Tether Buys $33 Billion US Bonds Amid Forthcoming Regulation

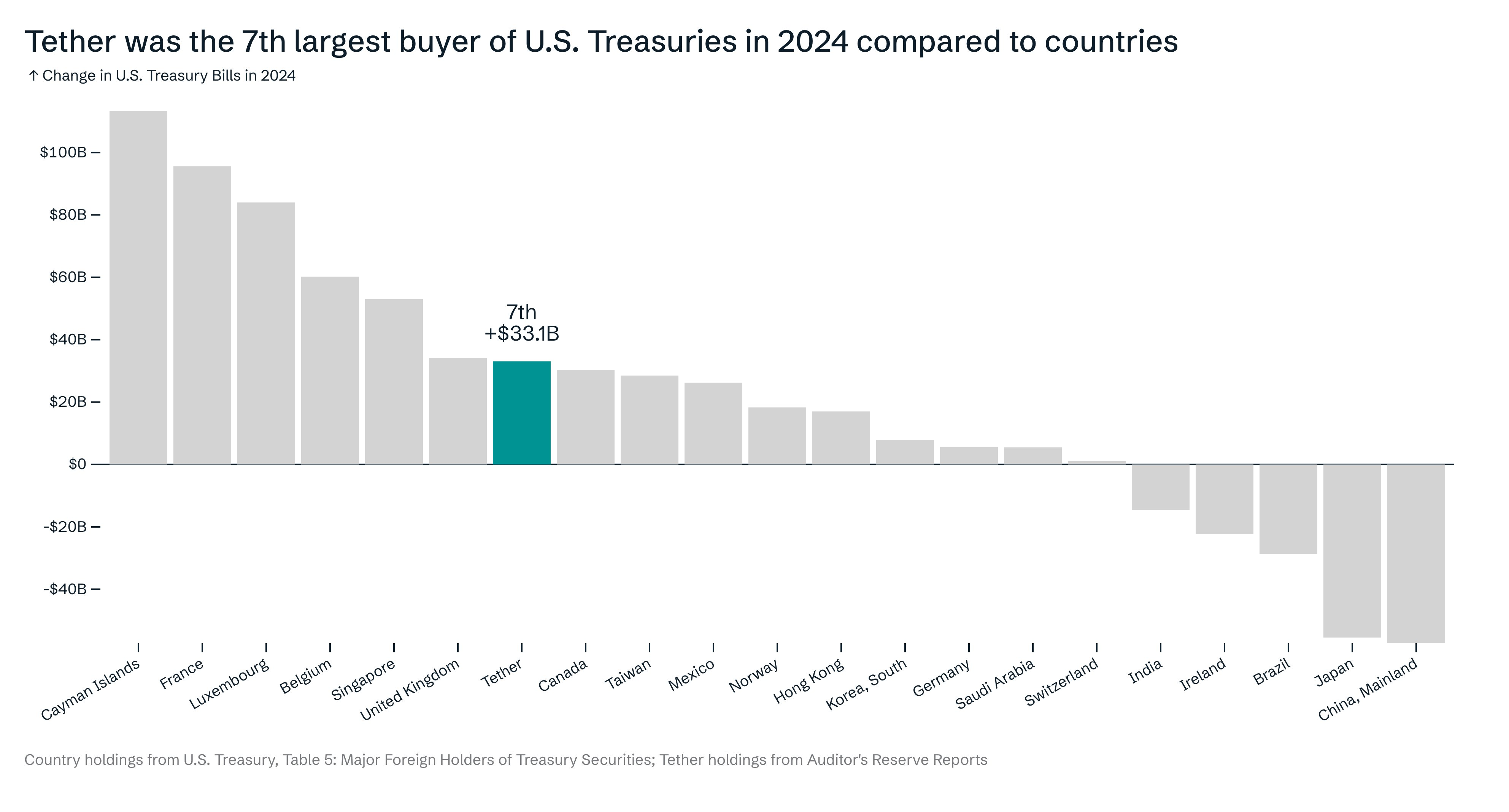

Tether surprised the market by announcing that it bought more than $ 33 billion in cash bonds last year. This is to tether the seventh buyer of American bonds, before countries like Canada, Mexico and Germany.

In a speech today, President Trump said that Stablecoins will be used to promote the domination of the dollar worldwide. By buying these obligations, Tether could obtain an incredibly precious partnership.

Why does the attachment buy us cash obligations?

TETHER, the largest stablecoin transmitter in the world, could soon have an important opportunity by hand. At the top of digital assets earlier during the day, President Trump alluded to major plans for future stable policies in the United States.

An important factor in these plans may be that Tether is now one of the largest buyers in the American treasury in the world:

“Tether was the 7th buyer of American treasury bills in 2024, compared to countries. Tether brings the US dollar to more than 400 million people mainly in emerging markets and developing countries. Without any doubt, Tether has built the largest distribution network for the US dollar,” Paolo Ardoino, Paolo Ardoino, told two media articles.

This could potentially stimulate the USDT compliance efforts with the next stable regulations. The proposed engineering law, which is awaiting the approval of the Congress, obliges stable issuers to hold reserve assets in the United States, denominated in the American Treasury.

Thus, this purchase could allow Tether to comply with the next American regulations, unlike EU mica.

“Force. Tether has become an essential partner of the United States in less than a decade,” wrote Anthony Poseliano.

In his speech today, President Trump has not made many commitments to the future policy of Stablecoin. However, he said that the stable -coated dollars “will expand the domination of the US dollar” for years in the future.

If the US government considerably influences the Stablescoin market, Tether could be a good conduct for Trump’s partnership.

Could Tether and Trump lead to the domination of the USD?

In the United States, all the proposed regulations of Stablecoin include a clear demand: issuers must be subject to third-party audits. Tether has never authorized one, although his new CFO supports an audit.

This slowdown has already moved Coinbase to indicate that it would remove the products from Tether if it was requested, just as it was expelled from the EU last December.

However, Tether may be able to solve many of these problems by buying cash obligations. Among other requirements, the law on engineering requires that stablecoin issuers hold a large part of their reserves in American treasury bills.

It was previously theorized that Tether may need to sell his bitcoin because of these regulations, but the fact that the company bought cash obligations amend speculation.

“If the Congress adopts the Act on Engineering, regulatory clarity could also attract traditional banking companies to the stablescoin ecosystem, feeding healthy competition. The stable market can potentially reach 3 dollars in the next 5 years. As a stablecoins.

Tether bought an amazing amount of cash bonds in the past year, but this may not guarantee a partnership with Trump and the US government.

Several large banks are considering stable launches, and several people in Trump’s orbit would also have discussed partnership with Binance to launch one. So far, there is no evidence that Tether had a similar matter.

However, Tether bought more than $ 33 billion in US cash obligations in one year, and this will have forced an impact. If Trump’s administration decides to use the attachment to promote the domination of the dollar, it could change everything.

It is too early to indicate with confidence that such predictions will come true. Tether may still need a third -party audit despite the purchase of these Treasury obligations. However, if the stars align, its dominant position on the Stablescoin market could be supercharged.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.