Top AI Coins To Watch In February: SNAI, VVV, VIRTUAL

Despite the strong corrections of the last 30 days, artificial intelligence continues to be one of the most disturbing stories of the crypto. While some pieces of AI have had trouble, others show resilience, making it key assets to look at in the second week of February 2025.

Swarmnode.ai (SNAI) was one of the strongest performers, up more than 170% in a week, while Venice Token (VVV) tries to recover despite transparency problems. Meanwhile, Virtuals Protocol (Virtual) fell by 44% in a week, reflecting the broader slowdown in crypto AI agents.

Swarmnode.ai (snai)

SNAI serves as a swarmnode skeleton, a platform designed to deploy server-free AI agents in the cloud. Thanks to the SDK Swarmnode Python, users can transparently coordinate and automate the interactions between these AI agents, the optimization of workflows and the improvement of efficiency.

SNAI is one of the few pieces of AI showing strong gains this week. It has increased by more than 170% in the last seven days and has pushed its market capitalization to $ 51 million. The technical indicators suggest that a golden cross could soon be formed in the price table, signaling a potential optimistic continuation.

If this happens, SNAI could climb to the resistance level of $ 0.749, with a successful escape opening the door for a move to $ 0.0839. However, if the momentum fades, the key supports are at $ 0.039 and $ 0.027, with a deeper correction to $ 0.010 possible if these levels do not hold.

Venice token (VVV)

VVV is the central token of Venice AI, a chatgpt alternative designed to prioritize confidentiality and unrestricted conversations. Founded by Erik Voorhees, the founder of Shapeshift, Venice AI incorporates decentralized principles to ensure user autonomy and freedom of interaction.

Initially distributed via an air card to the first adopters, VVV has since been launched on the basic chain, where it has quickly become one of the most trendy token on the network.

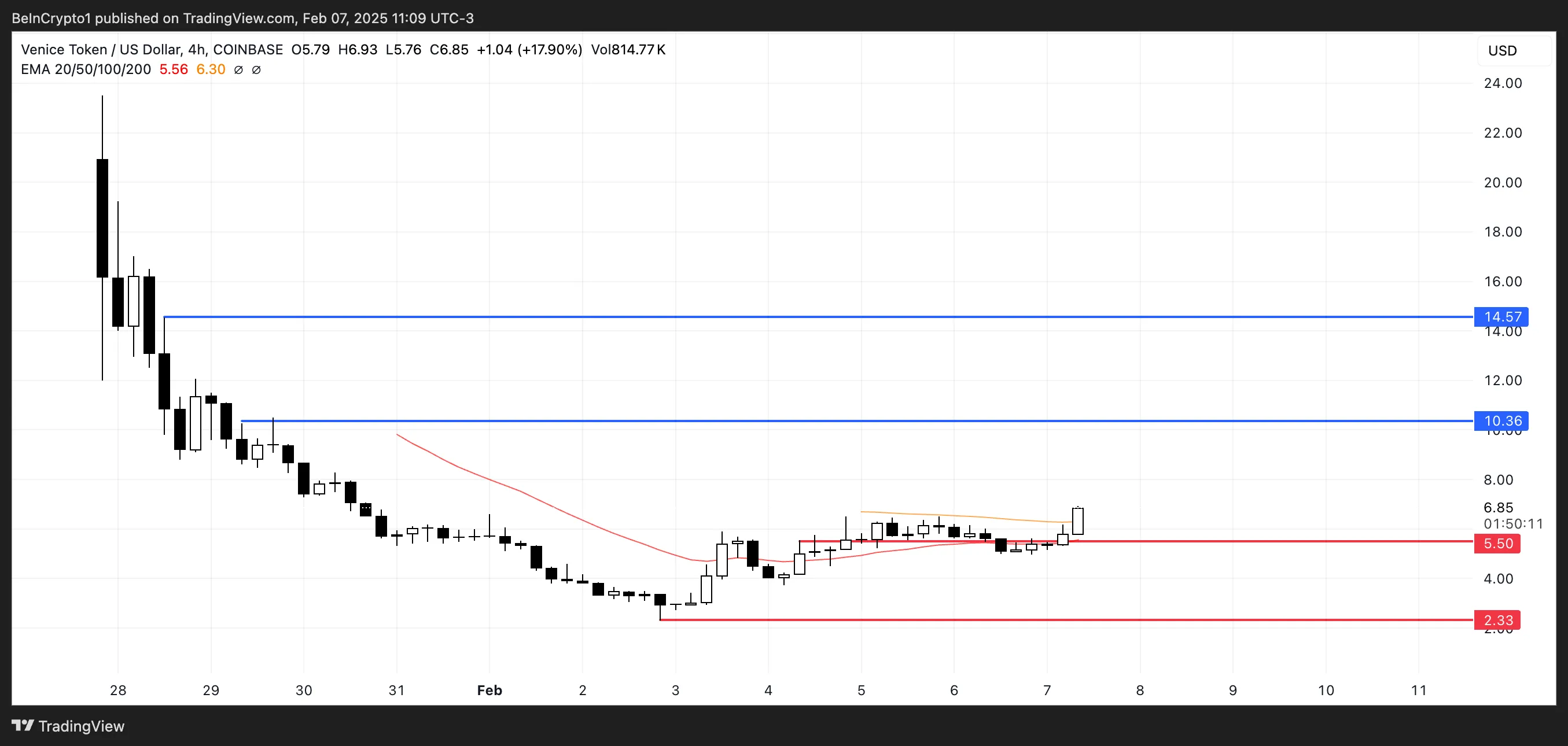

VVV is among the few artificial intelligence tokens publishing gains this week, climbing around 8% in the last seven days despite lows of all time recently.

If the bullish momentum continues, VVV could soon challenge the level of $ 10.36, with an escape potentially led the price to $ 14.57, its highest note since January 28.

However, concerns about transparency weighed on the feeling of the market. Some X users (formerly Twitter) alleged that the project team had started to sell VVV just hours after their Coinbase list.

If the sales pressure degenerates, the token could restore support to $ 5.50, with a deeper drop to $ 2.33 possible if the downward dynamics persist.

Virtual (virtual) virtual protocol

Virtual was once the main crypto of artificial intelligence, but it was faced with heavy losses. Its market capitalization has dropped 44% in the last seven days to $ 813 million.

The token is in difficulty due to the wider correction of the AI sector and also because the market for Crypto AI agents experienced a drop in engagement and stagnation in new projects.

However, if the media threw surrounding the agents of the crypto, virtual could resume the momentum and test the resistance levels at $ 1.63 and $ 1.77, especially if its expansion to Solana attracts more attention and new agents.

An escape above these key levels, combined with a renewed excitation of the market, could push virtual around $ 2.41, its highest price in weeks.

On the other hand, if the correction deepens, the risk of token fall further, with drop -down targets extending up to $ 1.03.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.