Bitcoin ETFs Hit 3-Day Outflow Streak Amid Sideways Action | ETF News

Bitcoin was held stable at around $ 105,000 in last week, triggering a slowdown in ETF activity. On Monday, the releases of BTC ETFs, BTC ETFs exceeded $ 250 million, marking on the third day of consecutive withdrawal.

This indicates that institutional appetite can disappear because the BTC remains locked in a consolidation phase.

BTC ETFS LOG 3rd day of outings in the middle of price consolidation

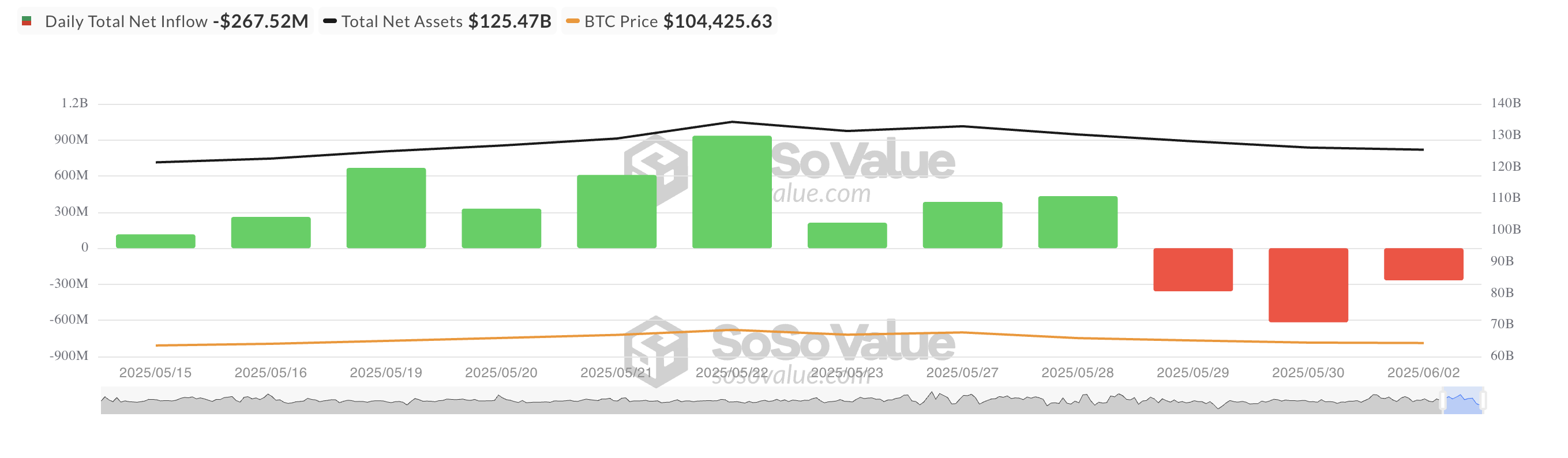

Institutional investors on Monday abolished the capital of the BTC ETFs from the United States American list, reporting a drop in exposure to cryptography among themselves. According to Sosovalue, the net outings of these funds totaled $ 268 million, marking the third day of coherent outings.

The slowdown in ETF entries was caused by the consolidation of the BTC around the $ 105,000 mark, which began to weigh heavily on institutional feeling. During last week, the main medal oscillated in a narrow price range, leading to a drop in investors’ enthusiasm.

However, it is not moved. During price consolidation periods, institutional investors are known to run alternative capital or adopt a waiting approach. This often leads to reduced ETF activity and attenuated short -term entries.

Bitcoin Bulls stir in the derivative market

Bitcoin is currently negotiated at $ 105,422 after increasing by 1% in the last day. The upward pressure persists through the long -term market of the medal while traders continue to bet on a sustained rally.

This is reflected by the positive financing rate of the part, which amounts to 0.0038% at the time of the press.

The financing rate is a periodic payment exchanged between long and short traders in perpetual term contracts. It maintains the contract price in accordance with the cash market. When they are positive, traders occupying long positions pay those who have short positions, indicating that the bullish feeling dominates the market.

