Top 3 Made in USA Coins to Watch This Week

Made in USA Coins recently attracted renewed attention, with Worldcoin (WLD), PI (PI) and Movement (Movement) in the foreground. WLD leads with an increase of 14.5% in the last 24 hours, bouncing global regulatory setbacks.

PI increased by 30% in two days, on rumors of media threshing and ecosystem binance despite the unlocking of imminent tokens. Meanwhile, Move is struggling to regain investors to follow internal scandals, but bounced 10.4% after a clear drop.

Worldcoin (WLD)

WLD increased by 14.5% in the last 24 hours, showing renewed force after a turbulent week marked by legal setbacks and a regulatory examination.

Although it was rendered with court decisions in Kenya – where a judge ordered WorldCoin to delete all the biometric data collected from users – and a suspension in Indonesia for data violations, the token has strongly rebounded after the BTC recovered $ 100,000.

The Kenyan decision considered the unconstitutional Worldcoin data collection practices, citing violations of privacy and non-compliance with legal consent standards.

Meanwhile, the authorities suspended operations in Indonesia due to unregistered activities and improper use of legal certifications, adding additional pressure on the project.

However, Worldcoin (WLD) continues to advance his expansion plans. It has recently been launched in six large American cities, joined forces with a cryptographic payment card and joined USDC via Circle to support rapid transversal transfers.

Speculations on a possible integration with a next OPENAI social media platform, combined with its recent list on Coinbase, have further fueled the interests of investors. Technically, the EMA lines of WLD have become upwards.

If the momentum holds, the token could test resistance to $ 1.18 and potentially increase to $ 1,259 or even exceed $ 1.30 for the first time since February 4. However, if the rally loses force, WLD could fall to $ 1.06 or even $ 1.00 if the sales pressure increases.

Pi Network (PI)

Pi Network tries a strong rebound after a brutal correction which saw the token drop by 67% between March 12 and May 7. In the past two days only, PI has jumped by 30%, arousing optimism among investors.

This renewed momentum coincides with an increase in the visibility of the PI network – by traditioning 6th among the most downloaded social applications in Finland – and an announcement of ecosystem scheduled for May 14.

Speculation also rises on a potential binance list, fueled by a suspicious portfolio activity on stellar and signs of infrastructure preparation for major exchange integration.

However, the opposite winds remain. More than 668 million Pi tokens should be unlocked between May and July, threatening to overwhelm the current liquidity of the market, which has dropped sharply – the daily volume is plunged from $ 1.3 billion to only $ 45 million in recent months.

Despite this, the EMA of Pi lines suggest that a golden cross could soon be formed. If the bullish momentum continues, Pi could test the resistance at $ 0.79, with upward potential at $ 1.23 and even $ 1.79.

However, if the feeling runs, the token can fall to $ 0.636, or even $ 0.55. All eyes are now turning to the announcement of May 14 and if it can support this fragile rally.

Movement (moving)

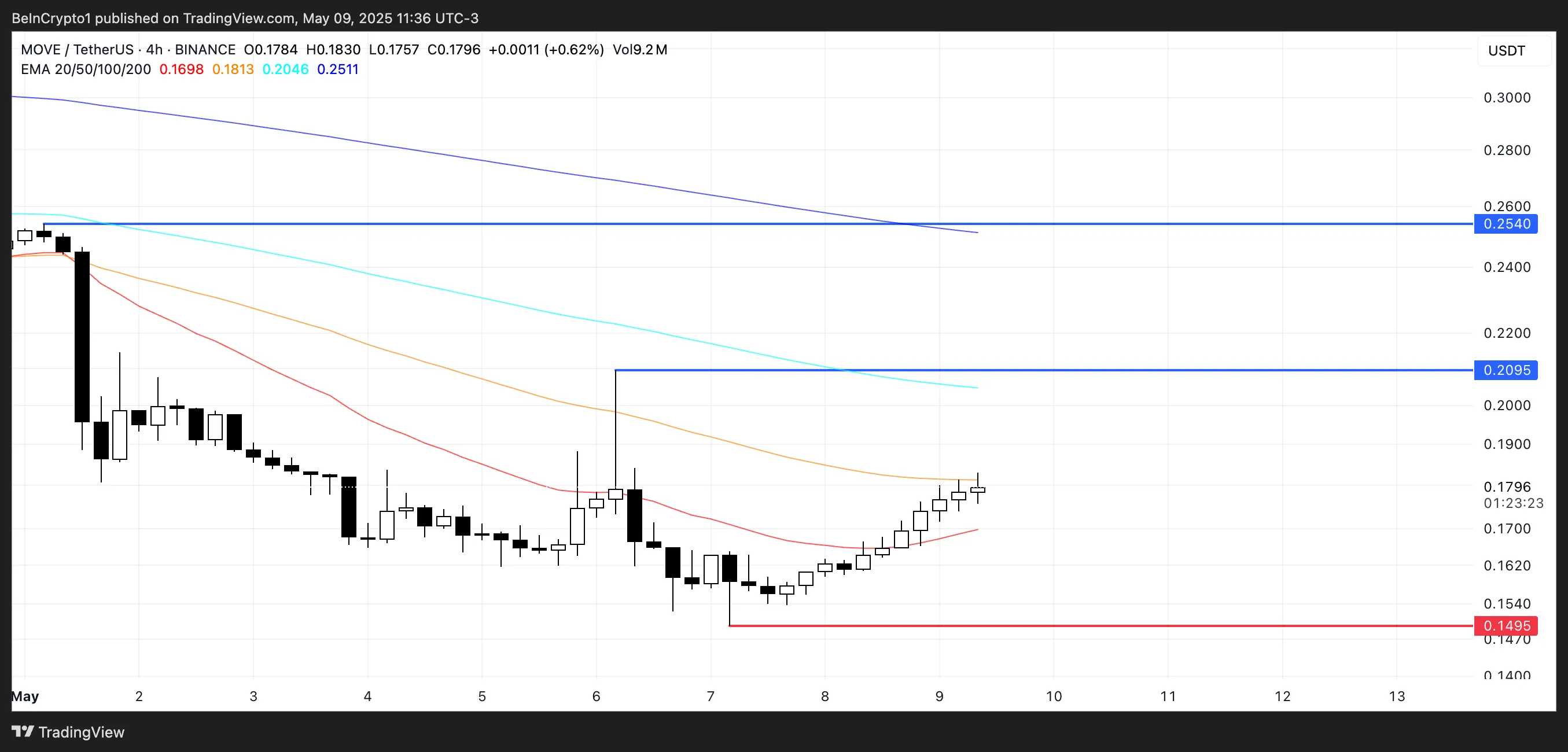

Move is one of the rare major in currency in the United States still down the week, lowering 9.8% despite the 10.4% rebound in the past 24 hours.

The wider decreased trend follows a series of controversies that have shook the confidence of investors. The sale started after Binance prohibited a market manufacturer to dump 66 million moving tokens, triggering a sharp price drop.

Shortly after, the movement laboratories suspended – and ended later – the founder of Co -Co -Manche, the rebrandaissement as Move Industries and the launch of a third investigation into the manipulation of token and the failures of governance.

As the dust sets in, the project is trying to rebuild trust in a new leadership.

If the feeling improves and confidence is restored, the movement could climb to test the resistance to $ 0.209, with a potential up at $ 0.254 if the momentum is maintained.

However, if doubts persist or more damaging revelations emerge, the movement could fall below $ 0.149 and even slide less than $ 0.14 for the first time, making it one of the most interesting parts of American parts for the United States for the third week of May.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.