Top 3 Made in USA Coins to Watch In April

Made in USA Coins continues to try a rebound, with Solana (ground), Render and Jupiter (JUP) standing as key names to watch in April. Despite recent prices corrections, each of these tokens plays a major role in high growth areas such as DEFI, AI and Blockchain infrastructure.

Solana has seen its price drop, but ecosystem activity remains strong; Render sets up the wave of AI demand despite the market turbulence; And Jupiter shows solid metrics of use even if his token difficulties. Here is a more in -depth examination of the technical and fundamental configurations for each of these projects outside the American competition.

Solana (soil)

Solana had to face a significant prices correction during last week, its value lowering almost 13%. If this lower momentum continues, the token could be on the right track to remember the level of critical support at $ 120.

A ventilation below which could see floor slide further towards the $ 112 mark.

Despite the recent slowdown, Solana remains one of the most relevant parts in American parts and continues to show impressive measurements of use. Pumpfun, for example, has generated nearly $ 9 million in income in the last 24 hours, just behind Tether.

After a short period when BNB led the volume race Dex, Solana seems to resume traction – its decentralized exchange volume jumped 128% in just seven days, reaching $ 18 billion and exceeding both Ethereum and BNB.

If this recovery of the momentum persists, soil could target a movement towards the level of resistance of $ 131. A successful escape could open the door to other gains around $ 136 and potentially $ 147.

GIVE BACK

Render, one of the most important American cryptocurrencies by focusing on artificial intelligence, has seen its price decrease almost 11% in the last seven days.

This drop reflects the wider correction which has had an impact on many tokens linked to AI in recent months.

However, new developments in the AI infrastructure space can provide a catalyst for a potential rebound, especially since the limits of centralized systems become clear.

Tory Green, CEO of the GPU-Power Global Leading Io.net aggregator, told Beincrypto:

“The recent OpenAi service request for the release of its new image generation capacities once again emphasized that these major centralized AI players are simply not ready to meet the demand for the GPU is not a lasting way to manage traffic, and it is not possible to operate and others to quickly increase their treatment facilities.”

He defends that the centralization of AI is a huge problem, decentralized solutions being an excellent alternative to additional active resources:

“The problem is not only access to fleas, but the centralization of these great actors. They can never bring thousands of GPUs online due to the time necessary to build a data center and because they lack access to other calculation resources that can be activated if necessary. (…) By connecting the existing data centers.

If the bullish momentum returns to the AI sector, Render could seek to challenge the resistance at $ 3.47, and a successful escape could open the door to a rally around $ 4.21.

However, if the current correction deepens, the token could fall to test the support level of $ 3.14. Ventilation can trigger new losses, which can potentially lead to rendering at $ 2.83, or even $ 2.52, which is the lowest level of recent weeks.

Jupiter (JUP)

Despite Solana’s recent difficulties, Jupiter – his main DEX aggregator – demonstrates an impressive force in terms of activity.

In the past 24 hours, Jupiter ranked as the fourth highest protocol in crypto per generation of fees, collecting nearly $ 2.5 million.

Only Tether, Pumpfun and Circle have managed to surpass it, highlighting the growing relevance of the platform within the Solana ecosystem, even during periods of wider market on the market.

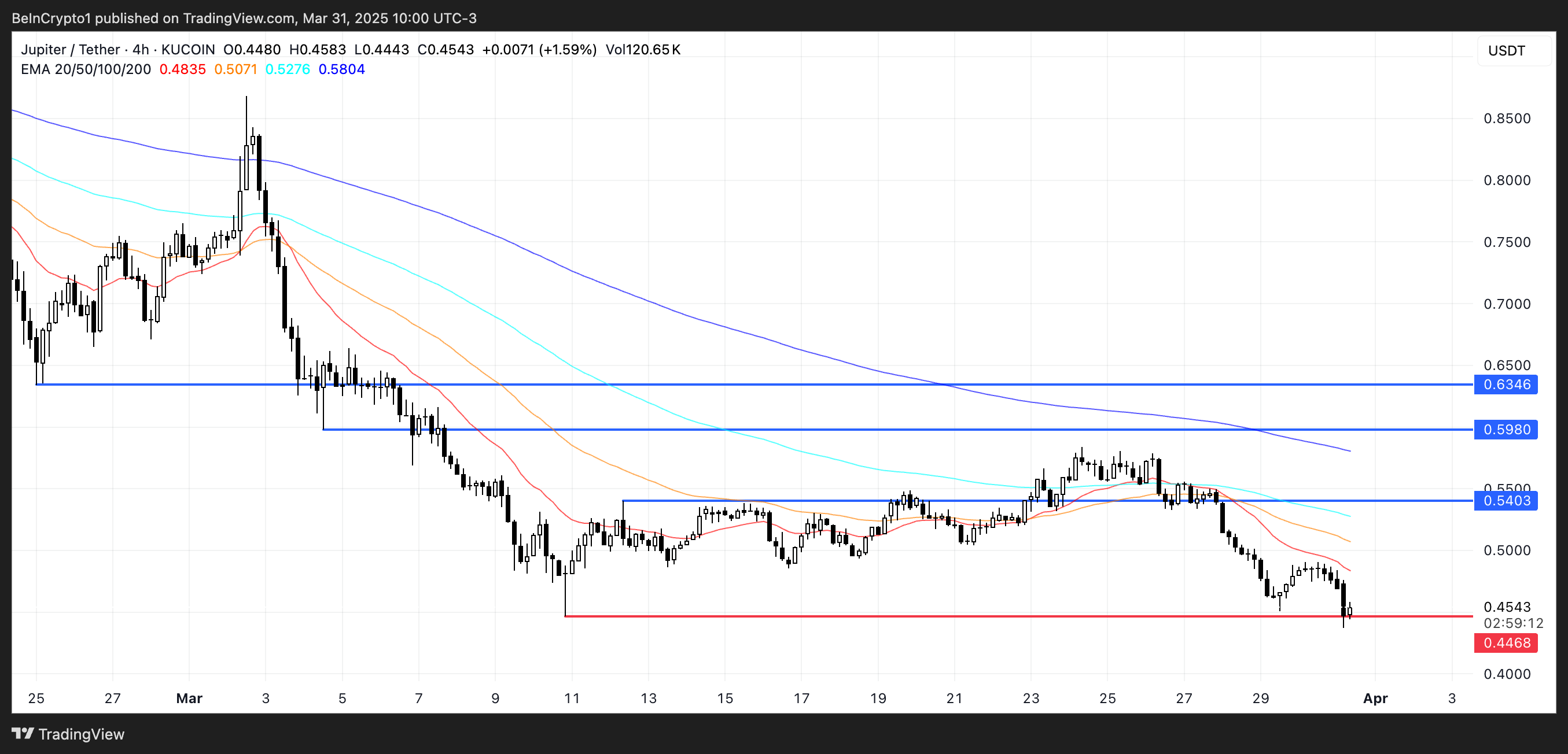

However, JUP, the native token of Jupiter, did not reflect this positive momentum. Its price fell by more than 21% in last week, being one of the worst interpreters among the largest coins in the United States. He remained below the bar of $ 0.65 for three consecutive weeks.

With JUP which now hovered dangerously near a key support at $ 0.44, a breakdown could see the drop in token below $ 0.40 for the first time.

However, if the feeling of the market moves and the yields of the momentum, JUP could start climbing again – first the resistance to tests at $ 0.54, then potentially evolve around $ 0.598 and even $ 0.63 if the bull’s bullshit is intensifying.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.