Bitcoin ETFs Outflow Hit $1 Billion as Institutional Investors Retreat

On Tuesday, the funds negotiated in Bitcoin (ETF) recorded their fourth consecutive day of net outings, marking the longest sequence of withdrawals since April.

This output of sustained capital reflects the slowdown in the feeling of the market, which could push the price of BTC below in the short term.

Bitcoin ETF exceeds $ 1 billion in 4 days while institutional bulls are withdrawn

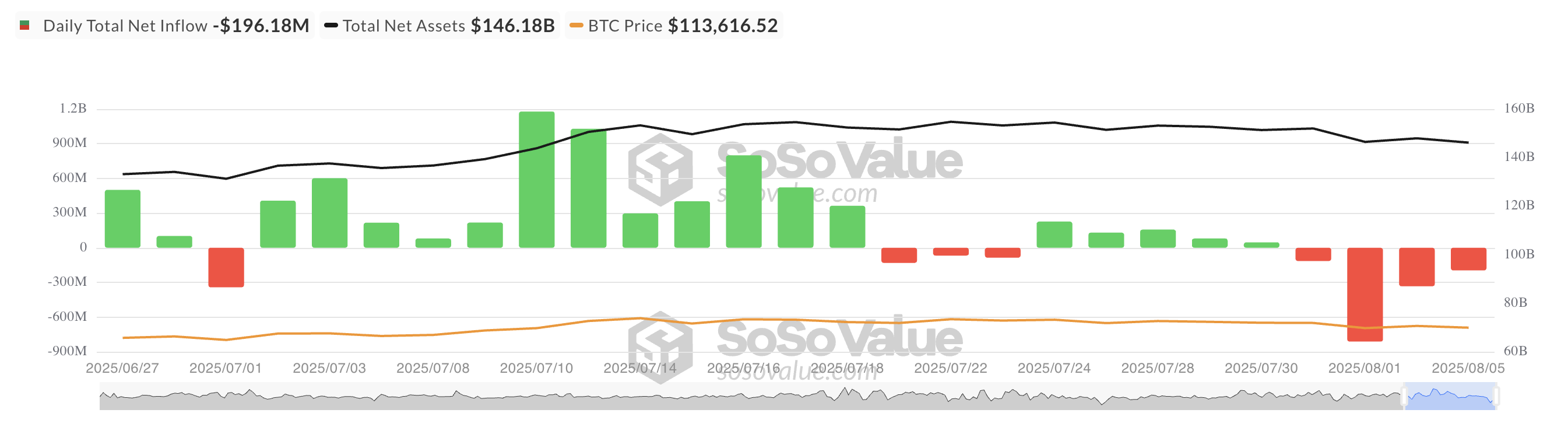

The four -day sale in the ETF points out a conviction to weaken among institutional investors, who are now looking to reduce their exposure to bitcoin. According to Sosovalue, the net outings of these funds exceeded $ 1 billion in the past four days.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

This is significant development because the recent BTC gathering at a new summit of all time of around $ 122,054 was largely fed by the activity of these same investors.

In July, the BTC Spot ETFs reported more than $ 6 billion in capital admissions, helping to increase prices. Their decline now suggests a lack of institutional support, a change that could weigh heavily on the value of the short-term cryptocurrency.

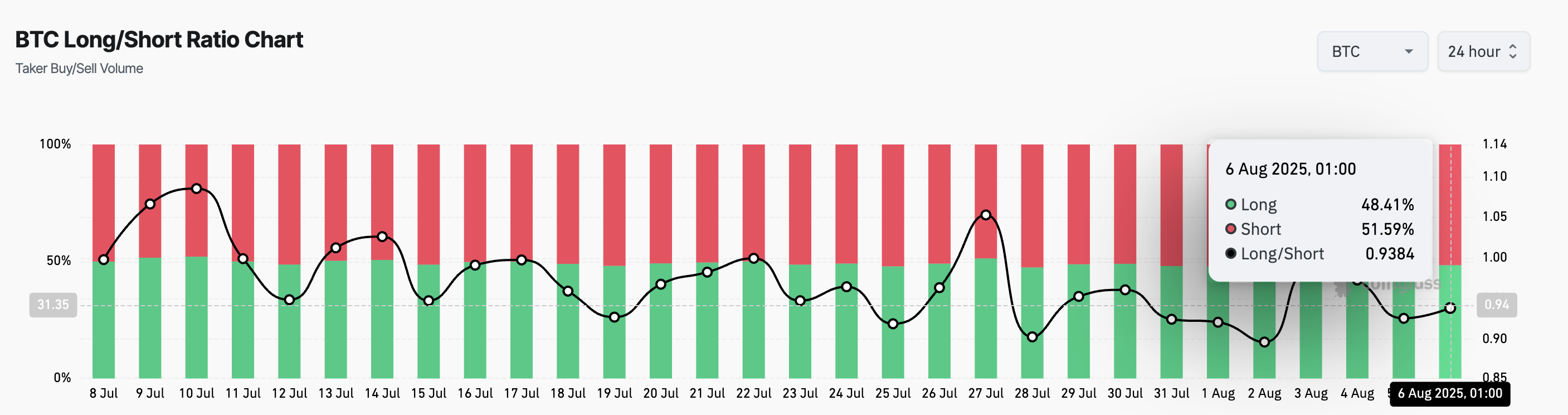

In addition, data on the chain also highlights the bearish turn. This is reflected by the long / short ratio of the play, which is 0.93 at the time of the press.

The long metric / short measures the proportion of Paris long to those short on the long -term market of an asset. A report greater than a longer position than short positions. This indicates a bullish feeling because most traders expect the value of the asset to increase.

On the other hand, as with the main part, a long / short ratio lower than one means that more traders bet on the price of the assets to decrease than those who expect it to increase.

BTC Bears Eye Target $ 111,000

The readings of the daily graphic show the price of BTC parked below its parabolic stop and reverse indicator (SAR). Currently, the points that make up the indicator form a dynamic resistance above the BTC price at $ 118,086.

The parabolic Sar indicator of an asset follows the direction and the potential trend reversals. When its points are under the price of an asset, the market witnesses a bullish dynamic and its value could continue to grow if the purchase activity continues.

Conversely, when it rests above the price of an asset, it signals a potential decrease in the middle of the climbing sales pressure. If this continues, the BTC price could drop to $ 111,855.

However, if a new request enters the market, it could push the king’s medal around $ 116,952.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.