Tether to Leverage GENIUS Act for $1 Trillion USDT Expansion

Tether CEO Paolo Ardoino said the company could increase its USDT supply, potentially exceeding 1 dollars.

His comments follow the adoption of the Genius Act, a Stablecoin bill which was promulgated by President Donald Trump on July 18.

TETHER EYES 1.6 Billion of dollars USDT Supporté

Legislation is the first federal framework for the regulation of stablescoin in the United States. It authorizes the federal reserve to concede and supervise the stubbing issuers supported in dollars.

It also forces support for the complete reserve, regular audits and anti-white (AML) compliance for all entities offering these tokens in the United States.

In a press release, Ardoino said that regulatory clarity could unlock a new level of adoption for the USDT, the largest stablecoin in the world.

“Now that President Trump has led the United States to adopt digital assets, we think we can increase ten times and cement the world domination of the dollar,” he said.

TETHER is currently reporting more than $ 160 billion in the USDT traffic to more than 500 million users worldwide. An increase of ten times would bring its supply to 1.6 billion of dollars, an important step which would still anchor the role of the token in the global markets of cryptography.

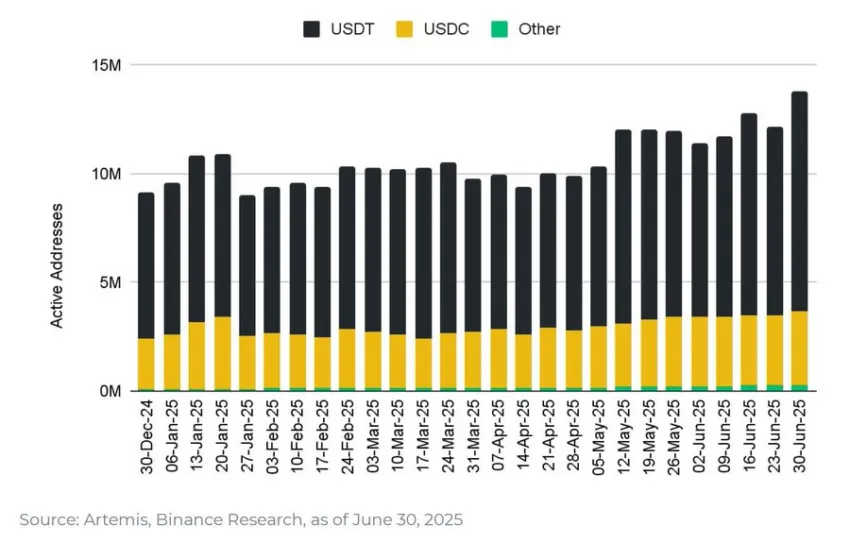

Ardoino’s objectives are not surprising since the USDT is the dominant stablecoin on the market. According to available market data, digital assets currently represents 73% of the global volume of stablecoin transactions.

Meanwhile, despite optimism, the act of engineering considerably increases the regulatory compliance bar for Tether.

Under the new law, Tether, which operates from Salvador, must respect the American standards on licenses, LMA procedures and reserve disclosure. These requirements are essential for the company to maintain access to the American market.

To date, Tether has only published quarterly certificates on his reserves. However, he has not yet delivered a complete and independent audit – a long -criticized omission by regulators and analysts.

Already, the company has committed to comply with the new rules and has reiterated its commitment to undergo a complete audit of its reservations.

However, the company’s ability to keep these promises – in particular with regard to reserve disclosure – will be critical.

He will probably determine if Tether can maintain his leadership in an increasingly regulated market which arouses the interest of traditional financial giants as a mastercard.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.