Top 3 Crypto Narratives to Watch For the Last Week of February

Automated market manufacturers (AMMS), BNB ecosystem parts and AI are the three main cryptographic stories to monitor the last week of February. AMMS faces a difficult week, with the seven best coins in red, but potential catalysts such as the growth and competition of Unichain in the Solana space of Solana maintain them relevant.

The BNB ecosystem is gaining momentum with the renewed advocacy of CZ, a roadmap focused on AI and an increasing activity on Pancakeswap. Meanwhile, AI’s account shows mixed signals. While the wider struggles of the AI cryptography market, projects like Story (IP), Clanker, Fort and BNKR capitalize on niche use cases.

Automated Market Makes (AMMS)

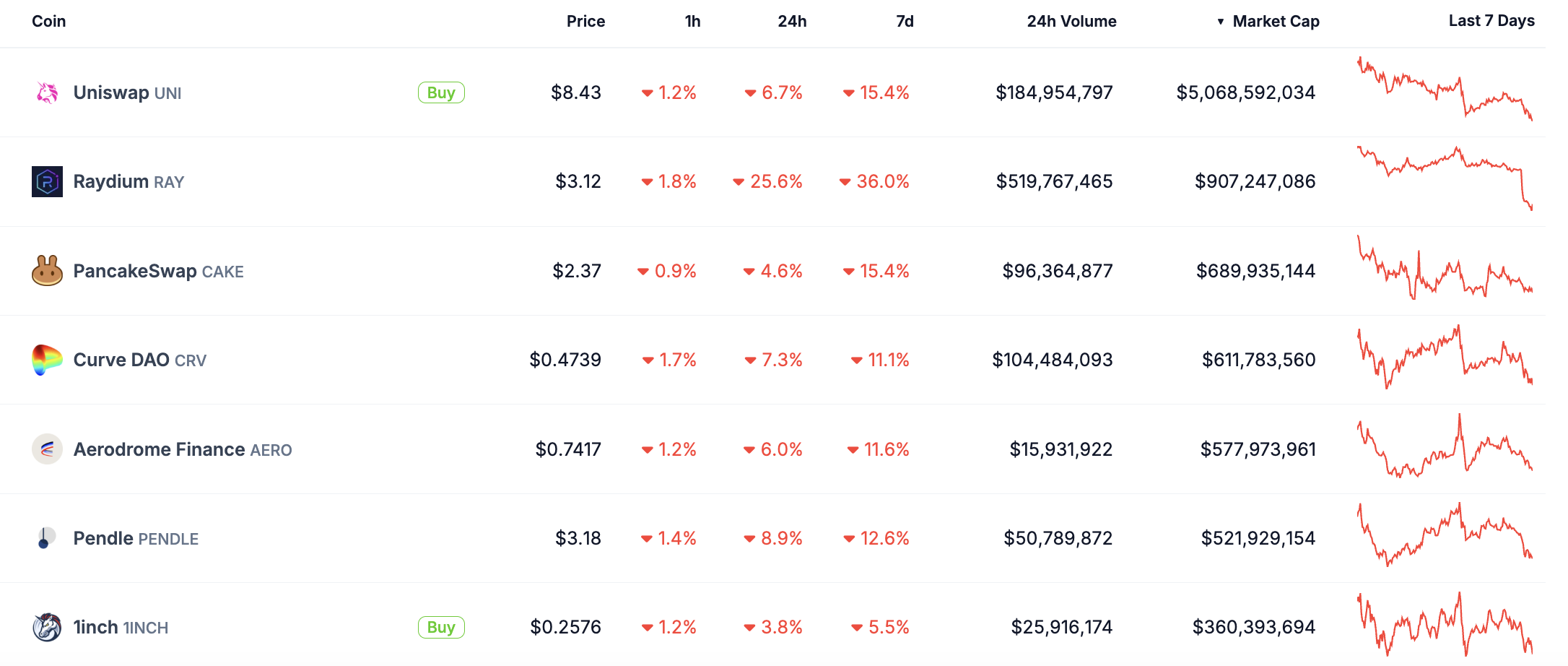

The Amms parts had a difficult week, with the seven best coins in red. Automated merchants are decentralized exchanges that allow users to exchange digital assets without using traditional command book.

They are counting on liquidity pools, where users provide funds that facilitate trading and gain costs in return. This model improves liquidity and eliminates the need for centralized intermediaries, making AMMS a crucial part of decentralized finance (DEFI).

Ray is the biggest loser among the best amms. Rumors about the launch of Pumpfun on their own AMM solution could have an impact

Uni and Cake are both decreasing by 15%, because the market does not seem enthusiastic by the new Uniswap channel, Unichain. In addition, the cake is corrected after its recent increase alongside the Rising BNB ecosystem.

