Top Reasons Why Bitcoin Price May Retest $92k First Before Reaching $120k in the Midterm

The Bitcoin (BTC) price has experienced increased resistance around $ 108,000 in recent days in the middle of the de-escalation of the Middle East crisis. The flagship piece dropped slightly to negotiate at around $ 107,472 on Thursday, June 26, during the American session in the middle of the North.

After saving an impressive return, after the 90 -day break on most reciprocal prices in April, BTC Price formed a potential reversal scheme. The lowering feeling for the BTC price has formed in the middle of the growing demand for institutional investors, led by the strategy and Metaplanet.

The main factors weigh down the bullish feeling halfway through the price of bitcoin

Technical Winds

The price of the BTC, within a daily time, has formed a trend lowered as a result of a lower break from an increasing corner formed at the end of May 2025. The slightly halfway-up feeling for the price of the BTC is reinforced by the daily relative force index which decreases (RSI) with the MacD line after crossing the zero line.

From the point of view of the technical analysis, the price of the BTC is well positioned to retain the level of support greater than $ 92,000 in the coming weeks. The ultimate level of support for the BTC price was established above $ 76,000 earlier this year.

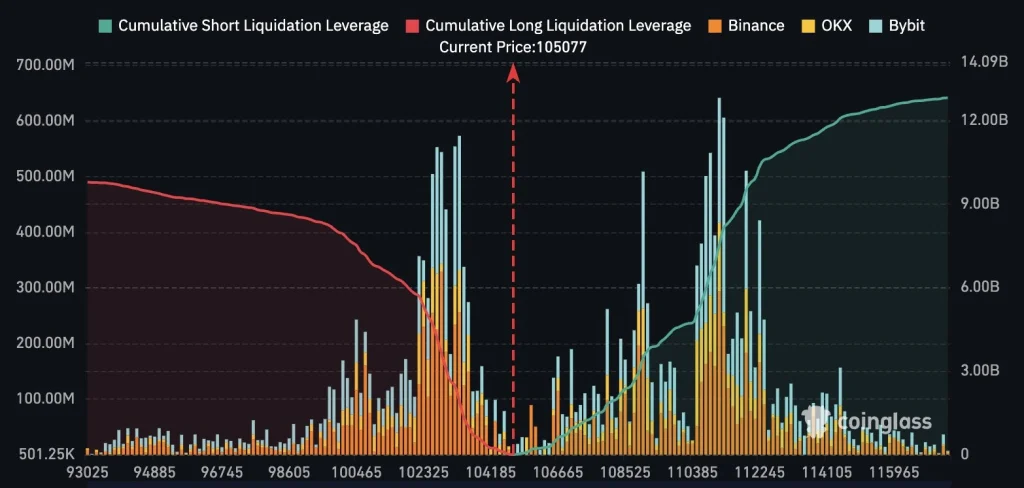

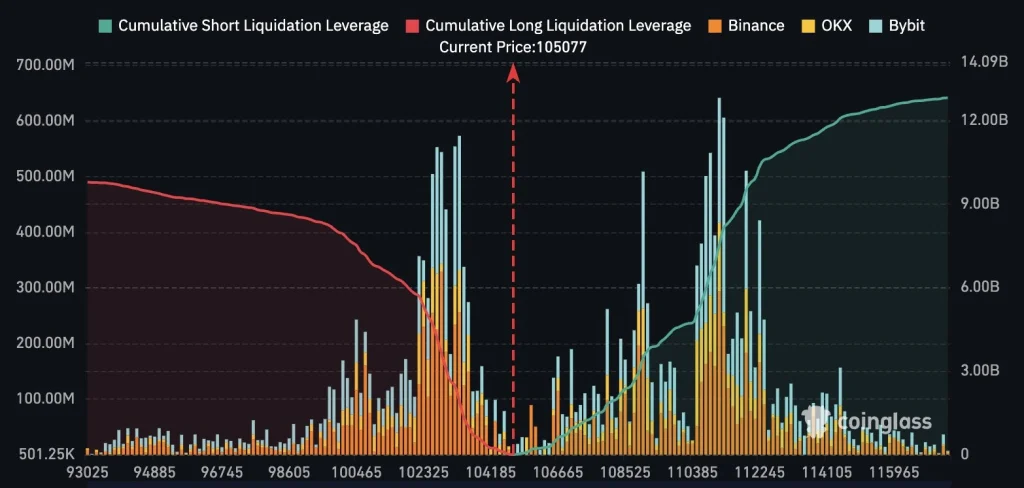

Cumulative lividation short -livid

The price of Bitcoin faces an intensified lowered feeling powered by a liquidation lever effect accumulated at around $ 12 billion around $ 112,000. Ideally, it is prudent to say that more institutional investors seek to remove the price of the BTC thanks to the term markets and leverage to acquire as many parts as possible before the highly awaited parabolic rally. According to Data from the Bitcointheries market, 251 entities have more than 3.47 million BTC in their respective treasury bills.