Trump Vs Powell Heats Up as Inflation Rises

Welcome to the morning briefing of the US Crypto News – your essential overview of the most important developments in the crypto for the coming day.

Take a coffee – you will need it. The financial market has become much more unpredictable due to rampant inflation, political power games and market assaults. As the Federal Reserve (Fed) is stable, new reports suggest that the next big quarter work may not come from data, but from Donald Trump.

Crypto News of the Day: American inflation increases while spending spending

The FED’s favorite inflation gauge, PCE (personal consumption expenses), increased in May. According to the latest data, the basic PCE price index increased by 0.2% per month (MOM) and 2.7% in annual sliding (yoy), slightly higher than forecasts.

The chief PCE arrived as expected, increasing 0.1% over the month and 2.3% in annual shift

Like the American CPI, this is the first increase in inflation of the PCE since February. In this context, the experts predict that the Fed break will continue.

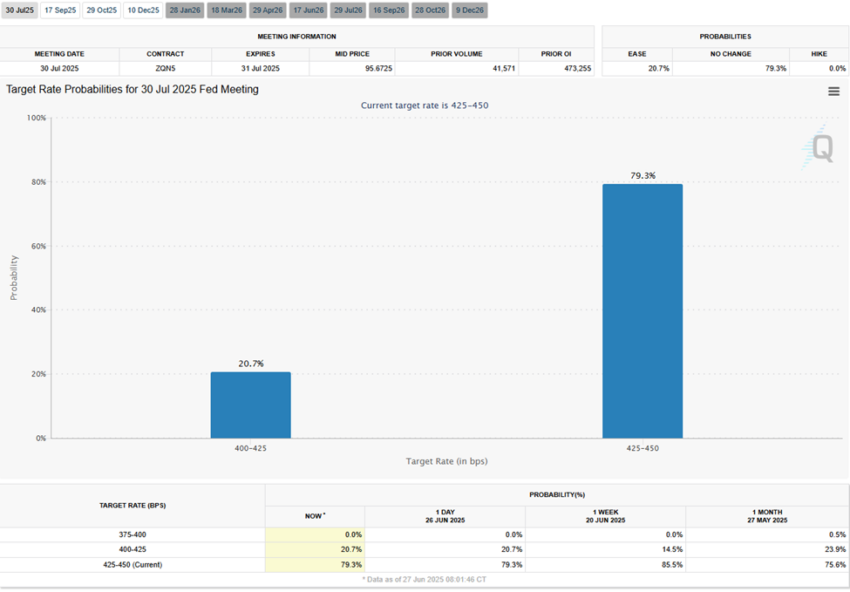

Based on the CME Fedwatch tool, there is a probability of 79.3% that the Fed kept the interest rates unchanged during the July 30 meeting.

In addition, the signs of weakening the momentum of consumers emerged as personal income dropped by 0.4%. Meanwhile, real personal expenses decreased by 0.3%. These two American economic indicators lacked forecasts, reflecting the softening of economic conditions.

Although these inflation figures strengthen the prudent position of the Fed, the political drama eclipses them. The growing possibility that President Donald Trump could soon install a president of the Federal Reserve aligned by Maga continues to shake the financial markets.

Trump vs Powell: Markets Eye Magi-Friendly Fed Reshudge

In his recent testimony to the senatorial banking committee, the president of the Fed, Jerome Powell, said that he expects inflation to increase this summer due to the Trump administration prices.

Meanwhile, reports indicate that Trump plans to replace Powell with a loyalist this summer.

While his mandate ended in May 2026, this decision would be undergoing the last year of power of Powell, potentially injecting the political risk in an institution for a long time for its independence.

The political maneuver sparked a strong reaction on the currency markets, sending the US dollar to a hollow of three years. The decline comes in the midst of fears of a politician environment politicized before 2026.

Trump, frustrated by Powell’s refusal to reduce interest rates, increased his rhetoric, as indicated in previous American publications of Crypto.

In recent weeks, he has called Powell the “worst” and a “model” which “costs billions of dollars in America”. Behind closed doors, the initiates say that Trump checks the candidates who would be “tirelessly” and willing to implement rate reductions aligned on his economic agenda.

Reacting to the news, the US dollar index (DXY) is declining, revisiting the levels observed for the last time in 2022.

While inflation is revealed and spending slows down, the markets are struggling with a new risk: this monetary policy could again be led by political loyalty rather than by economic logic.

Graphic of the day

Alpha the size of an byte

Here is a summary of more news from crypto in the United States to follow today:

- 0.1 Bitcoin is the new American dream? CZ, Saylor and Pulte think so.

- Trump Family, Hut 8, and attached a new era of the hyper-scale Bitcoin farm.

- The TRM Labs report shows that crypto flight reaches a record of $ 2.1 billion in funds stolen in H1 2025.

- Bakkt Holdings deposits S-3 to raise $ 1 billion, potential eyes Bitcoin Investissement.

- The US Congress adopts the deployment of American blockchains Act: What it means for crypto.

- The launch of ZILLIQA 2.0 stretches an increase in entries, the launch introducing the full EVM support and transversal communication.

- The APT price reaches a 16 -day high as the first ETF Aptos Spot closer to reality.

- Three macroeconomic factors to watch closely to find out if Bitcoin will thrive or fight in the third quarter.

- The PI Network team reduces 3 major updates before PI2day, but the Pi Coin price decreases 16%.

- Bitcoin remains close to its ATH greater than $ 100,000, but the punctual volume is late, reflecting a cooling market absent from speculative intensity.

- Layer 2 tokens show explosive assessments – the FDV report / Arbitrum fees reached 137.8x, while Starknet reaches an insufficient 4,204x.

- ETFE ETHEREUM attracts regular entries in the midst of a dull price action – a configuration for a July wave?

- XRP’s liveliness indicator shows long-term holders that accumulate, suggesting confidence in XRP’s long-term potential and providing a buffer against volatility.

Presentation of the actions of the crypto-actions

| Business | At the end of June 26 | Preview before the market |

| Strategy (MSTR) | $ 386.63 | $ 385.19 (-0.37%) |

| Coinbase Global (Coin) | $ 369.21 | $ 374.27 (+ 1.37%) |

| Galaxy Digital Holdings (GLXY) | $ 20.48 | $ 21.12 (+ 3.31%) |

| Mara Holdings (Mara) | $ 15.27 | $ 15.19 (-0.52%) |

| Riot platforms (riot) | $ 10.51 | $ 10.54 (+ 0.29%) |

| Core Scientific (Corz) | $ 16.36 | $ 17.62 (+ 7.70%) |

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.