Tornado Cash (TORN) Price is Set For Correction After 40% Rally

Tornado Cash (TORN) has recently experienced a net rally, increasing by 40% in the past 24 hours. This wave was mainly motivated by the abolition of Tornado Cash from the list of sanctions from the Office of Foreign Assets of the US Treasury (OFAC).

Although the pricing has been significant, the market can prepare for a drop because it adapts to news.

Tornado Cash Skyrocket

The recent gathering of Tornado Cash pushed its relative force index (RSI) after the 70.0 threshold, which indicates that the crypto is currently excessive.

This level is often considered as a sign of market saturation, where the bullish momentum of Altcoin has culminated. Historically, once the RSI crosses the 70.0 mark, a price reversal has generally followed, which suggests that a correction can be imminent.

Torn’s state of surouchee suggests that the bullish feeling leading the rally loses steam. While the price continues to consolidate or decrease, the probability of a drop in prices increases, which makes the current price unsustainable in the short term.

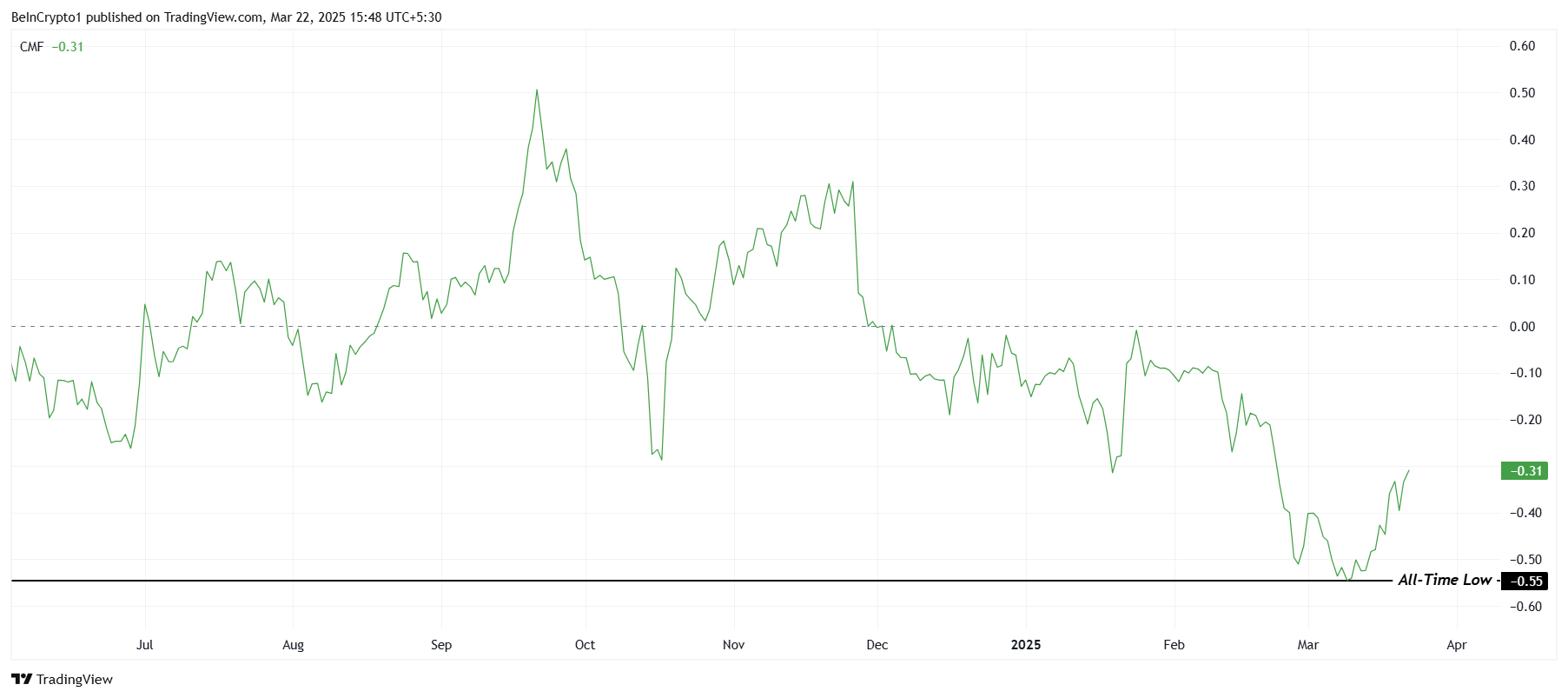

Tornado’s macro momentum points to new challenges. The Chaikin monetary flow indicator (CMF), which measures the weighted average as a function of the volume of accumulation and distribution, is currently stuck in the lower area.

He remained far from the zero line for an extended period, indicating that the sales pressure continues to prevail over the purchase pressure.

In addition, Tornado Cash has experienced its highest outings since its creation, further attenuating perspectives. These outings suggest that investors are taking more and more, which weakens the long -term recovery potential of the token.

Without significant entries to counter the outings, Torn will find it difficult to maintain or extend his recent earnings.

The torn price has aroused a tornado

The Tornado Cash price is currently negotiated at $ 11.77, up 41% in the last 24 hours. Altcoin also noted a strong intra-day increase of 88%. In the past 12 days, Torn has won 135%, marking a high short -term performance.

However, with the token at these high levels, it faces a risk of substantial decline.

Given the exaggerated state and the lower macro dynamics, Torn is vulnerable to a drop by key support levels at $ 11.63 and $ 9.75. A violation of these levels could send the price to $ 7.36, extend the correction and potentially erase recent gains.

On the other hand, if the torade in cash can maintain its bullish momentum and maintain above $ 11.63, it can bounce back. This could open the way to target $ 15.81.

A successful rally at this level would invalidate the lower thesis. This would also consolidate recent price gains, signaling the potential of the increase.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.