Tether and Circle Now Hold More US Debt Than Several Nations

Previously a niche tool for crypto, stablecoins gradually become an element of traditional finance. Circle and Tether now have larger portfolios of American debts than several sovereign nations.

The recent adoption of the Act on Engineering has legitimized the use of the stable reserve, the interest in banks, payment processors and fortune companies 500.

The circle and the amazing side quietly more American debt than Germany, South Korea and water

Stablecoins are digital tokens fixed to the US dollar and supported by reserves, often in American cash tickets (T cords). The structure guarantees that a token can be reliably bought against a dollar.

This stability makes them attractive for cross -border payments and as a set of regulation for the cryptography ecosystem.

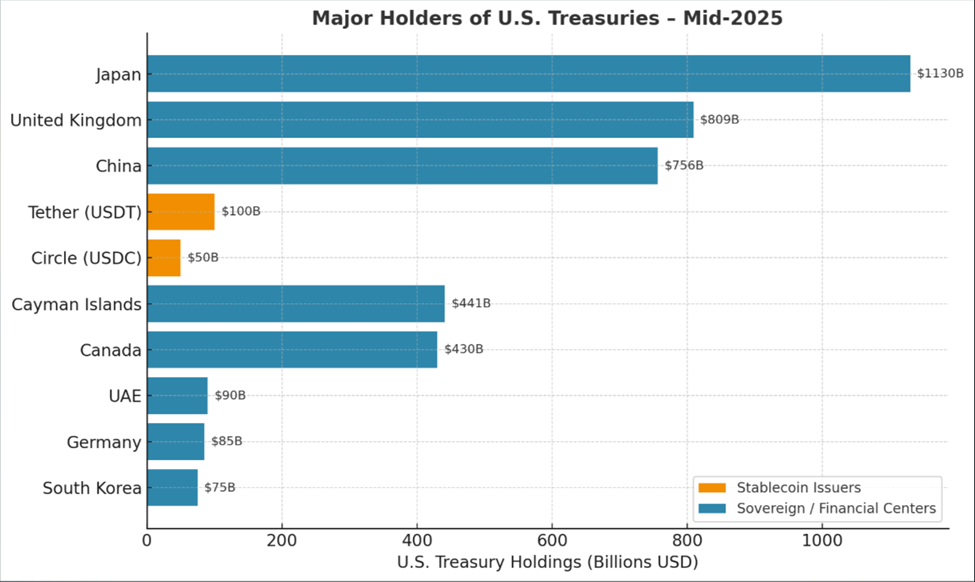

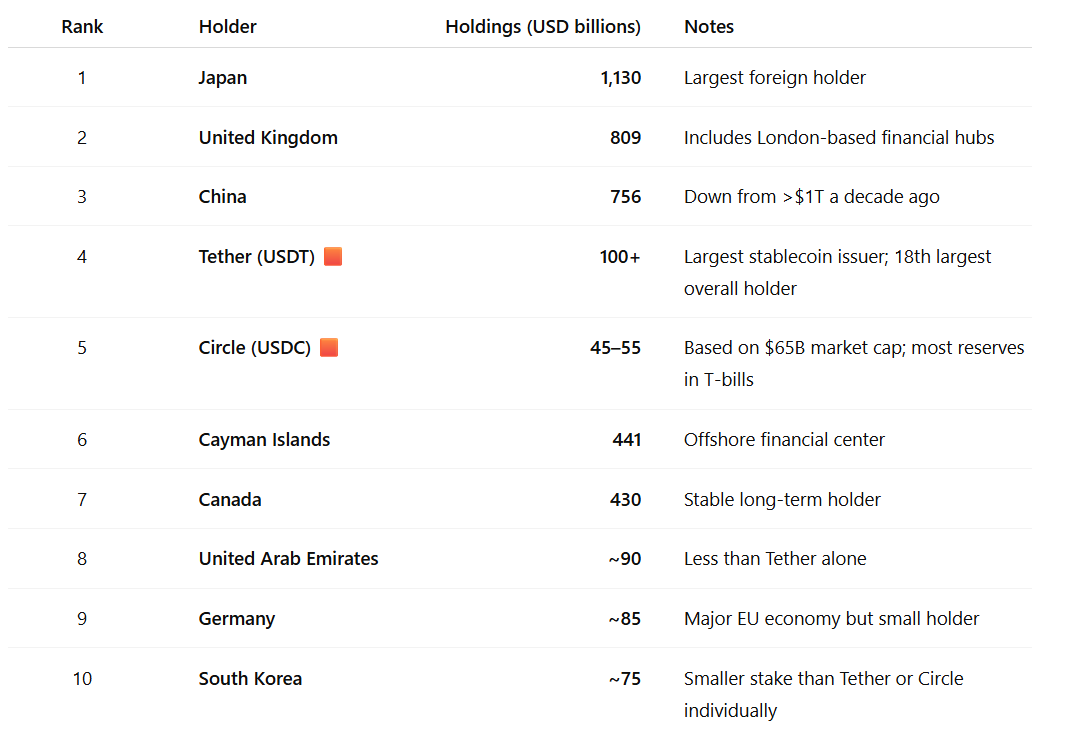

Two stable leading transmitters, Tether (USDT) and Circle (USDC), hold more American government debt than several major national economies. This includes Germany, South Korea and the United Arab Emirates.

TETHER, the largest stablecoin transmitter, now contains more than $ 100 billion in T-Bills. According to data from the Treasury Department, it ranks like the 18th overall holder of the American debt, above the water ($ 85 billion).

Circle, the USDC transmitter, holds between $ 45 billion and $ 55 billion in T-bills, placing it in front of South Korea (about $ 75 billion) if it was measured individually.

Combined, the two companies exceed the three countries, with a recent Apollo report emphasizing how speed the sector increases.

“Almost 90% of the use of stablescoin is an exchange of crypto, which will probably continue to grow. The large breakthrough will be if the stables of the US dollar are used for global retail payments. If the US dollar market has become financial stability. Apollo report.

The StableCoin industry is now the 18th largest external holder of treasury bills, with projections suggesting that it could go from its current market capitalization of 270 billion dollars to 2 dollars by 2028.

The USDC market capitalization alone increased 90% over the past year to $ 65 billion. It was fueled by institutional adoption and the IPO of high level of Circle in June.

Transaction volumes Rivals of traditional payment managers

Meanwhile, the adoption story goes beyond the reserves. At the beginning of 2024, Stablecoin transaction volumes exceeded the visa, largely due to their use in cryptographic trading. The growing use in global monetary transfers has also contributed to the traction, with a Beincrypto report indicating that 49% of institutions use stablecoins.