However, Ray continues to be a dominant force in Solana, which could lead some users to wonder if the recent decline is not an excessive reaction.

Chris Chung, founder of Solana decentralized Exchange Aggregator Titan, believes that this could be good for Solana’s ecosystem after all.

“The fact that Pump.fun develops its own automated market (AMM) is not a surprise – is an obvious commercial decision. They created so much volume with the trading of parts even that it was only a matter of time before building infrastructure to take advantage of the costs. This creates competition for Jupiter and Meteora, but Raydium is the most affected pieces of memes, given the majority of the volume on Raydium, “said Chung at Beincrypto.

In addition, Unichain is at its beginnings, and a new Altcoin season could increase its use. In addition, the BNB ecosystem seems to have experienced a good dynamic in recent weeks, which could prepare the ground for recovery of the cake prices.

Everything that combined makes Amms one of the most interesting crypto stories of this week.

“Now that the competition in the Solana Dex space is warming, the exchanges will probably start to compete with the token lists. Some expect this to drop for costs, but I think we are more likely to see other incentives, such as income sharing, token allowances beyond liquidity pool costs or the advertising support. The Dex have great treasury bills and we will see them plunge into them so that their offer stands out, “said Chung.

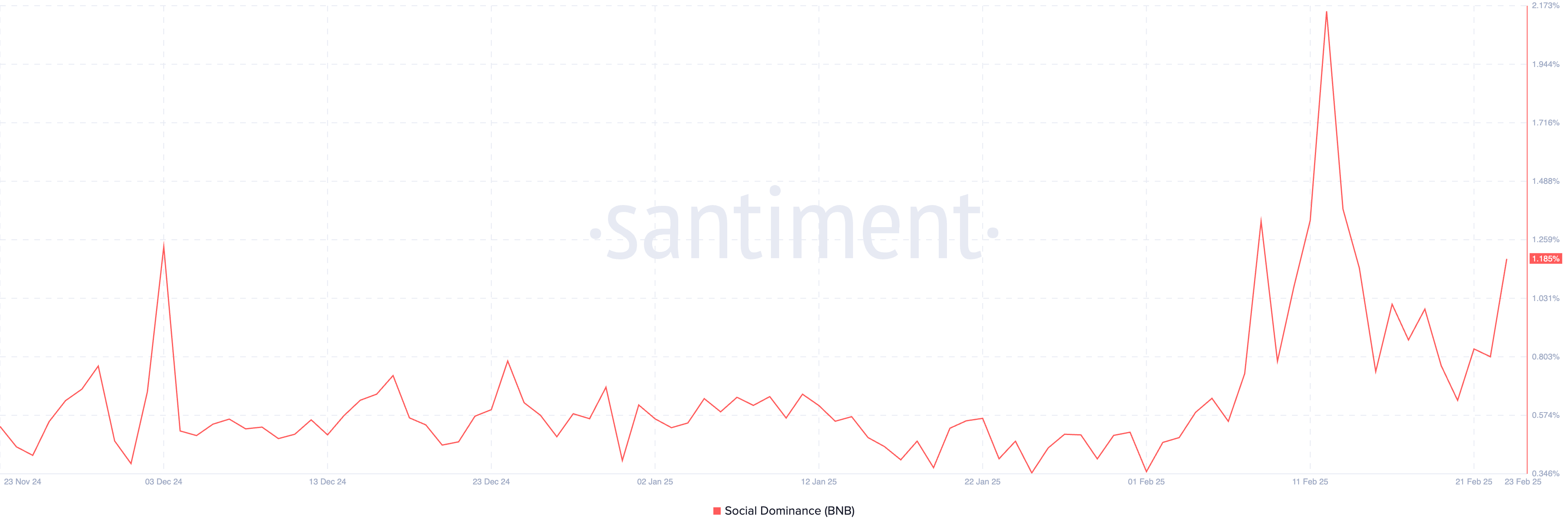

BNB ecosystems

The BNB channel has recently been under the spotlight, because CZ has renewed its advocacy for the network. The chain has introduced a roadmap focused on AI and a new solution to facilitate the launch of new coins.

These developments in the BNB chain also line up with other cryptography stories, such as coins and artificial intelligence.

Pancakeswap, the largest decentralized exchange on the BNB ecosystem, experienced an increase in fees, going from $ 2 to 3 million in early January to stay constantly over $ 4 million and even reach $ 18 million on some days Since January 16.

This growth reflects an increased activity and interest in the BNB chain.

The chain has also seen the rise of trendy memes currencies, such as broccoli, inspired by the CZ and TST dog, which has become one of the largest native coins in the BNB chain.

If this momentum continues, it could attract more manufacturers and new coins in the chain, benefiting existing products and altcoins in the ecosystem.

