Toncoin (TON) Gains 14% in a Lackluster Market—Is $4 the Next Stop?

The cryptocurrency linked to Telegram has become one of the most remarkable artists on the cryptography market in the past two weeks. He challenged the slowest momentum on the market to increase by 14% since July 24.

Altcoin is currently negotiating nearly $ 4, technical and technical data point to a short -term increase in potential.

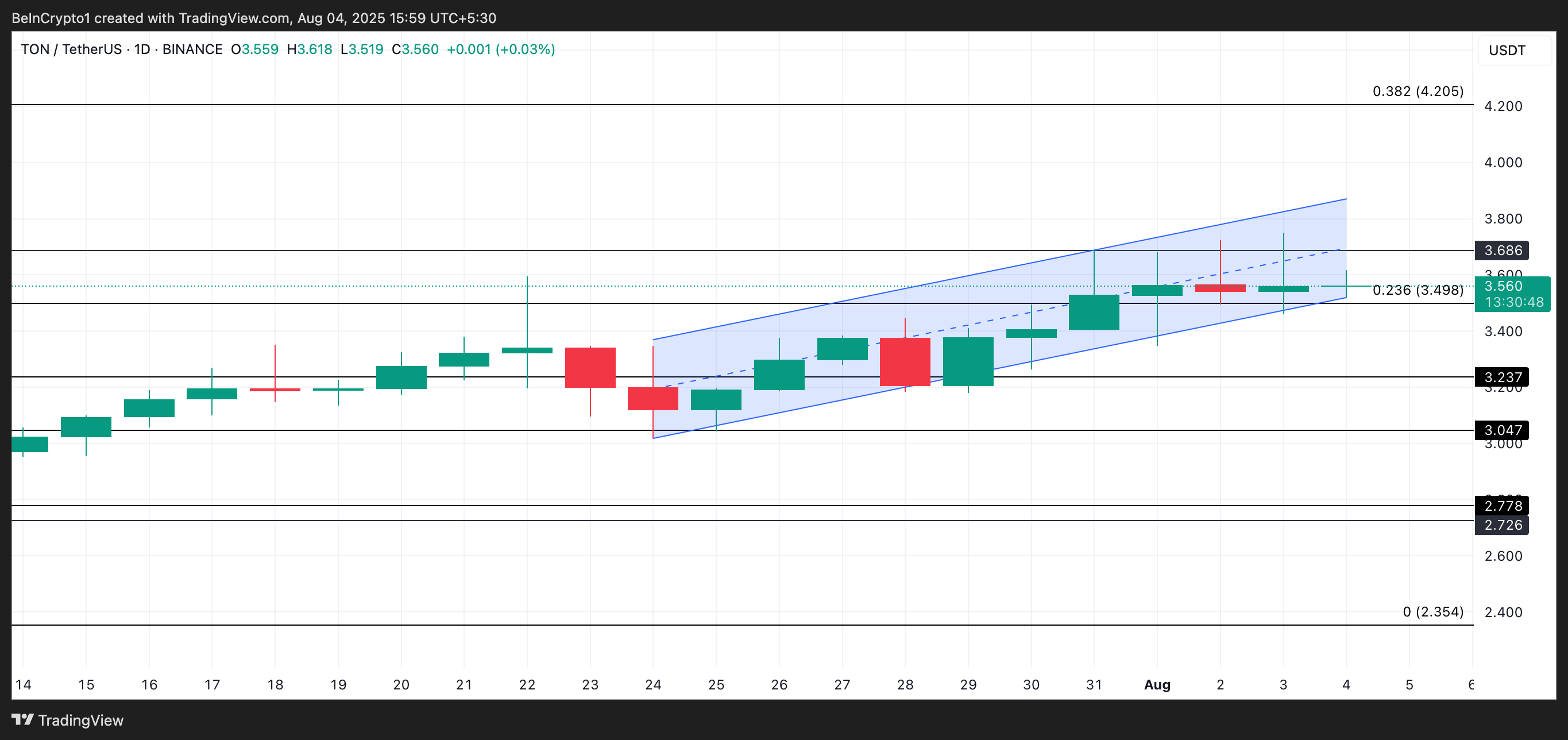

The price of your is ready for more action

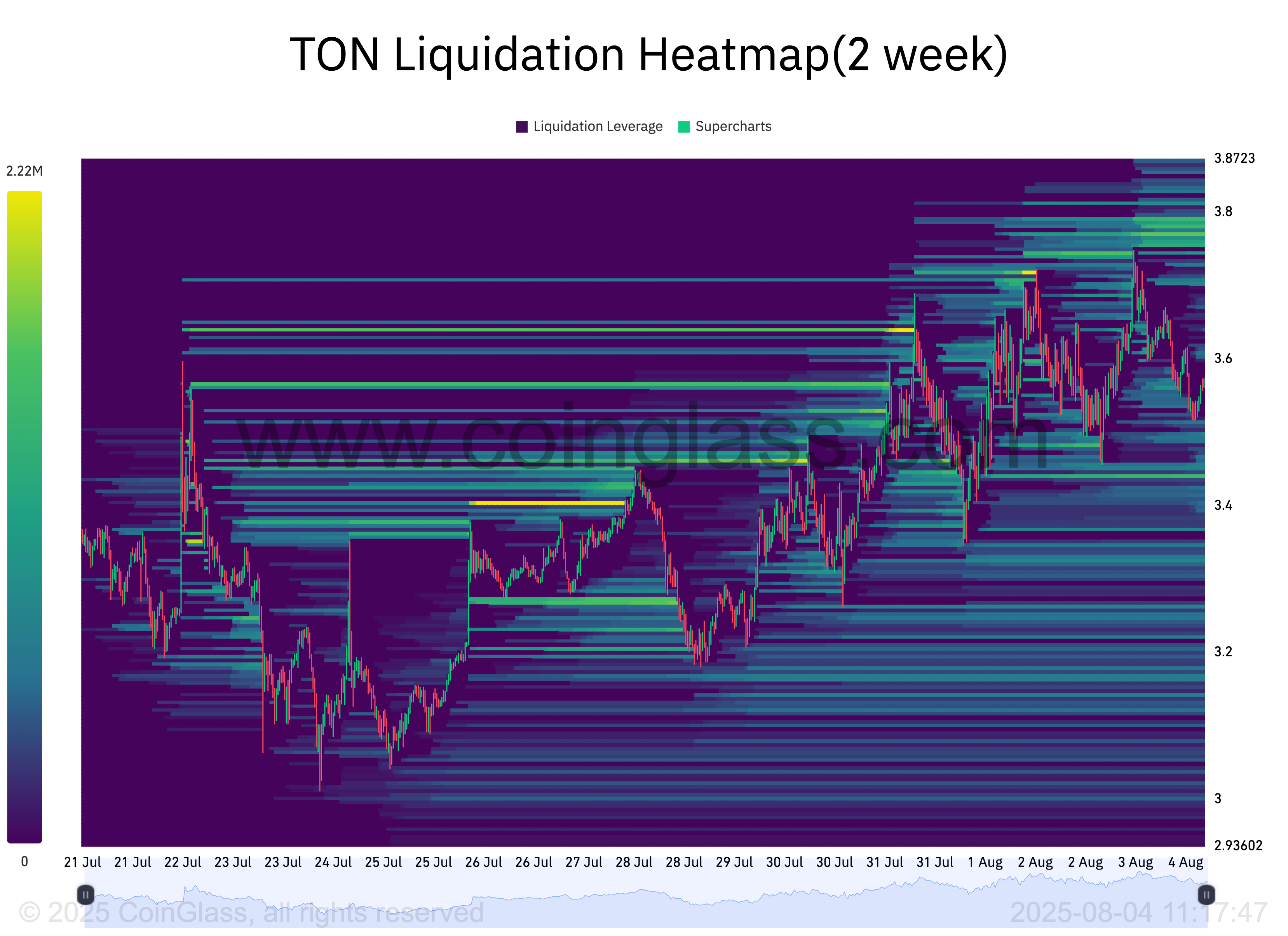

According to CorciLass, the thermal liquidation card of your shows a considerable concentration of liquidity around the price zone of $ 3.77.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

These thermal cards are visual tools that help traders identify the price levels where large clusters of leverages are likely to be liquidated. They highlight high liquidity areas, with brighter areas representing a greater liquidation potential.

For tone, the liquidity group approximately $ 3.77 shows a strong interest from merchants who seek to buy or close short films. This configuration could easily trigger a new price rally.

In addition, from a technical point of view, the relative force index of tone (RSI) remains in a healthy range, which indicates that there is still room for more growth. At the time of the press, the momentum indicator amounts to 67.21.

