TRUMP Trading Volume Hits $1.50 Billion as Token Surges 15%

Trump (Trump), head of the same corner, based in Solana, recovers recent losses. In the middle of the wider market rally, the value of the token jumped almost 15% in the last 24 hours, exceeding the best parts of memes by market capitalization.

The technical indicators suggest the probability of a sustained short -term price rally. This analysis provides details.

ASSET Surpasses the best active people even

The gradual resurgence of commercial activities on the cryptography market has led to a two -digit peak in Trump’s value. At the time of the press, the token is negotiated at $ 16.87.

He noted an increase of 13% in the last 24 hours, eclipping the main active ingredients such as Shib, Doge and Pepe, which have experienced price increases below 10%.

During the examination period, Trump’s negotiation volume exceeded $ 1.50 billion, climbing 102%. When an increase in the volume of negotiation accompanies the prices rally of an asset, it indicates a strong market interest and a confidence of investors.

He points out that the increase in prices is supported by real demand rather than speculation, which suggests that the movement of the same part prices is more durable.

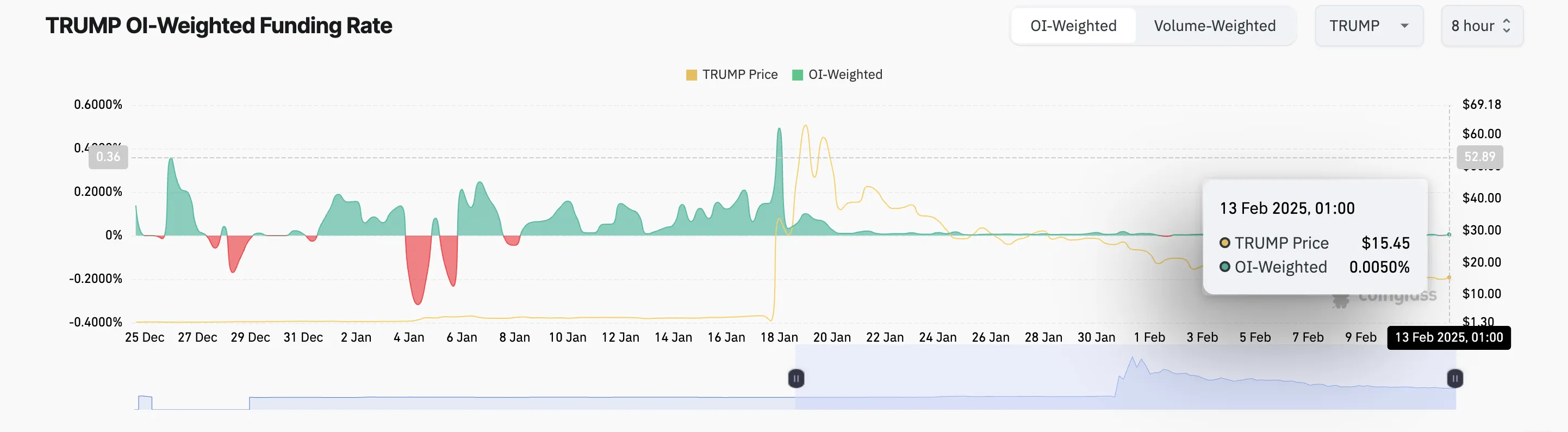

In addition, Trump’s financing rate has remained positive despite recent market problems. At the time of the press, it is 0.0050%.

The rate of financing of an asset is a periodic payment exchanged between its long and short traders on term contracts. It is intended to maintain the price of the contract online with the price of the underlying assets.

As with Trump, when the financing rate is positive, it means that long traders pay short -term merchants, indicating that the market is optimistic and that there is more pressure of purchase than selling.

Could Trump prices: could $ 29.13 be the next one?

On a daily graphic, Trump is above the descending trend line that had maintained its low prices since January 22. When an asset moved above a descending trend line, it signals a potential reversal of the feeling of the market, indicating that assets can drop from a downward trend to an upward trend.

This escape suggests an increasing purchasing interest in Trump and could be the start of a new increased phase if demand is strengthened. In this scenario, the token price could increase to $ 29.13.

On the other hand, if Trump Traders regains profits, he could lose his recent earnings and drop to $ 14.27.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our general conditions, our privacy policy and our warnings have been updated.