Top 5 Made in USA Cryptos to Watch – Late February Picks

Story, Ondo Finance (ONDO), Official Trump, Solana (Sol) and UNISWAP (UNI) are five made of cryptos in the United States to carefully monitor the last week of February. History has drawn massive attention as an Crypto of the upper AI, despite a recent short -term correction.

Ondo continues to lead in the active sector of the real world, but faces downward pressure, while Trump hovers near all time with high volatility due to the sensitivity to news. Meanwhile, Sol is struggling after a sharp drop, and UNI shows a potential for breakthrough with the launch of Unichain, aroused a renewal of interest.

History (IP)

History quickly became one of the most successful cryptos in the United States recently launched, securing a place in the top 10 artificial intelligence cryptos during its first days.

The Story market capitalization is around $ 1 billion, and its price has increased by almost 160% in the last seven days, showing a strong bullish dynamic. However, it was dropped by more than 6% in the last 24 hours, suggesting a short -term correction, investors to benefit from the benefits.

If this correction continues, Story (IP) could test the support at $ 3.65, and lose this level could lead to a drop to $ 2.12. Conversely, if Momentum is recovered, he could question resistance to $ 5.32 and, if broken, target $ 5.88 afterwards.

Finance Ondo (Ondo)

Ondo remains one of the most relevant and most important players in the real active sector (RWA), now its strong presence despite a recent drop in prices.

Its market capitalization is currently $ 3.55 billion, but the price is corrected by more than 25% in the last 30 days.

If the current downward trend continues, Ondo could test the support at $ 1.09 and lose this level could push the price to $ 1. However, if Ondo manages to reverse this trend, this could question resistance to $ 1.25.

The rupture of this resistance could lead to an increase of $ 1.44, and if the increase trend earns a strong momentum, Ondo could test $ 1.66. This would mark the first time that Ondo goes above $ 1.5 since the end of January, reporting a potential upper break.

