Pi Network (PI) Gains 4% Despite Mixed Roadmap Reactions

PI Network (PI) has climbed more than 4% in the last 24 hours after the launch of its migration roadmap. The token shows the first signs of recovery through several indicators, but the confirmation of a sustained rise trend remains uncertain.

While technical configurations such as the Ichimoku and RSI cloud suggest a possible change in feeling, the levels of resistance continue to maintain hard. At the same time, frustration among the community persists due to the lack of clarity in the migration roadmap, adding another layer of pressure to the next PI movement.

Pi tests cloud resistance with a low trend structure to come

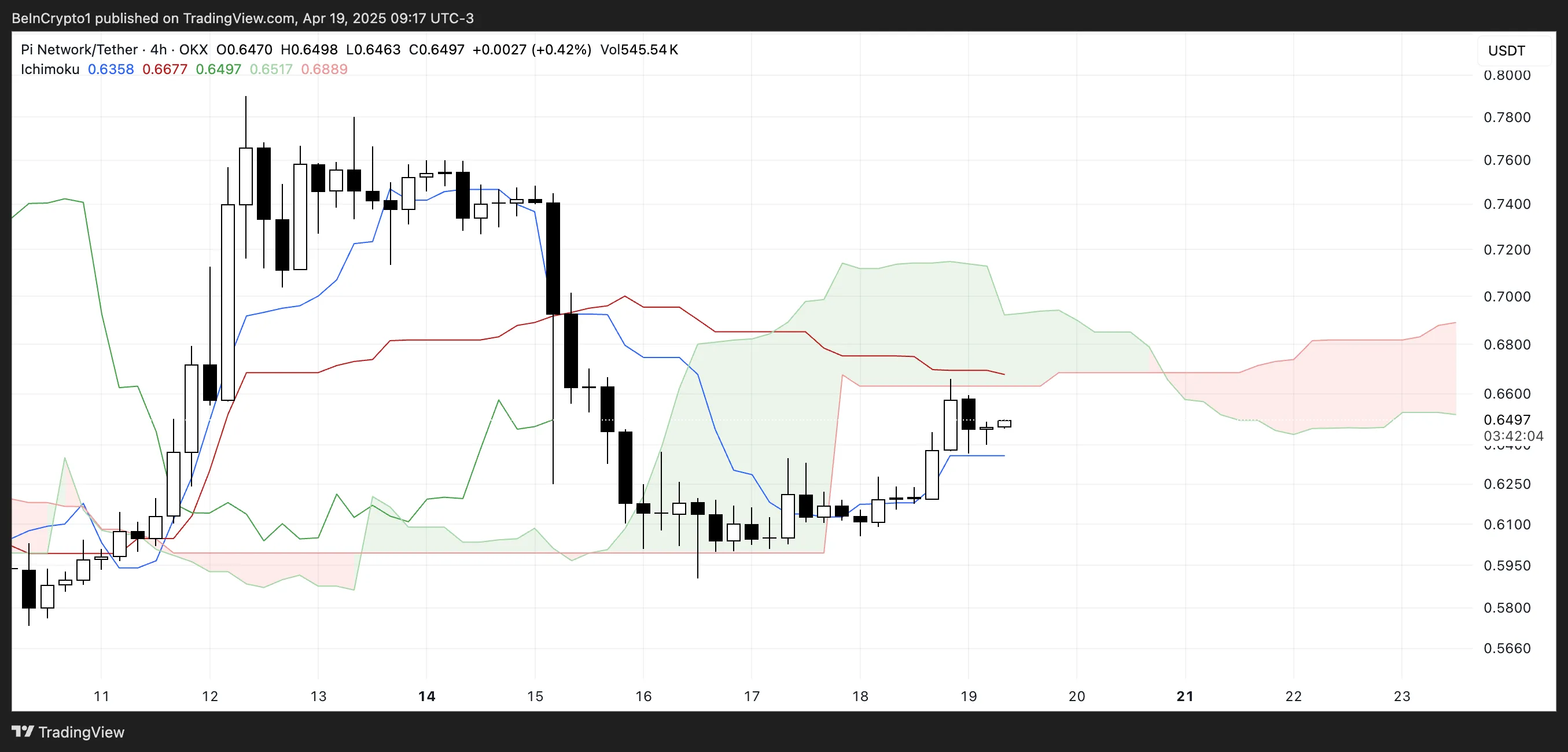

Pi Network is currently negotiating just below the Ichimoku cloud, signaling hesitation while buyers are trying to regain control. While recent candles show higher stockings and an optimistic intention, the price remains under the cloud resistance area.

Tenkan-sen (blue line) is still below the Kijun-Sen (red line), which means that short-term momentum has not yet exceeded the medium-term trend.

Until a bullish crossing forms and the price crosses the cloud, the structure promotes prudence on confirmation.

In the meantime, the cloud becomes thicker and more and more inclined, which suggests that volatility can come back and a stronger – bulky or downward trend – could soon develop.

This extended Kumo indicates that the market can prepare for a more decisive decision, and a successful break above the cloud would be an important signal.

However, as long as PI remains under this area, it remains in a vulnerable position, with the rejection and the laterally continuous movement always on the table.

Pi Network RSI rises, but does not hold above 57

The RSI of the PI network is currently at 53.77, reflecting a significant recovery of its in -depth reading of 32.34 two days ago.

However, after having culminated at 57.25 yesterday, the RSI was slightly cooled, which suggests that the bullish momentum has somewhat weakened.

This change indicates that if the purchase of the recently returned pressure, it has not yet been sufficiently solid or consistent to maintain a complete break. The market seems to stabilize, but not aggressively in both directions.

The relative resistance index (RSI) is a Momentum oscillator which measures the speed and extent of recent price changes on a scale of 0 to 100.

The values above 70 generally suggest that an asset is exaggerated and may be due to a correction, while the readings less than 30 indicate surolon conditions and possible increase inversions. With RSI of Pi seated at 53.77, the token is in neutral steam territory, showing a moderate force but still far from the surachat levels.

This leaves room for more upward if the momentum resumes, but also indicates that prudence is justified because the trend has not yet solidified.

Pi Eyes Breakout despite the frustrations of the roadmap

Pi Price currently oscillates just below a key resistance level, suggesting that a decisive movement could approach. If this resistance is tested and broken, PI can resume its ascending trajectory, with potential targets around $ 0.789 and $ 0.858.

A sustained break could even rekindle the strong momentum observed a few months ago, paving the way for a push towards $ 1.23, even $ 1.79.

Despite the recent increase in prices of 4% in the last 24 hours, the feeling remains mixed due to the growing frustration of the migration roadmap, which still has no clear calendar.

Right down, if PI fails to unravel the resistance of $ 0.66, the token could face a withdrawal around $ 0.54. A loss of this level of support would open the door to a deeper correction, potentially resulting in the price at $ 0.40.

This makes the current area a crucial battlefield between buyers and sellers, because the next sessions can determine if Pi between a new increased phase or dates back in decline.

Until there is a clear break or ventilation, the price remains in a sensitive position, strongly influenced by technical levels and community feeling.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.