Top Bittensor Tokens to Watch: Chutes, Taoshi and Targon

Three Bittensor – Falls, Targon trading and Targon network – are among the best projects to monitor this week.

Falls remain the largest subnet token by market capitalization despite the recent price pressure, while the owner’s commercial network attracts attention thanks to the DEFAI story. Targon, on the other hand, is negotiated at deeply occurred levels and could be set up for a potential rebound. Here is a more in -depth examination of each of these Bittensor -based tokens before the first week of May.

Falls

Falls is a server-free calculation platform built by Labs radius. It is designed to deploy, execute and set up any model of artificial intelligence in a few seconds.

Users can interact directly with the fall platform or easily integrate it via a simple API, offering a fast and flexible AI infrastructure without the complexity of traditional servers.

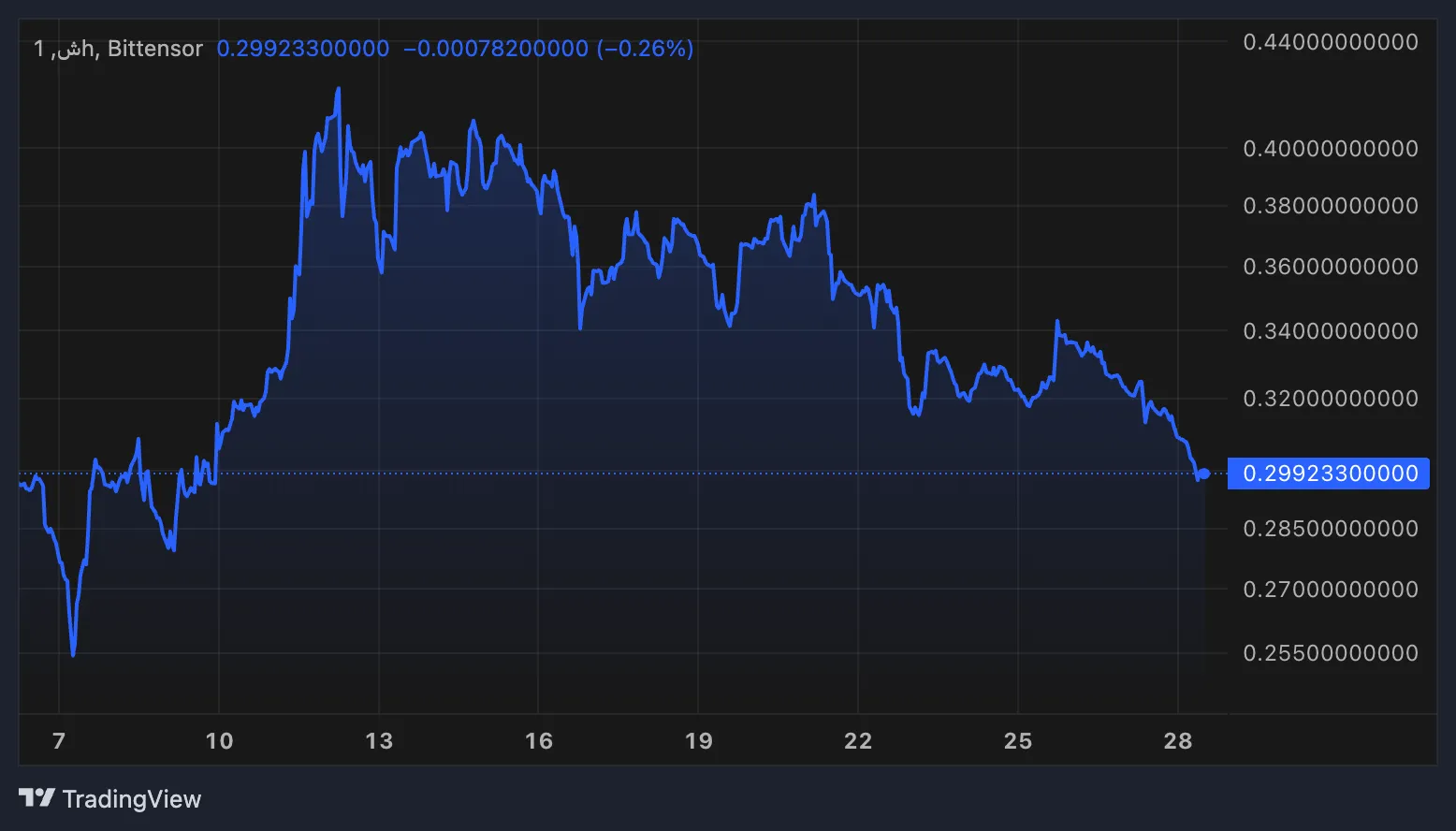

Falls is currently the largest Bittensor subnet token by market capitalization, but it has faced a pressure recently, lowering almost 18% in the last seven days.

