TIA Price Continues to Fall in a 3-Month Bear Run – What’s Next?

Celestia (TIA) had a hard time getting out of a three-month persistent decreasing trend, with several unsuccessful attempts to maintain the gains above key resistance levels.

This suggests a market without a strong conviction, investors hesitating to push Altcoin in a clear ascending trajectory.

Celestia finds investor support

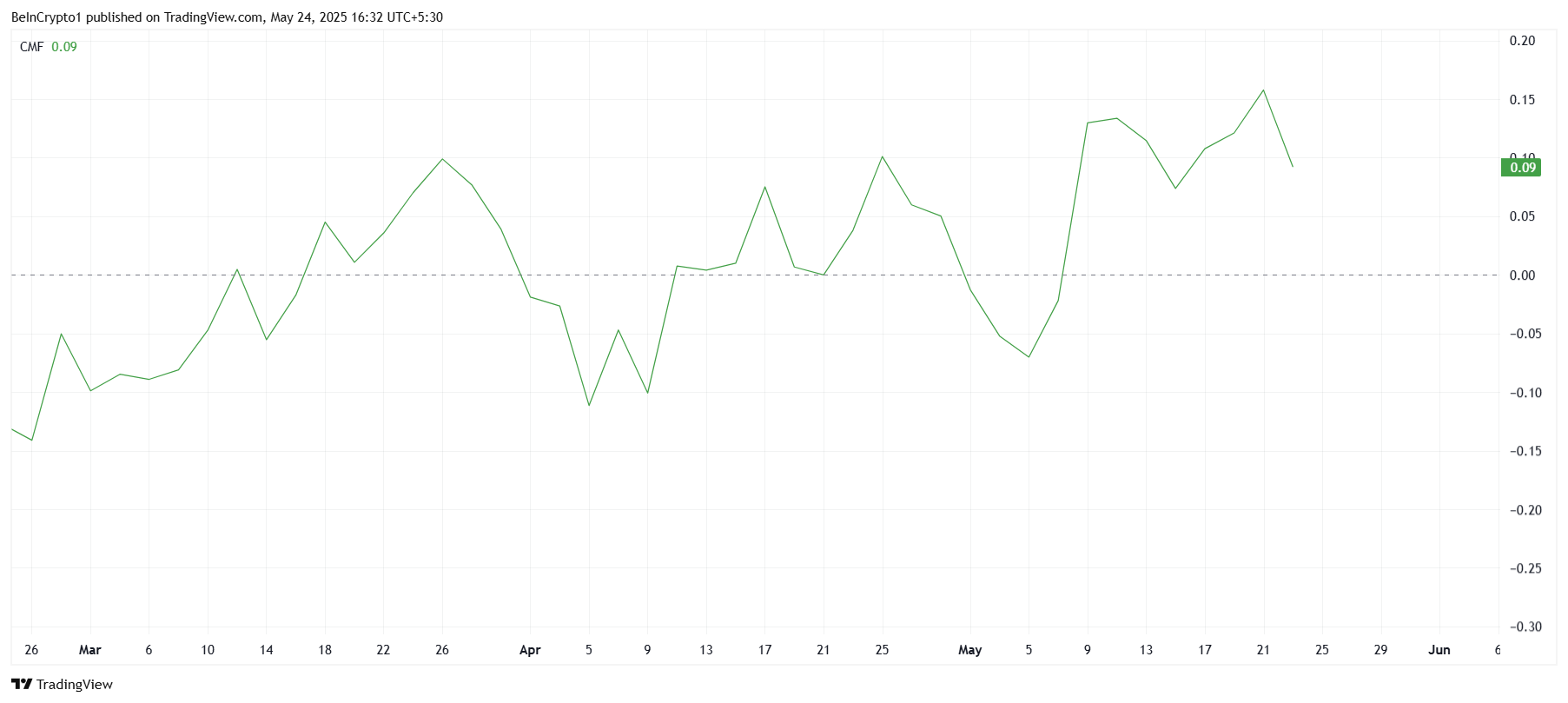

The Chaikin monetary flow indicator (CMF) has recently shown a modest increase but remains just below zero. This implies that if the capital entries are present, the overall confidence of investors is temporary.

Buyers seem to be attracted to the relatively low price of TIA, but the momentum is not strong enough to decisively break the downward trend.

The failure of the CMF to climb above zero persistent signals and suggest that traders are only cautiously in the positions. This provisional interest can cause increased volatility unless support for the wider market emerges.

