Strong Technicals and Institutional Confidence Drive Bullish Outlook

On May 22Bitcoin has reached a New top of all timeclosing $ 111,390 After briefly touched an intrajour peak $ 112,000. Despite this step, market behavior suggests that this may not be the euphoric summit – capital is still flowing at unprecedented levels.

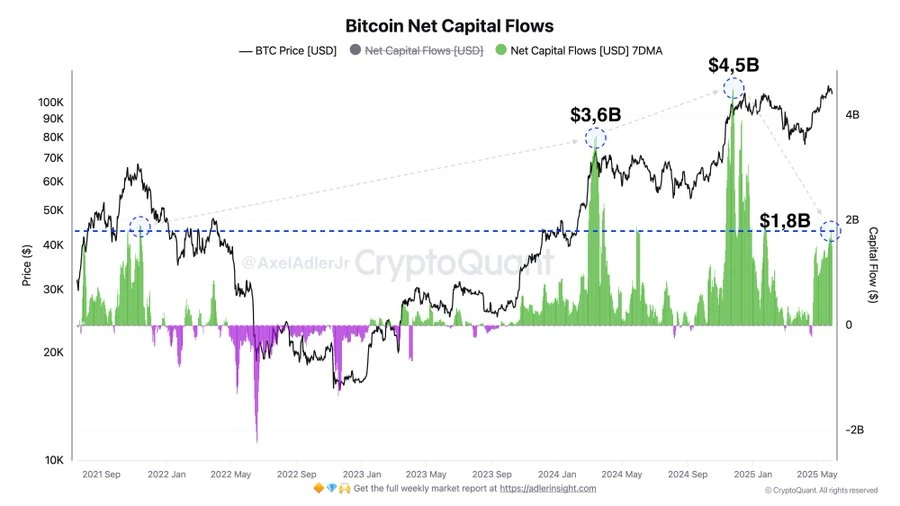

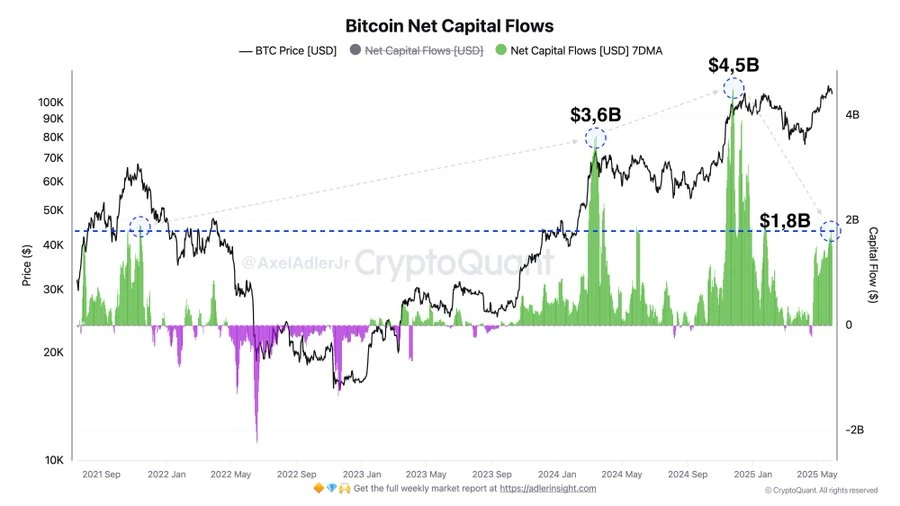

Investors’ confidence remains unshakable: $ 1.8 billion, daily entries correspond to 2021 peak

According to the chain analyst Axel Adler Jr.Bitcoin is now on average $ 1.8 billion in daily net entriescomparable to the peaks seen for the last time in the November 2021 Bull Market, when BTC reached $ 64,000. Adler, known for his ideas based on shared data on platforms like X (formerly Twitter), underlines that this input volume is a strong indicator of Confidence of supporters supportedEven after having established new heights of all time.

Axel Adler Jr. on x

“Daily net entries remain historically high, which even exceeds the PIC 2021 levels at current prices.”

The highest capital flows at high prices – not the decline

In particular, Adler’s data reveal that capital has increased the most aggressively during price peaks – not decreases. HAS $ 73,000Bitcoin saw $ 3.6 billion in daily entries, while the figure has jumped $ 4.5 billion per day when BTC was there $ 92,000.

This is a significant passage compared to the behavior of the past market where the purchase has generally intensified during declines. The current cycle shows growing comfort among investors to buy at higher levels, perhaps reflecting institutional condemnation Rather than short -term speculation.

Market structure: a break followed by Consolidatio

In early May, Bitcoin hovered $ 94,181Exchanging laterally in a narrow strip. A Sharp 6.42% overvoltage on May 8 Broken this model, launching a new phase of bullish impetus.

From May 18 to May 22Bitcoin has engendered 8.3%reaching its new summit. However, a brief decline followed: since May 23BTC fell approximately 5.8%merchant now $ 105,171.54. The retrace suggests a period of healthy consolidation Rather than the sale of panic, in particular given the broader macroeconomic stability and the continuous interest of Crypto ETF.

Technical indicators show continuous strength

- RSI (relative force index): Currently at 53.58suggesting neutral impulse. He has held between 50 and 70 since the end of May, indicating the consolidation without conditions of overchat immediately.

- Golden cross: On May 22THE My 50 days crossed above 200 days– A bullish signal. Mobile averages are now found $ 9776.48 And $ 94,668.91 Respectively, with the widening of the gap, affirming a strong momentum of the trends.

- ADX (average directional index): HAS 25.88This indicates a sustained trend force. Since the end of April, the ADX has remained above 25 years, still validating the momentum at the current increase.

In the front: beyond ATH

While the 5% weekly drop may seem alarming in isolation, the zoom out reveals a Gain at 30 days of 11.1%. The volume of capital entrances, even at high price levels, underlines a change in market psychology. Long-term investors seem to be more and more comfortable entering the market to higher assessments, perhaps considering Bitcoin as a macro-hut Rather than a volatile asset.

Final to take away

The new summit of all time for Bitcoin is notable, but what matters most is the context behind. The historic levels of entry into capital, strong technical signals and a basis of master’s degree in control all point to a market which is scalableDo not overheat.

In the words of the analyst Axel Adler Jr.It may be the “The most structural sound of the bull cycle. “”

Never miss a beat in the world of cryptography!

Stay in advance with the news, expert analysis and real -time updates on the latest Bitcoin, Altcoins, DEFI, NFTS, etc. trends

Faq

According to the BTC price forecasting of Coinpedia, the Bitcoin price could peak at $ 168,000 this year if the haus feeling suffered.

With increased adoption, the price of Bitcoin could reach a height of $ 901,383.47 in 2030.

According to our latest BTC price analysis, Bitcoin could reach a maximum price of 13,532,059.98 $

By 2050, only one BTC price could reach $ 377,949,106.84