Circle IPO Success Reveals Shocking Frustration for Employees

Circle’s public debut aroused criticism of high-level investors, in particular the way the first employees may have missed almost $ 3 billion in unrealized gains.

The CHAMATH PALIHAPITIYA billionaire capital capital noted that CIRCLE Insiders had sold 14.4 million shares at the initial price of the public offer (IPO) of $ 31 each, obtaining approximately $ 446 million. However, the action now negotiating more than $ 240, the same shares were currently worth around $ 3.45 billion.

The IPO circle leaves billions on the table for the first employees

The difference marks a difference of almost $ 3 billion, which Palihapitiya described as an expensive misstep caused by the choice of a traditional IPO.

He noted that firm takers had bought initiate actions and redistributed them to select customers, leaving the original shareholders with a limited increase.

In his opinion, employees have mainly given billions of values to external investors who had no role in the success of Circle.

“In this case, it was a gift of $ 3 billion of employees and circle investors to the people they do not know, will never know and will have nothing to do with their trip,” said Palihapitiya.

Palihapitiya argued that the situation could have taken place differently if Circle had chosen an acquisition company merger for special purposes (SPAC) or a direct list.

These alternative routes often give initiates more control over prices, calendar and disclosure, helping them to keep more value during a public transition.

He added that the spaces and direct lists more clearly disclose the dynamics of the evaluation and can be structured for the benefit of sellers and buyers.

“To be clear, this value transfer method does not occur via direct registration or a SPAC – the advantages in spaces and DLs are disclosed very explicitly.

Circle had previously planned to become a public via a spac merger with Concord Acquisition Corp, but canceled the agreement in 2022. The company then continued a traditional IPO, which, although successful, seems to have left the first stakeholders with regrets.

CRCL increases as stable confidence increases

Despite the controversy, Circle’s performance on public procurement was remarkable.

His actions, now negotiating under the CRCL of the Ticker, has increased by more than 675% since its beginnings of $ 31, reaching a peak of $ 248 per share on June 20.

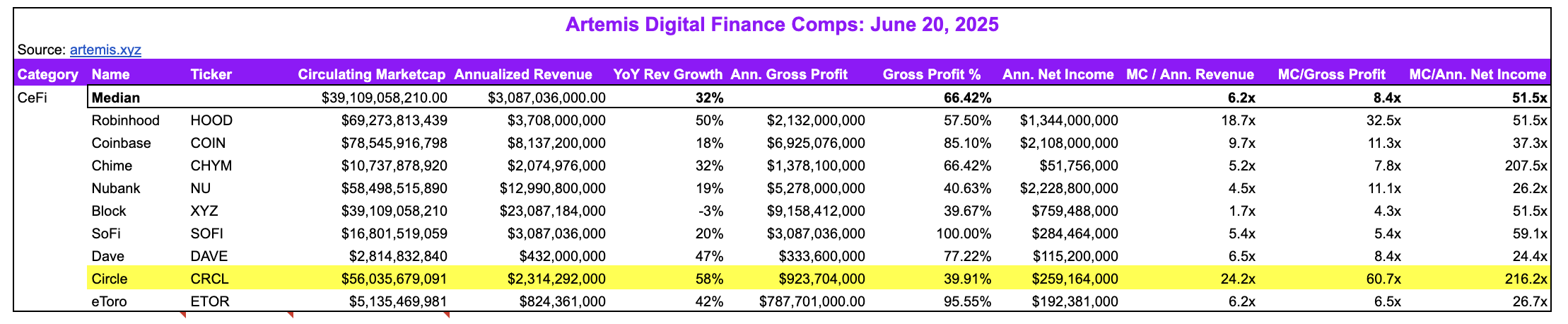

Jon Ma, CEO of the Blockchain Analysis Society, Artemis, noted that Circle is traded to multiple evaluation far above those of Coinbase and Robinhood, despite companies reporting a higher net income.

“The circle is now traded for: 24.2x [its] Rate of execution of income Q1’25, 60.7x Q1’25 gross realization rate [and] 216x Q1’25 Net income execution rate, ”said Ma.

According to him, the premium probably reflects the belief of investors in the future growth of Circle and the potential regulatory advantage.

A key factor behind this optimism is the recent adoption of the law of engineering in the Senate – a bipartite bill designed to provide stablecoin clarity on the American market. The legislation, supported by President Donald Trump, still needs approval of the Chamber and a final signature.

If it is adopted, it could consolidate Circle’s regulatory sole, strengthen its domination in the stable sector and help justify its stock market course.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.