Ethereum Struggles Below $3,000 Amid Weak Buying Pressure

Ethereum (ETH) had a hard time regaining a bullish momentum after having briefly became positive in the controversy of the memes Solana. Although this initial thrust alluded to a stronger rise, it failed to gain ground, leaving ETH trapped in a consolidation phase.

Now, Ethereum is trying to recover the level of $ 3,000 while it recovers by a drop of almost 18% in the last 30 days. The technical indicators always showing mixed signals, the ETH remains at a central point where a break or a decisive failure could shape its next major movement.

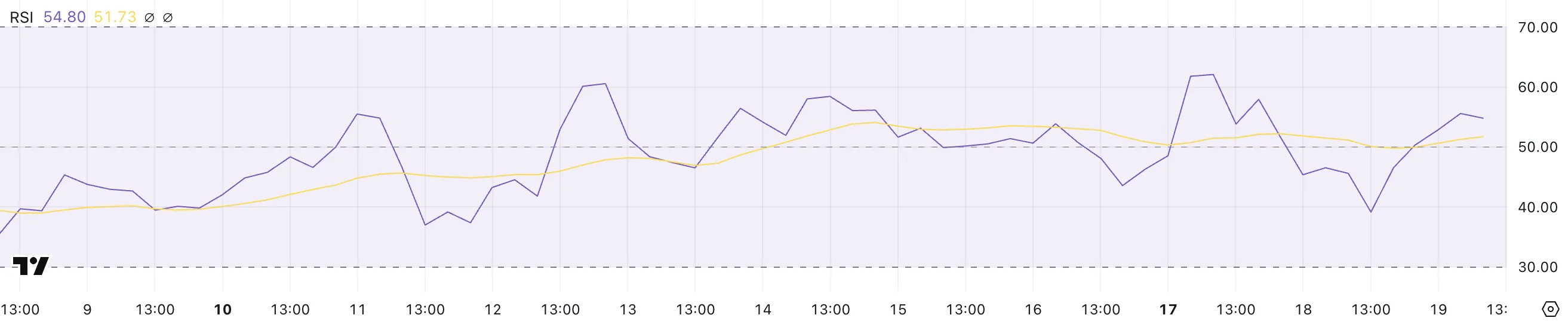

ETH RSI has been neutral for 16 days

ETH RSI is currently at 54.8 after reaching a summit of 62 and dropped to 39.1 between yesterday and today. This movement reflects an increased volatility period, when the prices of the prices has briefly accelerated before retreating.

Despite this fluctuation, RSI has now stabilized at a mid -range level, which suggests that neither a strong purchase or sale pressure is currently dominant.

This occurs after a series of neutral readings in recent weeks, strengthening the idea that ETH does not have a clear directional trend.

RSI, or the relative resistance index, is a momentum indicator which measures the speed and extent of recent price movements on a scale of 0 to 100.

Readings above 70 generally indicate over -racket conditions, which may indicate that an asset is due for withdrawal, while readings less than 30 suggest occasions of occurrence, often preceding a potential rebound. Ethereum RSI at 54.8 places that it is downright in neutral territory, a position it has maintained since February 3.

The last time he reached the over -rascal levels above 70, it was January 6 – almost a month and a half ago – suggesting that the ETH had trouble generating the type of ‘Optimistic impulse supported for an escape.

Unless RSI moves decisively above 60 or less than 40, the price of the ETH should remain linked to the beach without a strong directional bias.

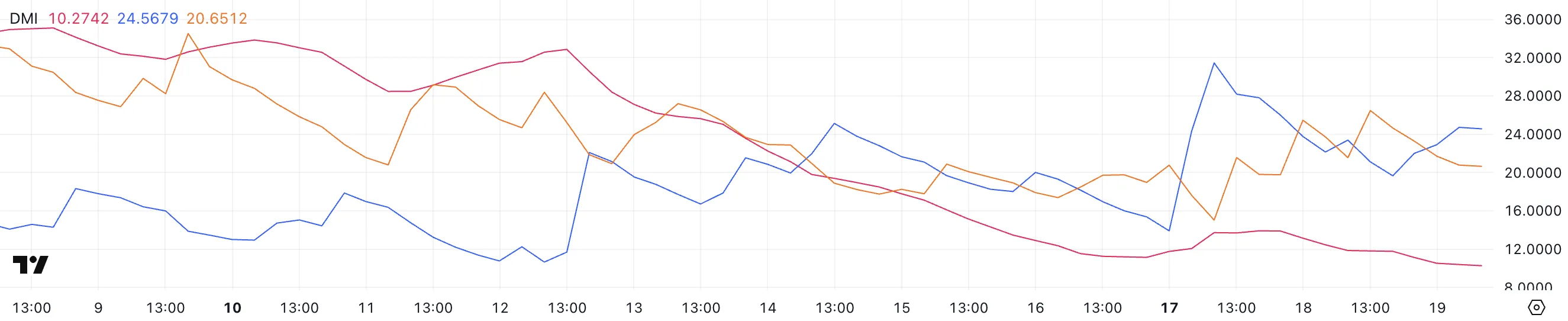

Ethereum DMI shows that the upward trend is always trying to obtain a traction

Ethereum’s DMI graph indicates that its ADX is currently at 10.2, decreasing by 13.7 yesterday and decreasing considerably compared to 32.8 a week ago.

This clear drop suggests a weakening of resistance to the trend, because ADX measures the overall momentum of a price movement rather than its management.

A lower ADX reading generally indicates that the market is in a period of consolidation or indecision, neither the bulls nor the bears clearly winning control. Since Adx has now fell to a low level, the recent action of ETH seems to lack strong conviction in both directions.

The average directional index (ADX) is a key component of the directional movement index (DMI) and is used to assess the resistance of a trend on a scale from 0 to 100.

Readings above 25 indicate a strong trend, while values below 20 suggest a low price action or linked to the beach. Currently, the + Di d’Ethereum is at 24.5, against 31.2 two days ago, reflecting a decreasing burst after a brief rally which coincided with the controversy of the memes Solana.

Meanwhile, DI went to 20.6 against 15, indicating the increase in down pressure. The combination of an ADX and the di converging lines that fall suggest that the bullish momentum of Ethereum fades. Without an escape renewed in both directions, prices’ action can continue to consolidate rather than a decisive trend upward or downward.

Will Ethereum fall below $ 2,200?

Ethereum’s short -term EMA lines are currently very close to each other and are still positioned below the long -term EMA, signaling a strong momentum in both directions.

If Ethereum’s price can establish a sustained increase trend, it could contest the resistance to $ 3,020, marking the first time that it has been negotiated over $ 3,000 since February 2.

A successful escape above this level could open the door to additional gains, the next major resistance located at $ 3,442. However, the convergence of short -term EMA suggests that ETH still needs stronger purchase pressure to confirm a bullish change.

Lower down, if Ethereum fails to build an upward momentum and a downward trend emerges, it could test the level of key support at $ 2,551.

Ventilation below this level would expose the ETH to new losses, with the next critical support at $ 2,160. A decision less than $ 2,300 would be important, because the ETH has not exchanged these levels since September 2024 at five months ago.

EMAS always signaling indecision, ETH remains at a crossroads. An escape in both directions is likely to define the next major trend.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.