Solana Network Nears 400 Billion Transactions as SOL Recovers

Solana (soil) again wins a significant momentum, both in chain and in prices. The network is approaching an important step of 400 billion transactions in total. In the past seven days, Sol has increased by more than 12% and recovered the level of $ 150 for the first time since early March.

From its lowest cycle of $ 9.98 in January 2023, Solana climbed more than 1400%, supported by growing adoption through its ecosystem. With bullish technical signals, prosperous applications such as Pumpfun and Jito, and talks about a potential of $ 500 in 2025, Solana cement its leading place on the market once again.

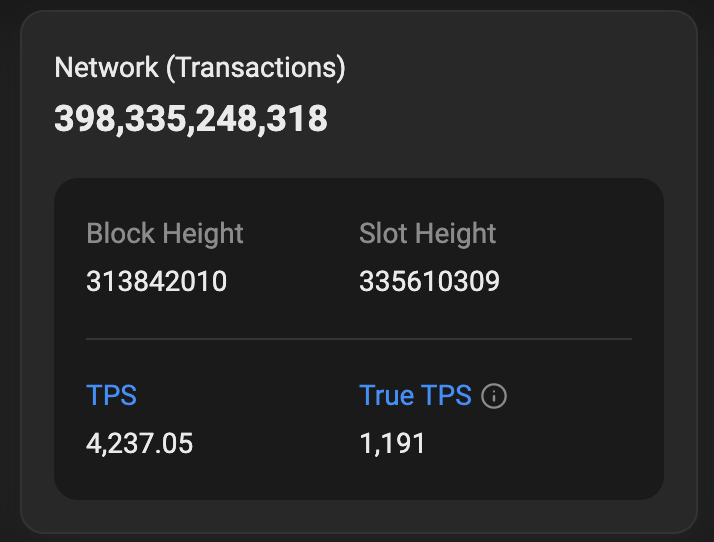

Solana Network is approaching 400 billion transactions

Solana is approaching an important step. There are less than 2 billion transactions by reaching the 400 billion mark.

This occurs while the floor price wins a new movement, increasing by more than 12% last week and exceeding $ 150 for the first time since March 2, its DEX negotiation volume reaching nearly $ 16 billion in the last seven days, more than any other channel.

From the background at $ 9.98 on January 1, 2023, Solana has skyrocketed by an incredible 1412%, becoming one of the most efficient in the current cycle.

But it is not only price action – this cycle has also brought an explosion of real adoption to Solana’s ecosystem. Applications like Pumpfun, launched last year, quickly became among the most profitable in crypto.

Meanwhile, basic protocols like Raydium, Meteora and Jito continue to generate millions of monthly costs, highlighting the growing usefulness and economic force of the network.

Solana RSI plunges but the bullish momentum holds

The Relative force index of Solana (RSI) is currently at 64.51, cooling from a recent summit of 77 just one day. Interestingly, it bounded by an intraday dip at 58.64, signaling a potential change in short -term momentum.

This fluctuation suggests that even if the recent gathering may have briefly overheated, buyers are still active, keeping the momentum in bullish territory.

The RSI is a Momentum oscillator ranging from 0 to 100, used to assess whether an asset is exaggerated or exceeded. Readings greater than 70 generally suggest surachat conditions, often preceding a decline, while the values of less than 30 indicate potential purchasing levels and purchasing opportunities.

With RSI of soil now seated at 64.51, he indicates an optimistic feeling which continued without being exaggerated.

This level again increases if the momentum is strengthened, but the merchants will watch closely to see if the RSI can go back to the Subouche zone – or if the sales pressure begins to rise.

Will Solana reach $ 500 in 2025?

The Solana price is negotiated in a tight fork. It faces resistance at $ 152 and holds Support at $ 147.60.

Its EMA lines remain optimistic, with short-term averages above those in the long term, indicating that the wider rise trend is always intact.

If the resistance of $ 152 is broken, soil could climb to $ 160, and with a sustained momentum, even target $ 180.

Looking further, if Solana resumed the momentum she had at the end of 2023 and at the beginning of 2024, he could retain her summit of $ 256 and potentially pushed around $ 300 in the first half of 2025.

If the overall cryptography market is recovered in the second period and Solana continues to lead to Dex volume and developer activity, the $ 500 bar becomes a long -term realistic target.

However, on the lower side, a loss of the support of $ 147.60 could open the door to a correction at $ 124, or even $ 112 if the downward trend is accelerating.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.