The RSI indicator measures excessive market conditions and occurs as an asset. It varies between 0 and 100. The values greater than 70 suggest that the asset is overflowed and due for a drop in prices, while the values less than 30 indicate that the assets are occurring and can attend a rebound.

The RSI readings of Ton indicate that market players are always raised, with space for more increases before buyers become exhausted.

Your traders bet on the rise

In the midst of market volatility and repeated attempts to lower prices, the tone financing rate has remained firmly positive, confirming the bias bias among its traders in the long term. At the time of the press, it is 0.0061%.

The funding rate is a mechanism used in perpetual term contracts to maintain prices aligned on the cash market. When it is positive, it means that long traders (those who bet on price increases) pay for unable to discover traders. This indicates that the majority of market players lean bruise.

An always positive financing rate suggests strong confidence in the upward potential of tone, even in the face of a broader uncertainty of the market.

Pressure constructions on the purchase side – will they be sufficient to inflict $ 4?

With chain and technical indicators confirming the pressure on the buy side, your seems ready to extend its short -term rally. The token could violate the resistance to $ 3.68 in this scenario and join $ 4.02.

On the other hand, if the request falls and the bears regain domination, they could push the price of Altcoin less than $ 3.49.

The post Toncoin (ton) earns 14% on a dull market – is the next stop $ 4? appeared first on Beincrypto.