Pi Network Weekly Loss Extends to 16%

The prolonged decline in the PI network has extended to another week, the losing token almost 16% of its value in the middle of a wider market lull.

While macro uncertainty is intensifying and the daily unlocking provided by PI continue to weigh heavily on the feeling, the downward pressure appears far from over.

The sellers dominate while Pi fall below the key thresholds

Since he reached a summit of $ 3 on February 25, PI has recorded coherent weekly losses, without significant requests to stop the slide.

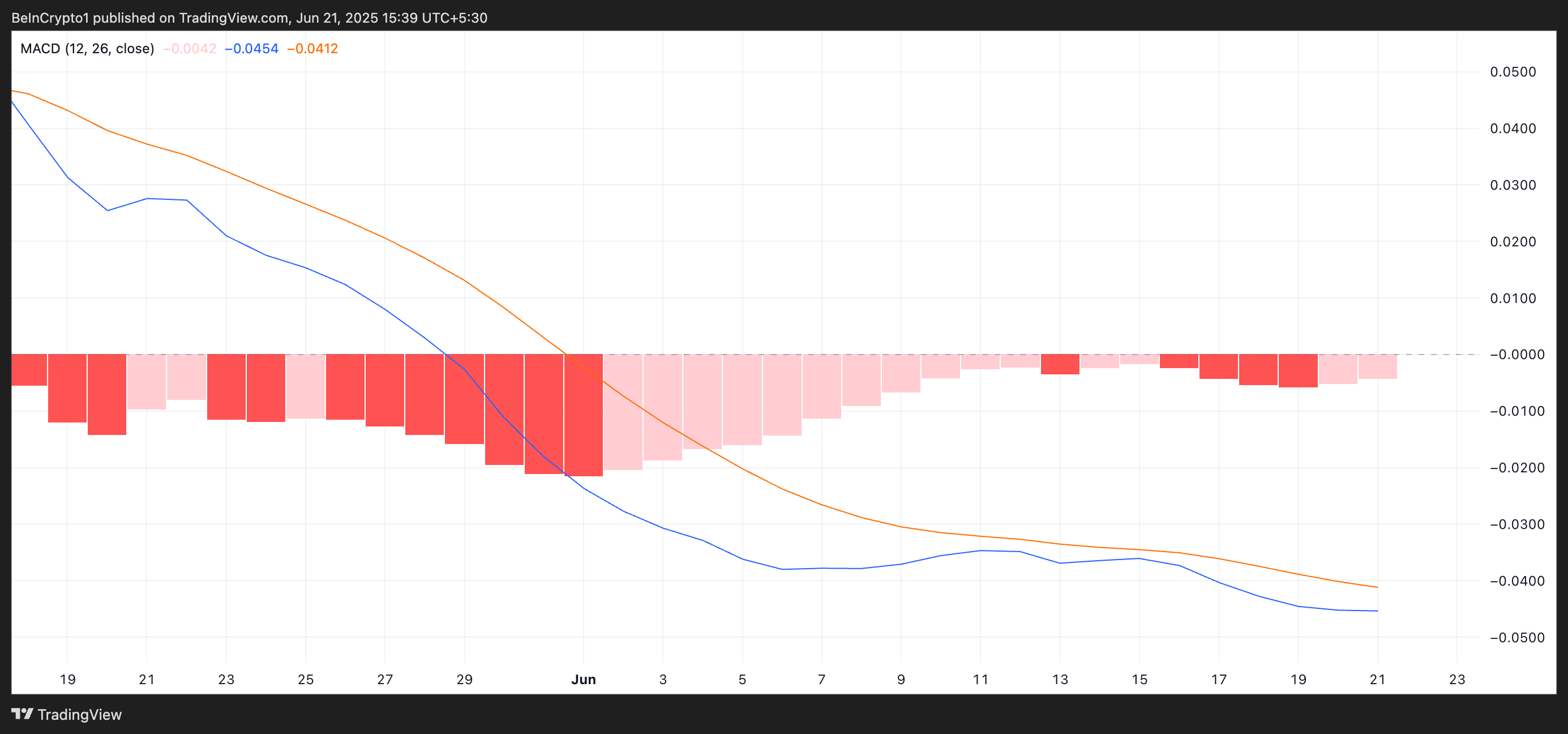

On the daily graphic, the readings of the average convergence divergence indicator of the average token (MacD) reflect the deepening downside. At the time of the press, the MacD line of PI (blue) is based under the signal line (Orange).

The MacD indicator identifies trends and momentum in its price movement. It helps merchants to identify potential purchase or sale signals via crosses between the MACD and the signal lines.

As with PI, when the MacD line rests under the signal line, this indicates a decreasing purchase activity. Traders see this configuration as a sales signal. Therefore, this could exacerbate the downward pressure on the PI price.

In addition, the negative balance of PI (BOP) powers shows that sellers remain firmly in control. To date, the indicator is at -0.12.

The BOP indicator measures the strength of buyers compared to the sellers on the market, helping to identify the changes in momentum. When its value is positive, buyers dominate the market on sellers and stimulate more recent price gains.

Conversely, negative BOP readings point out that sellers dominate the market, with little or no resistance from buyers. This indicates sustained drop pressure and weaken investors’ confidence.

For PI, negative BOP readings strengthen the downward perspective. This suggests that the sale of the momentum can persist unless a new request emerges.

Pi Network fights below the EMA key level

Currently, PI is negotiated at $ 0.53, exchanging hands below its 20 -day exponential mobile average (EMA), which constitutes a dynamic resistance greater than its price at $ 0.56.

The 20 -day EMA measures the average price of an asset in the last 20 days of negotiation, which gives more weight at recent prices. When the price of an asset is negotiated below its 20 -day EMA, it signals a short -term lower momentum and continuous potential. If the Bears retain control, they could generate the PI price to review its hollow of all time to $ 0.40.

However, a rebound could push the PI network token over the EMA 20 days and around $ 0.79.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.