Will Ethereum Price Survive $2.5 Billion Sell-Off?

Ethereum saw a side movement this week, helping Altcoin getting out of a downward trend of almost three weeks. Despite the lowering signals, including the sale of whales, the price of Ethereum has managed to remain stable.

This stability increases the expectations of an upcoming escape, potentially preparing the ground for an increase.

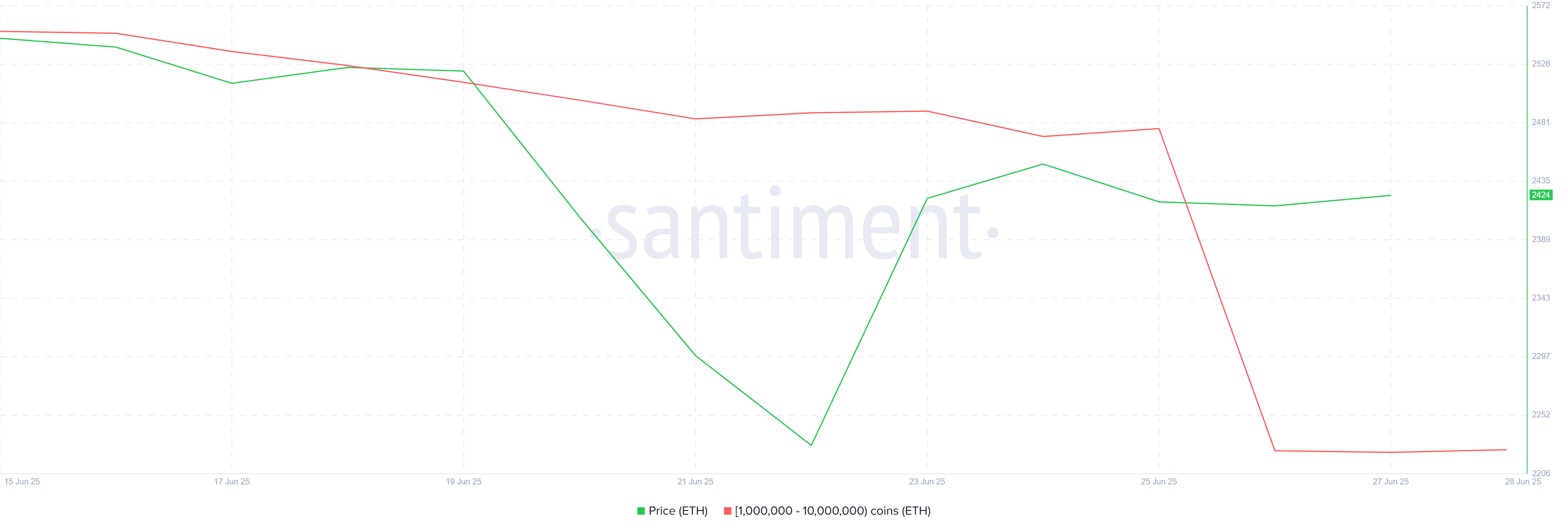

Ethereum whales move to sell

Whale addresses currently have a lower feeling, because several major holders have started to liquidate their positions.

In the last 48 hours, the addresses holding between 1 million and 10 million ETH have sold more than 1.06 million ETH worth around 2.57 billion dollars.

The sale of whales generally exerts downward pressure on the price, signaling the lowering potential. However, in this case, the price of Ethereum continued to maintain itself, which indicates the resilience of the market.

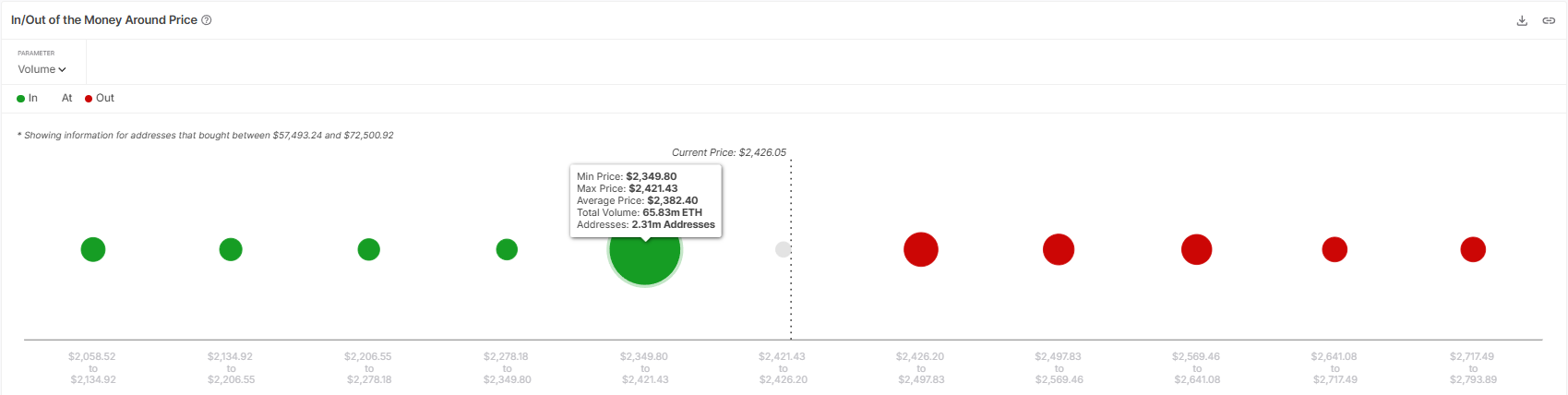

Looking at the Macro Momentum of Ethereum, the Iomap graph (in / Out of money around the price) reveals an important demand zone for ETH. The area holds 65.83 million ETH, worth more than $ 159 billion.

