SUI ETF Filing Hits SEC Register as Sui Recovers from Hack

The NASDAQ has filed a 19B-4 form with the Securities and Exchange Commission (SEC) of the United States to list the 21Shares Su Etf.

This decision marks a central step towards the dissemination of an ETF SPO SPO (Stock market negotiated funds) on the US markets, even if the network returns from recent misfortunes linked to ecosystems.

Arrow metrics reinforce the case for approval of the Su Etf

The dossier, published in the SEC public register, initiates the official examination process of what could be one of the first ETFs based on Altcoin in the United States after Ethereum.

In a blog, the Foundation SUD declared that this deposit marks the official start of the United States Review process SPO ETF.

“The 19B-4 file, now officially published in the SEC public register, marks the official start of the examination process,” read an extract in the blog.

The deposit follows the previous registration of 21Shares in April. It represents an important stride in the institutionalization of the SU ecosystem.

With more than $ 300 million already invested worldwide in ETPs based on SUPs (products negotiated on the stock market), mainly through the Euronext Paris and Amsterdam lists, the request for exposure regulated in the United States increases.

The unique technological architecture of SUI has strengthened its ascent. The oriented programming object of SU and the evolutionary infrastructure horizontally supports various uses. The use cases range from the DEKE tokenization and the game to the tokenization of active active world (RWA).

The metrics of the ecosystem reflect this momentum. According to Defillama, Suis ranks eighth in total locked value (TVL), with $ 1.944 billion currently deployed on its platforms.

Its market capitalization of the stable reserve increased to more than $ 1.1 billion, up more than 190% up to date (YTD). Similarly, the volume of transfer from Stablecoin de Su Blockchain exceeded $ 110 billion in May only.

Sui retrieves after the hacking incident of Cetus

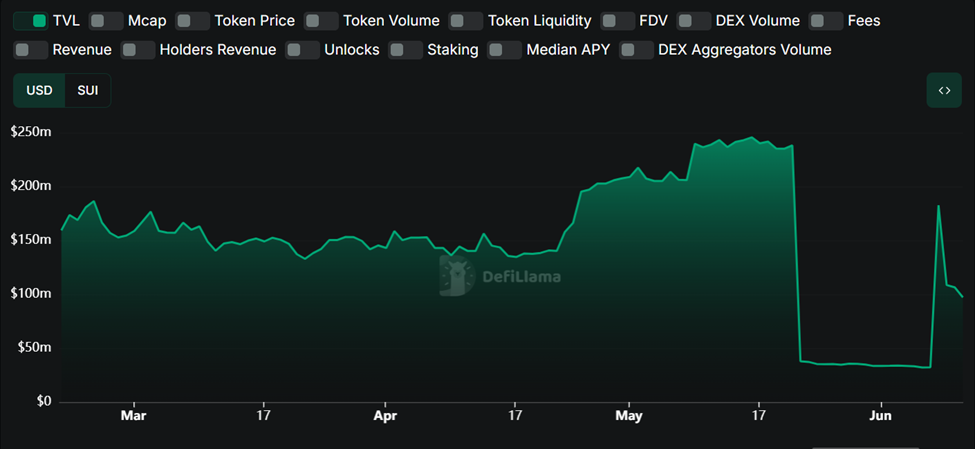

Beincrypto reported the recent Hack Cetus of $ 260 million Sur Su Suis, which sparked a freezing of the network in the midst of decentralization problems. In the middle of the speech, the SUP network was also faced with the controversial recovery plan of $ 162 million for Cetus.

Cetus is a key and concentrated decentralized exchange protocol in SU and Aptos ecosystems. The network has since recovered, with its TVL rebound, reassuring the participants of the resilience of the protocol.

The platform plays a fundamental role in the support of merchants, liquidity suppliers and DEFI applications built on chains based on trips like SU.

For Sui, efforts to restore user confidence included security of $ 10 million revision. He moved to shared responsibility And direct support for DAPP manufacturers to avoid future vulnerabilities.

In this context, the Suppre price has rebounded. Suis Price has increased by 18% since the beginning of June and has been negotiated at $ 3.47 at the time of the editorial staff. This represents a modest gain of almost 2% in the last 24 hours.

The president of Mysten Labs, Kevin Boon, said that the SUP ecosystem has become a main destination for manufacturers and serious institutions.

“… The milestone of a Nasdaq depot is a powerful moment. We are proud to help 21Shares to build towards a world where each investor can access Suit, “read an extract from the blog, citing Boon.

This decision also feeds growing speculation on a broader “ETF Altcoin Etf”, and Bloomberg analyst Eric Balchunas takes note.

However, when they were asked for a potential request, Balchunas explained that all ETFs Altcoin could not correspond to the level of request observed with the Bitcoin ETF.

“… The more BTC you get, the less assets,” said Balchunas.

He also noted that the aggressive deposit of Solana d’Osprey could speed up the dry calendar for Altcoin ETF decisions.

Meanwhile, the SEC delayed a decision on the ETF Hedera application, extending the commentary period.

“The Commission deems appropriate to appoint a longer period in which to take measures on the change of rule proposed so that it has enough time to examine the change of proposed rule and the questions raised there,” said the president of the SEC, Paul Atkins.

While the market remains cautiously optimistic, the progression of the 21Shares Su Et Etf marks an important moment in the equipment of alternative layer 1 ecosystems. It remains to be seen if Suis becomes the next major active class to be unraveling in the financial market; However, institutional demand seems ready for the moment.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.