With an almost instead regulation and low costs, the stablecoins are being lifted as a faster and cheaper alternative to Swift and other inherited payment rails. The acquisition of $ 1.1 billion in Stripe from the Stablecoin start -up bridge in October marked one of the first major finch betting on technology.

The rise of stable issuers as a major T-Bill buyers occurs when traditional foreign holders reduce. The assets in China went from more than 1 dollars ten years ago to $ 756 billion.

Although the largest foreign holder at $ 1.13 billion, Japan also reported a more cautious approach. This creates an opening for stable transmitters to serve as a coherent source of demand for American debt.

“The fact that stable transmitters are always a massive boost in terms of Treasury confidence [Department] Where to place the debt, ”reported Fortune, citing Yesha Yadav, professor of the Vanderbilt Law School who studies the intersection of the crypto and the bond market.

Supporters argue that stablecoins could help cement the domination of the dollar worldwide, as is the offshore “Eurodollar” market in the 20th century.

They also suggest that an increasing demand for T -shaped hole of stablecoin companies could help reduce long -term interest rates and strengthen the application of American sanctions abroad.

The skeptics, however, cautious against the overhanging of figures, with the sector of the American silver market fund (MMF), for example, eclipizing Stablecoin farms at around 7 billions of dollars.

Meanwhile, banking lobbyists warn that stablecoins could drain banks deposits, which could reduce loan capacity.

“Citi plans that stablecoins among the best owners of American T -ts, if the American debts are climbing and the T -shaped hidingses, the same goes for the self -confidence in digital dollar. Creation of a temporary passage to other currencies,” wrote a user, citing Citibank.

Industry leaders have counter that similar fears concerning MMFs ago have proven unfounded.

However, if the stablecoins continue to absorb large amounts of short -term treasury bills, this could disturb the way Wall Street manages liquidity and risk.

Nevertheless, Circle and Tether’s growth indicates that the American debt market has a new class of heavyweight buyers born in the arena of volatile cryptography rather than in traditional banking rooms.

The post office and the circle now hold more American debts than several nations did not appear first on Beincrypto.