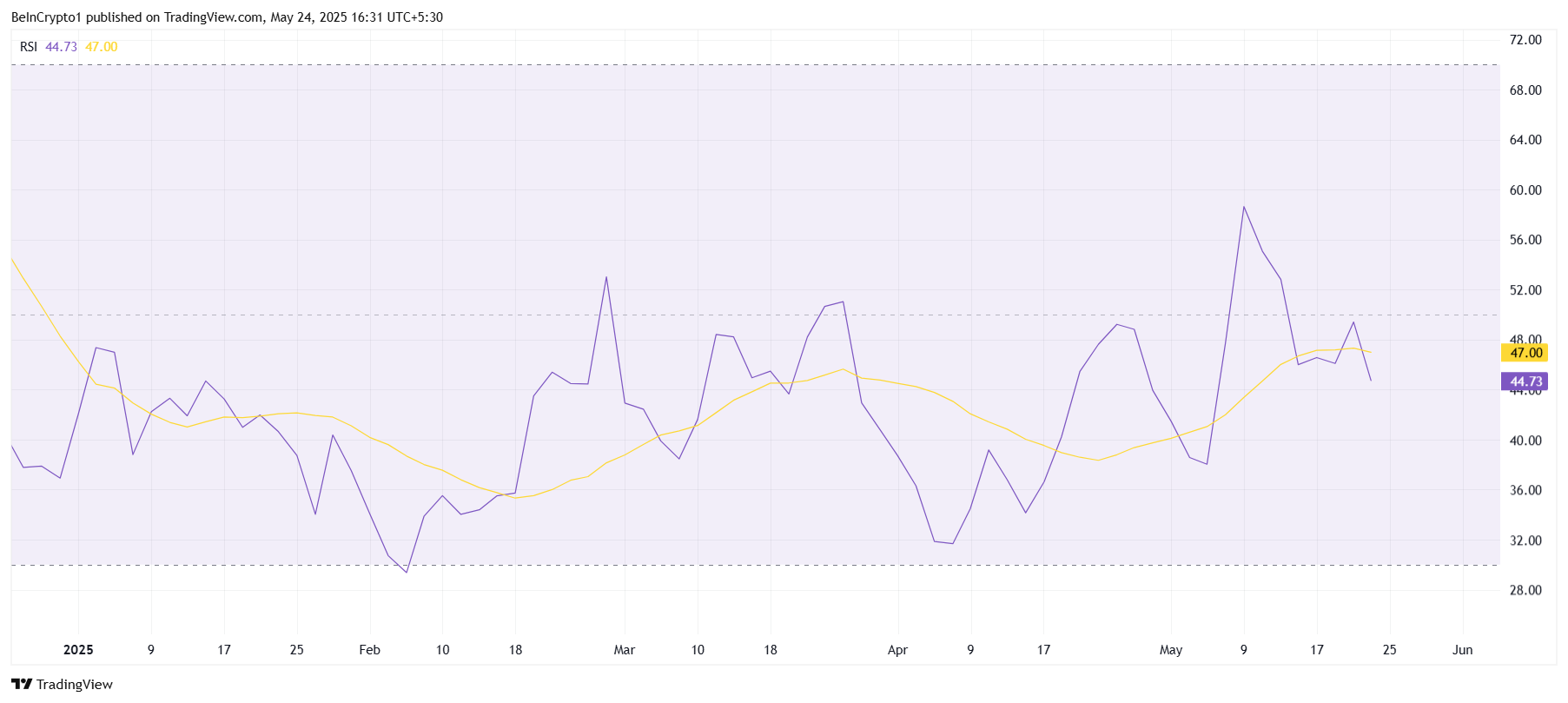

The relative resistance index (RSI) has briefly increased in bullish territory, but has since removed below the neutral level 50. This scheme indicates a fragile optimistic impulse, probably hampered by selling pressure or uncertainties of the external market.

The drop below 50 strengthens the idea that the recovery of TIA prices is precarious. Without renewal of purchasing force, it faces difficulties in overcoming resistance and can continue to languish in moderate trading ranges.

Tia Price aims to jump

Currently exchanging $ 2.54, TIA is testing a level of critical support at $ 2.53. This level is essential to stabilize prices and prevent new losses, especially after failing to exceed the resistance of $ 3.00 during its prolonged downward trend.

A significant rise in the significant increase seems unlikely for the moment. However, if the $ 2.53 support holds, TIA could consolidate, potentially creating momentum to retest the resistance of $ 3.00 after violating $ 2.73.

Conversely, a decisive rupture below $ 2.53 could intensify the down pressure, lowering the price to $ 2.27. Such a decision would invalidate the short -term upper prospects and increase the risks downwards.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.