These assets were purchased between the fork of $ 2,349 and $ 2,421, establishing a solid support area.

It is unlikely that the large number of investors who bought ETH in this price range will be sold at the profitability threshold, which makes the price of the price below this key support.

This demand zone acts as a solid cushion for the price of Ethereum, protecting it from any clear drop. The support of these investors provides a base for the price of Ethereum to remain stable despite the recent sales pressure.

Consequently, the price is less likely to drop sharply below the $ 2,344 mark, which would otherwise mean a larger downward trend.

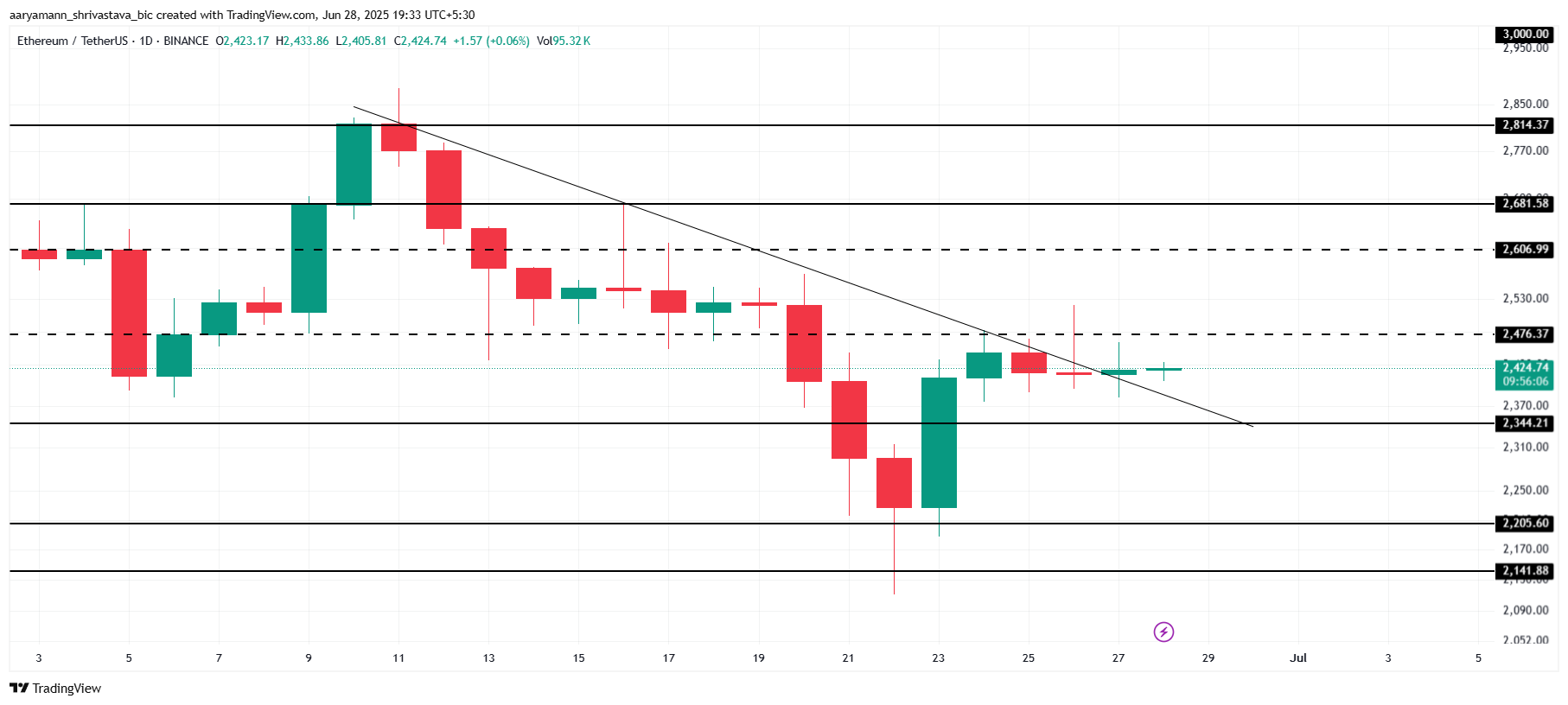

The price of the ETH is consolidated

Ethereum Prix is currently negotiated at $ 2,424, just under the critical resistance of $ 2,476.

Although there was no significant increase, the lateral movement allowed ETH to get out of the three -week decreased trend. This consolidation phase is preparing the ground for a high potential momentum.

The factors discussed previously indicate that Ethereum can continue to consolidate between $ 2,344 and $ 2,476 or potentially drilling resistance.

If Ethereum successfully transforms $ 2,476 into support, an increase at $ 2,606 is likely. This would mark a significant escape and could attract more buyers to the market.

On the other hand, if wider market conditions become extremely downwards, similar to the feeling last week, the price of Ethereum could slip below $ 2,344 and fall to $ 2,205.

A drop below this support would invalidate the current thesis, potentially signaling a new decline.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.