After joining 67% between April 7 and April 12, the token has since dropped around 30% of its peak. Its relative resistance index (RSI) is now at 23.78, reporting deeply occurring conditions.

This configuration could mean that falls approaches a potential reversal area.

If the project manages to recover its previous momentum, being the largest subnet on Bittensor could amplify its earnings thanks to the effects of the network, potentially triggering a strong upward trend which could bring the price to the fork of $ 0.40.

Owner trading network

The owner trading network, or Taoshi, is a decentralized financing platform operating in the Bittensor ecosystem. It builds dynamic subnets where AI and decentralized machine learning models analyze data on several asset classes.

Its mission is to democratize access to sophisticated trading strategies, combining AI, blockchain and finances to provide advanced data that help users make more informed financial decisions.

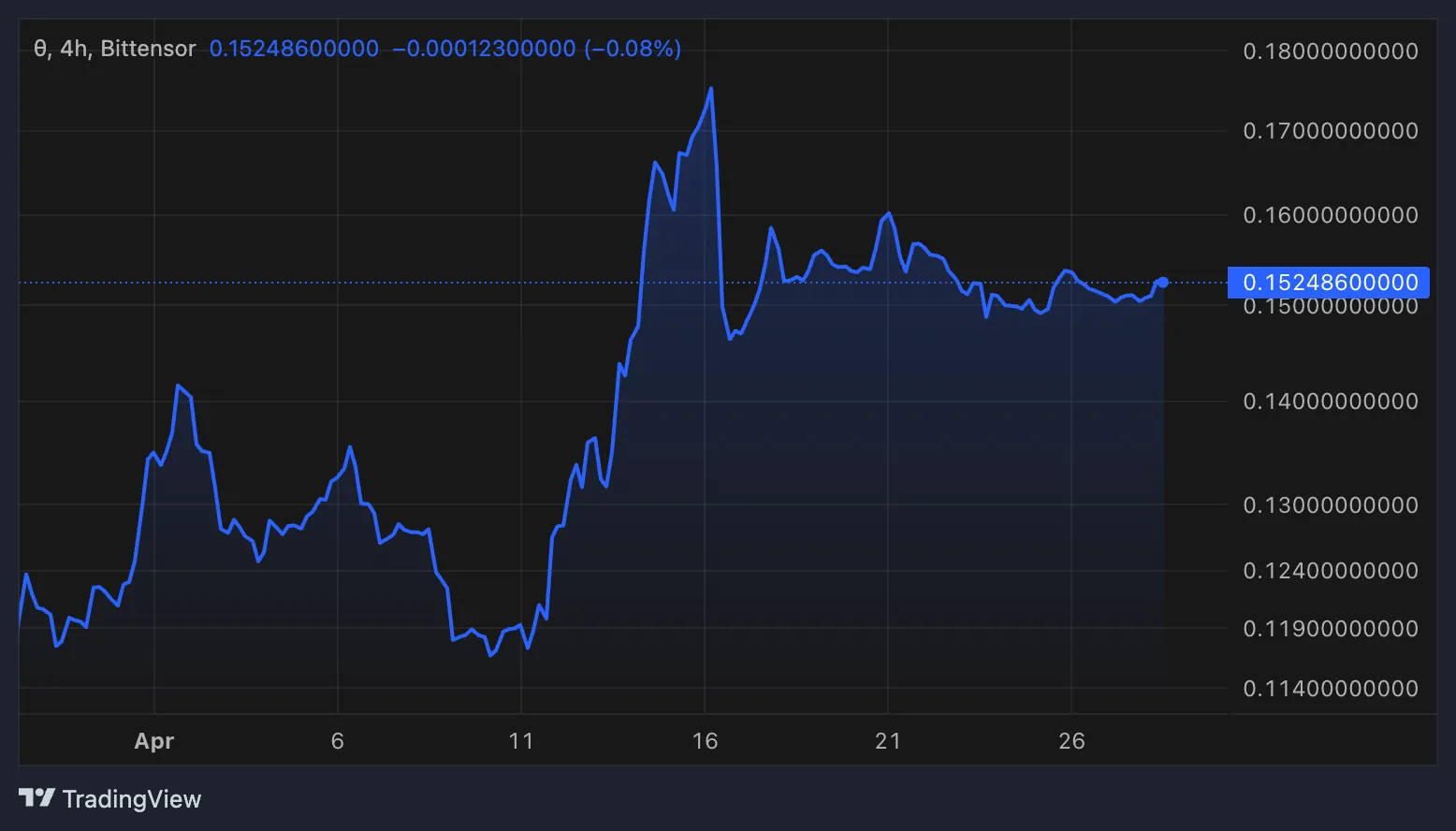

The market capitalization of the owner’s commercial network is close to $ 50 million, its negotiation volume jumping almost 160% in the last 24 hours to reach $ 3 million.

Defai emerging as one of the hottest accounts of 2025, the owner’s commercial network is well positioned to take advantage of its exposure to trendy sectors such as AI, bitten-trading subnets and trading.