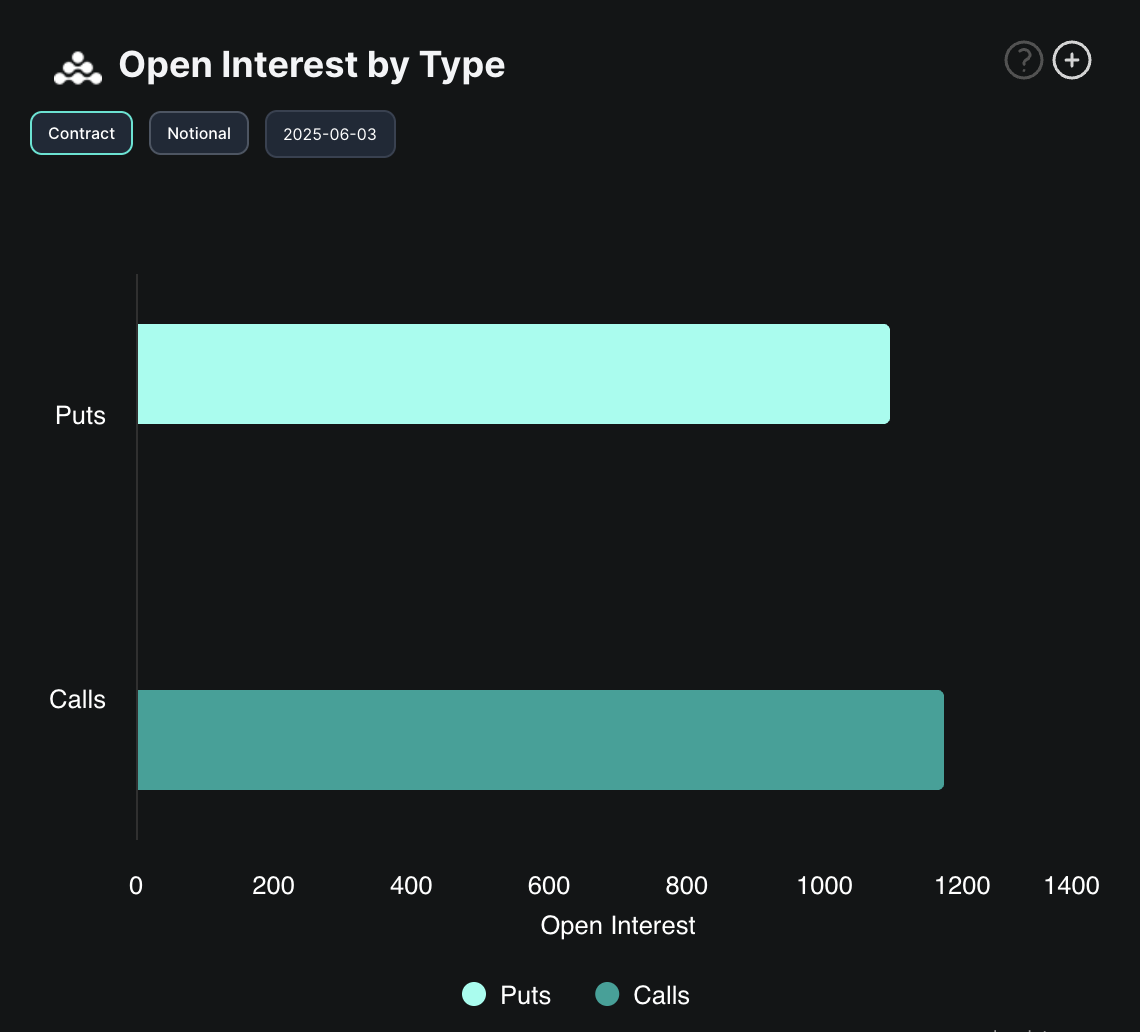

In addition, it is also the trend among BTC options, as evidenced by the high demand for today’s calls. A purchase option gives the holder the right to buy an asset at a predetermined price, and an increased request for calls like that of signals that traders expect BTC to be assisted by a rally.

These indicators suggest that if institutional FNB flows are declined due to the recent BTC prices stagnation, derivative traders remain optimistic and position for upward escape.

The post FNB Bitcoin of the post struck the 3 -day exit sequence in the middle of the lateral action | Etf News appeared first on Beincrypto.