Artificial intelligence

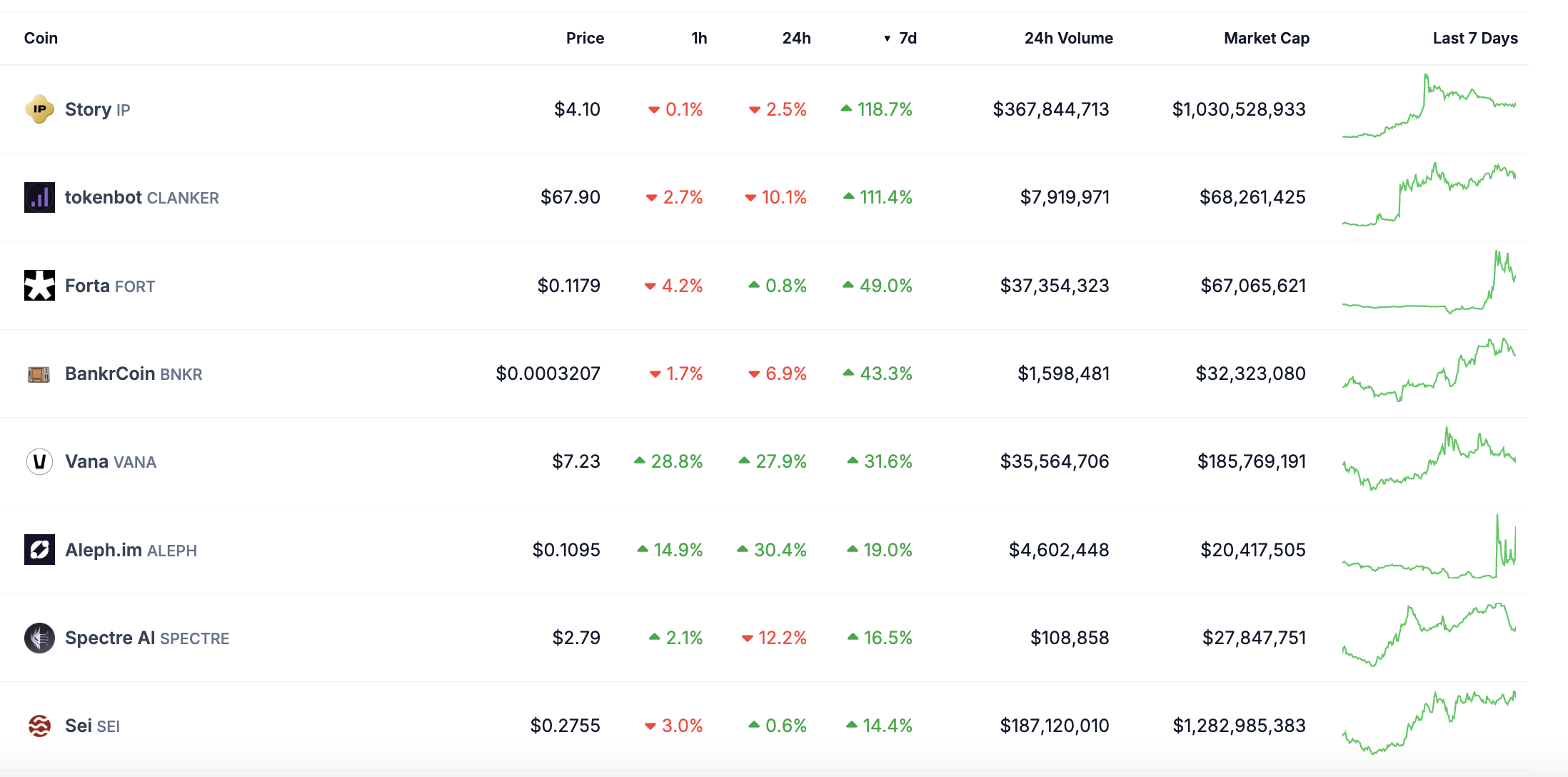

Although several pieces of AI are in difficulty, with the rendering, the FET and the virtual which records all the two -digit losses in the last seven days, certain specific segments manage to increase despite the overall narrative correction.

Story (IP) is an out -of -competition interpreter, up around 120% last week. It has become one of the most trendy altcoins and quickly reached a billion dollars market capitalization. Likewise, Clanker, one of the largest winners of basic coins, increased by 111%, reaching its highest levels since the beginning of January 2025.

Strong is up 49%, taking advantage of his safety crypto firewall after the Hack bybit. BNKR also won 43%, capitalizing on the story around Crypto AI agents and cryptographic companions.

Perhaps the market indicates that the simple brand as a “help piece” is no longer enough. This change could open more space for parts which become more specific to their use cases and not only to define itself as a “frame of the crypto” or a “part of agent crypto ai”.

The post of Crypto Strong Top 3 to watch the last week of February appeared first on Beincrypto.