If the current moment is strengthening, the token could soon increase to retest the resistance levels by $ 0.20 and $ 0.25, supported by increasing attention in these sectors.

Cargo

Manifold laboratories have developed Targon, which is a Bittensor subnet token which builds a Cloud AI platform which allows users to execute inferences on high-speed and low cost AI models.

Thanks to its playground and API, Targon offers many optimized models for completion and cat tasks.

The platform emphasizes rapid performance, high scalability and profitability, allowing developers and companies to deploy and extend AI models while easily minimizing the complexity of infrastructure.

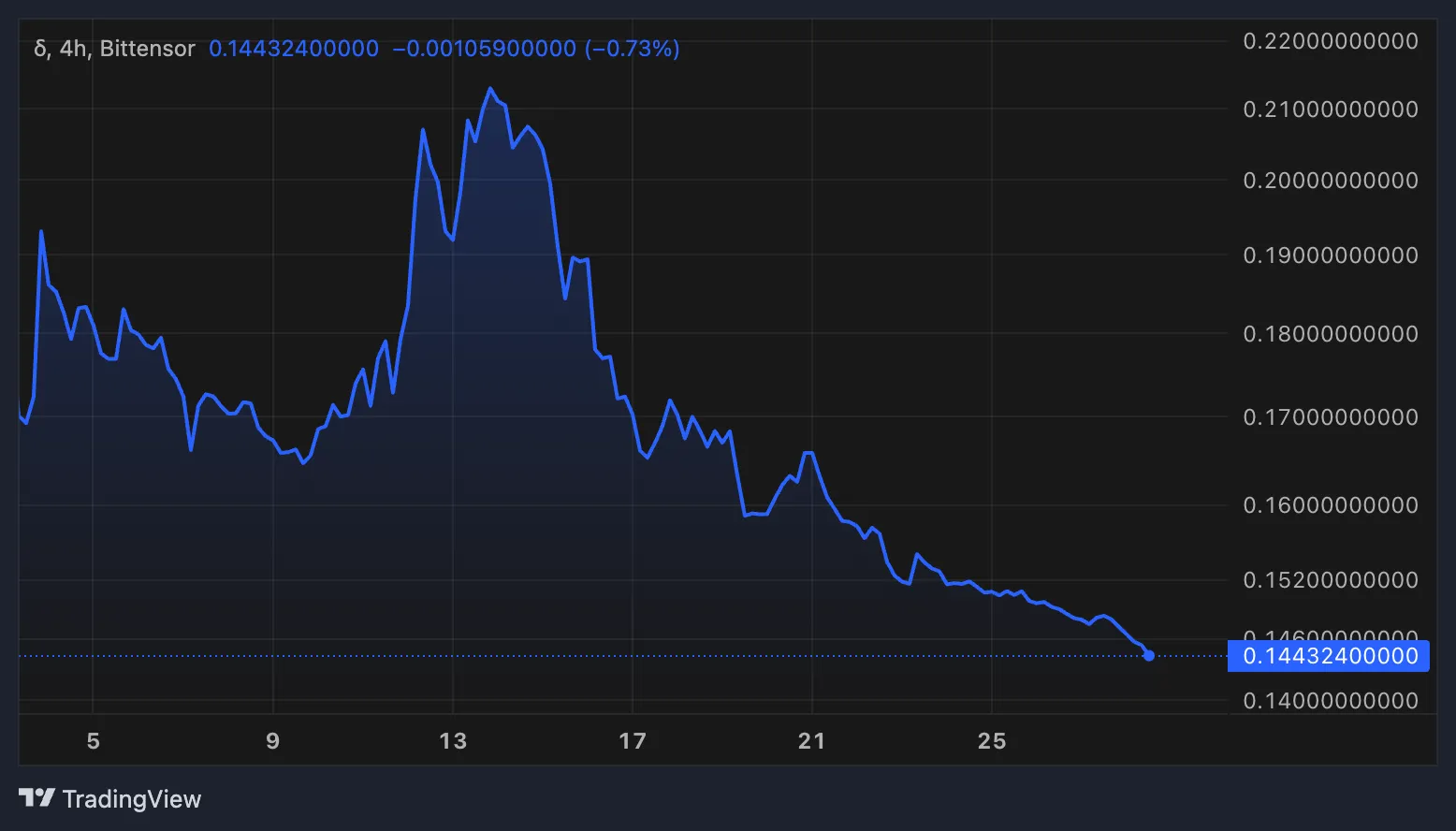

Targon’s market capitalization is currently around $ 47 million, the daily negotiation volume reaching $ 1.33 million.

Targon’s price has dropped more than 9% in the last 24 hours. His RSI is 19.23, signaling deeply occurring conditions which often precede a rebound.

The Targon could gain up to 48% if a new momentum is built and retains price levels 15 days ago.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.