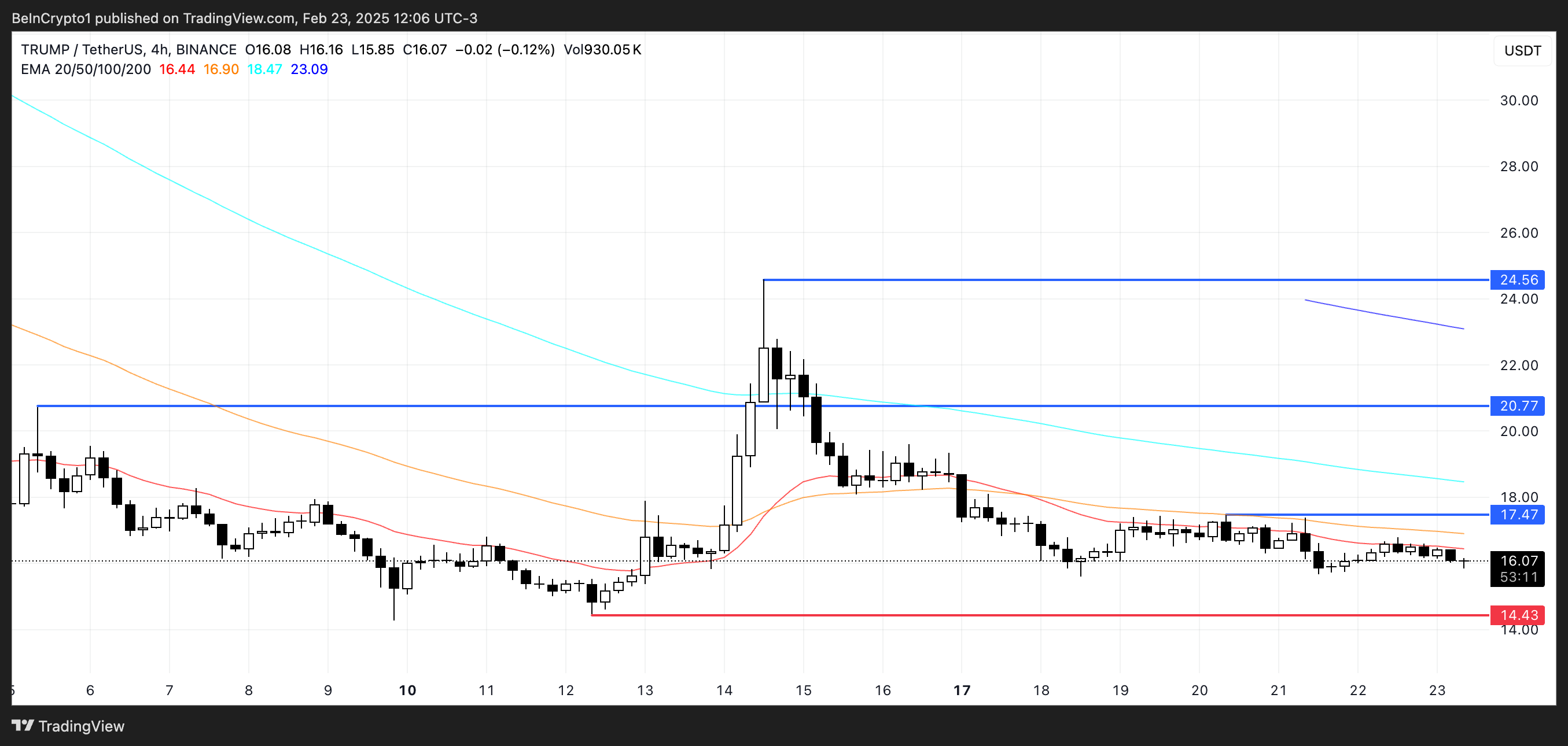

Official Trump (Trump)

Trump, the most excited piece of memes ever launched, is now negotiated near the stockings of all time, remaining below $ 20 since February 15. After reaching peaks greater than $ 70 in his beginnings, Trump is now $ 16 $ 16, reflecting a significant drop.

Donald Trump’s unpredictable nature makes the Trump coin very sensitive to news or declarations related to him. Any new impacting could trigger sudden price movements.

If Trump can resume a positive dynamic, it could test the resistance of $ 17.4, with the potential to increase to $ 20.7, or even $ 24.5 if it is broken. However, if the downward trend continues, it could test the support at $ 14.4 and perhaps fall below $ 10 for the first time since its launch.

Solana (soil)

Sol has faced significant sales pressure in recent weeks, lowering more than 36% in the last 30 days. It went from $ 268 to around $ 170 and has remained less than $ 200 since February 15, reflecting a clear correction.

Despite this slowdown, Solana remains a leader in various measures, including the parts launched, the commercial volume and the Dex trades. However, the growing concerns about the extractive ecosystem of the chain have sparked a debate between users. The feeling worsened after the launch of the memes balance piece, adding additional uncertainty to the soil prospects.

If Sol can resume the momentum upwards, it could test the resistance of $ 180, and the breakthrough of this level could lead to $ 188. A strong upward trend would be necessary to challenge $ 205.

Conversely, if the sales pressure continues, Sol could test the support at $ 160, risking more.

Uniswap (uni)

UNISWAP remains one of the most influential DEFI applications, and the recent launch of Unichain could attract a new wave of users and capital. The UNI is also one of the most important altcoins of the Dex ecosystem for years.

If UNI can establish an upward trend, it could test resistance at $ 9.68, with the potential to reach $ 10.24 if the momentum continues. A strong gathering could push united at $ 12.8, its highest level since February 1, reporting a renewed bullish feeling.

However, UNI is currently down more than 7%, and if the correction continues, it could test the support at $ 8.59. The loss of this level could lead to a drop as low as $ 7, falling below $ 8 for the first time since November 2024.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our general conditions, our privacy policy and our warnings have been updated.