ONDO Drops 18% After a Brief Rally

Ondo Finance (Ondo) briefly jumped almost 20% yesterday, but the gains were reversed within 24 hours. Despite this decline, Ondo remains a major player in the active sector in the real world (RWA).

The technical indicators suggest that the momentum slows down, while the activity of whales decreased for the first time in more than two weeks. Whether the Ondo can recover and repel the levels of resistance of the keys or continue its correction to lower support areas will depend on the feeling of the market and potential future developments concerning its inclusion in the reserve.

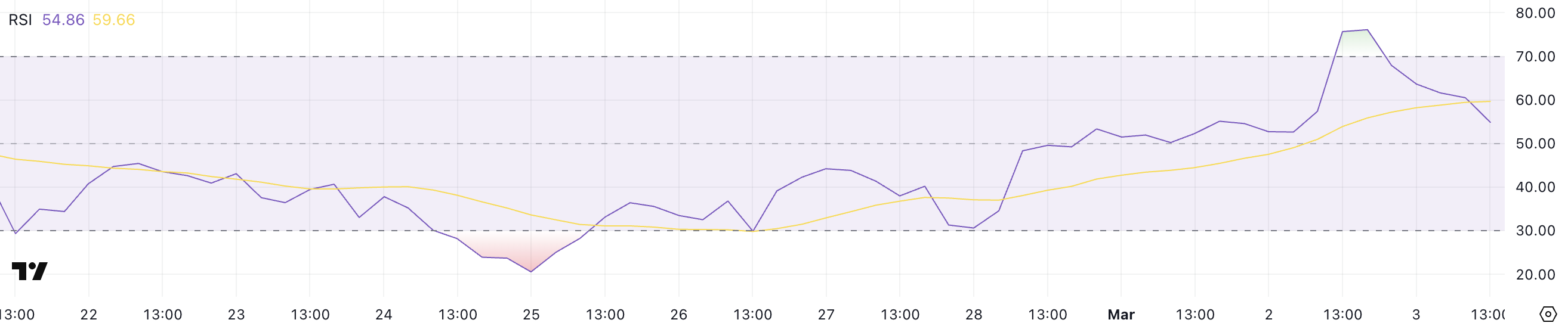

Ondo RSI drops after reaching its highest levels in 3 months

Ondo gained momentum yesterday, pushing its relative force index (RSI) at 76.1 before cooling at 54.8.

The RSI is a widely used momentum oscillator which measures the speed and extent of price movements on a scale of 0 to 100. Readings greater than 70 indicate too hidden conditions, often signaling a potential withdrawal.

Meanwhile, readings less than 30 suggest occurring conditions that can lead to a rebound. With RSI d’Ondo by briefly crossing 70 for the first time in three months, the traders took it as a sign of a strong bullish dynamic before the recent retrace.

Now seated at 54.8, RSI of Ondo returned to a neutral territory, reflecting a slowdown in the purchase pressure. This suggests that the recent gathering may have been surpassed, resulting in potential profits and a period of consolidation.

If RSI stabilizes above 50, Ondo could maintain its bullish structure and try another movement higher.

However, if it continues to decrease around 40 or less, it could indicate a weakening momentum, increasing the chances more downwards.

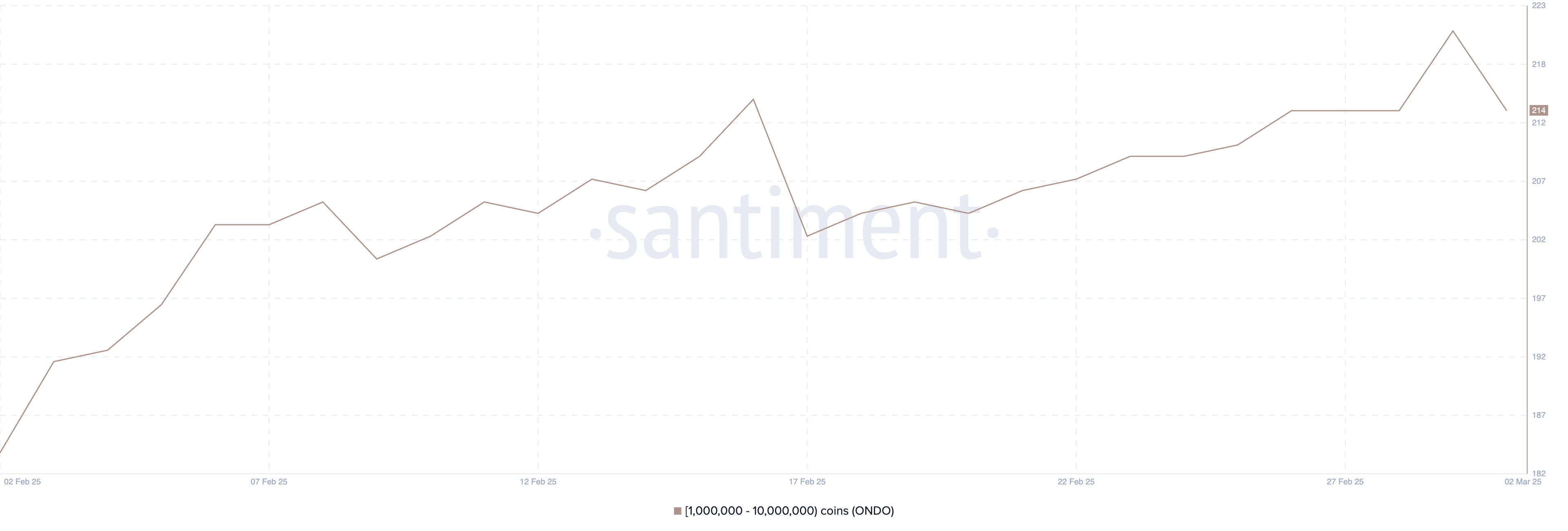

The number of Ondo whales has dropped for the first time since mid-February

The number of Ondo whales – portfolios holding between 1 million and 10 million Ondo – has not increased regularly since February 17, from 203 to 221 by March 1.

However, this trend has overturned in recent days, the number of whales now falling at 214. Following the activity of whales is crucial because large holders can have a significant impact on price movements thanks to their purchasing or sale decisions.

An increasing number of whales often signals accumulation, suggesting confidence in the long -term ONDO potential, while a drop could indicate the distribution, increasing the risk of pressure sales.

Despite the recent decrease, the current number of whales remains high compared to previous months. This suggests that a wider confidence in the asset is always intact.

However, this is the first drop of more than 15 days, which could point out that some major holders make profits or repositioning. If this trend continues downwards, the RWA part could face increased sales pressure, potentially resulting in new corrections.

On the other hand, if the whale numbers stabilize or start to increase, this could indicate a renewed accumulation. This would suggest a price for price potential.

Ondo falls below $ 1

The wider market rally brought Ondo’s price nearly $ 1.20 yesterday before the start of a correction, reporting that traders took advantage.

While Ondo remains a key player in the active sector of the real world (RWA), its short -term price movement will depend on the fact that the current withdrawal deepens or stabilizes.

If the correction continues, it could test the support of about $ 0.95. Additional drops could potentially bring it back to $ 0.90 or $ 0.88. If it falls below $ 0.80, it would be the first time that has happened since November 2024.

However, if the bullish feeling returns, Ondo could resume momentum, especially if the United States adopts a more friendly crypto position on Rwas or if Ondo is finally added to the American Strategic Cryptography Reserve.

In this scenario, he could receive resistance at $ 1.26 and $ 1.44, with a strong rally which potentially sends it to $ 1.66.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.