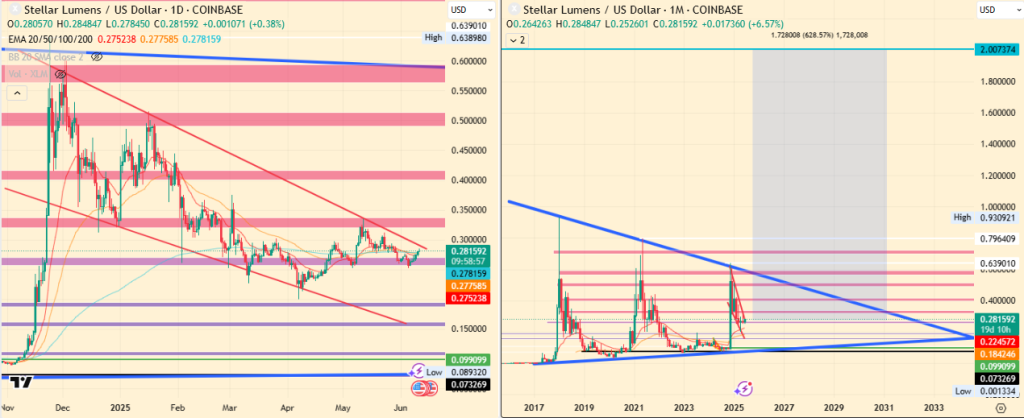

On these current bullshit tickets, if in the short term, if the XLM price reflects high altcoins, it could exceed $ 0.40 and target the summits observed in early December 2024.

However, this short -term perspective could face notable obstacles if the bears take control below $ 0.30. If the falls can also reach a brand of $ 0.10.

In addition, in the long term, this year’s goal goes up to $ 0.639 and $ 0.796. While in extreme increase conditions on the monthly time, the rupture of the symmetrical triangle could show higher targets. When these objectives are intended up to $ 2 after the breakdown of the summits of all current time, around $ 0.93 seen in 2018, it can be possible from the long -term bull menu.