Trump’s 3-Point Rate Cut Could Trigger Biggest Crypto Bull Run

Wall Street is betting more and more on American interest rate drops before the end of 2025. At the same time, Donald Trump’s political pressure has intensified, because it becomes more aggressive towards Powell for rate reductions.

With the cooling of inflation and the markets adjusting expectations, the crypto could make the most of a more loose monetary policy.

Trump wants Fed to reduce the interest rate to 1%

Earlier in the day, Trump renewed his attack on the president of the federal reserve Jerome Powell. He called for a drop in the point rate of 3 percent and said that this would allow the US economy of 1 Billion of dollars per year.

The President also accused Powell of maintaining high rates for “political reasons”.

While the Fed has maintained stable rates at 4.25% to 4.50% since June, speculation has increased. Goldman Sachs now expects the first cup to arrive in September.

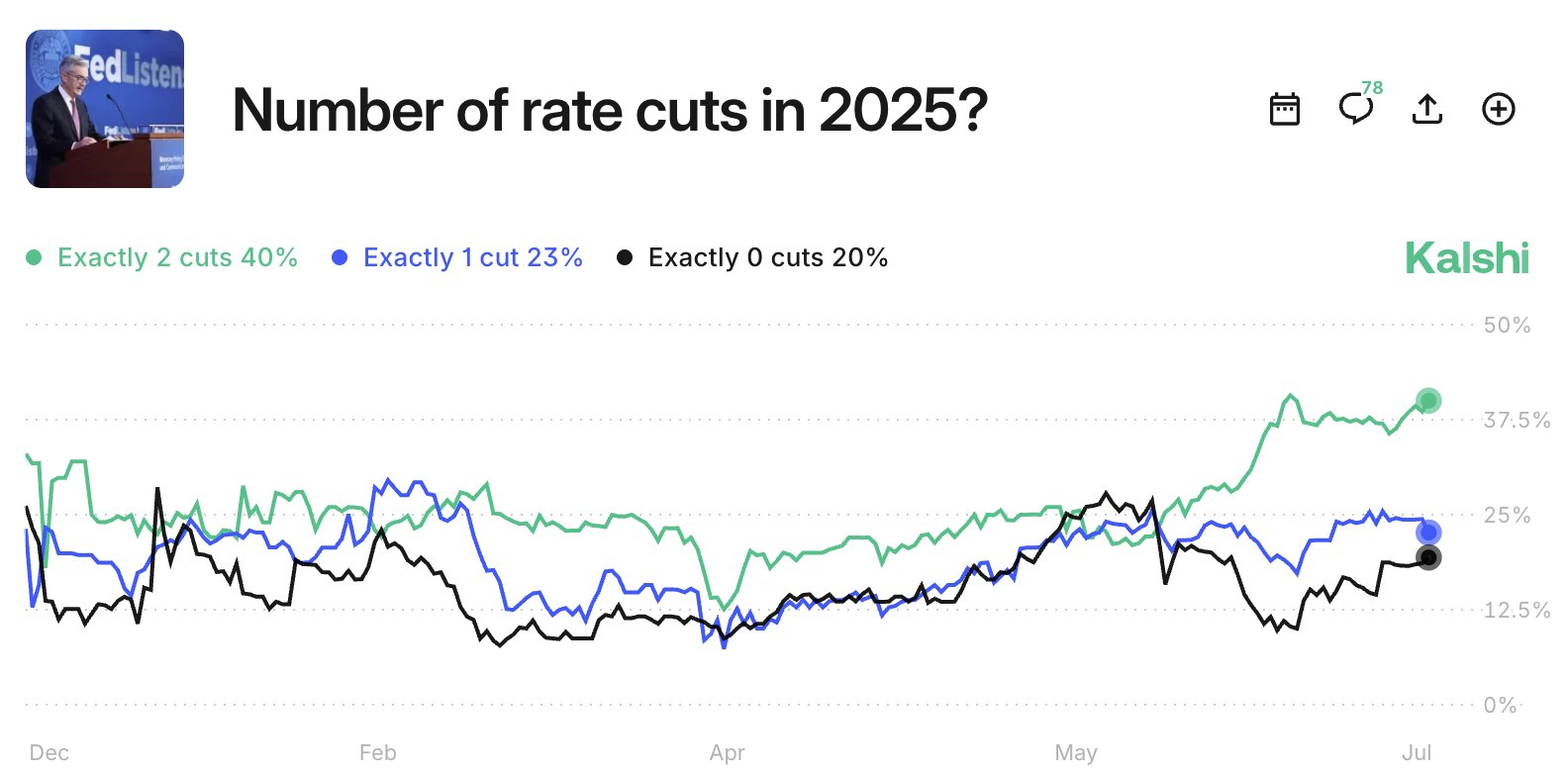

Meanwhile, merchants on the Kalshi prediction market see 40% of two discounts before the end of the year.

This change follows an steep drop in American inflation expectations. One -year -old consumer expectations fell 4.4% in July, the lowest since February. This marks a drop of 2.2 percentage points over only two months, one of the largest decrees of two months in history.

The longer -term inflation expectations also settle down. The five -year prospects fell 0.8 percentage points in the last quarter, now at 3.6%.

Overall, these trends suggest that the Fed has more space to facilitate relief without arouse fears of a prices spiral.

The cryptography market pays particular attention.

Bitcoin remains more than $ 118,000, while Ethereum holds nearly $ 3,700. The two assets have historically joined after the Fed rate reductions, benefiting from the increase in liquidity and appetite for investor risks.

Could a large crypto-taurius begin?

Historically, rate reductions have launched solid cryptographic bull markets.

After the Fed reduced the prices in March 2020 during the COVVI-19 crisis, Bitcoin rose from $ 10,000 to more than $ 60,000 in a year. Ethereum followed, supported by DEFI and NFT growth.

If a new rate of drop in rates begins in September, it could provide similar conditions. Lower yields push investors to risky assets, including crypto.

Capital could also turn obligations and money in Bitcoin, Ethereum and Altcoins with high conviction.

In addition, the decline in inflation expectations and improving regulatory clarity – such as genius and clarity acts – can strengthen the confidence of investors.

This convergence of macro and political signals could prolong the current cycle beyond the summits of all previous time.

However, timing is important. The crypto is already close to record levels, so the momentum can depend on the speed and depth of the cuts. A delayed or shallow response of the Fed could limit the increase.

Key dates to watch

The next federal reserve policy meeting will take place on July 29 to 30. Although the markets do not expect any change, the Fed comments will be closely analyzed for the signals on September.

The next critical date is September 16-17When the FOMC recalls. This is widely considered to be the first realistic window for a drop in rate, especially if inflation continues to lower.

Other key indicators to monitor:

- July CPI impression: Due to the beginning of August, this will shape the expectations of the September decision.

- Jackson Hole Symposium (August 22-24): Powell’s speech here could considerably change the feeling.

- American job reports (August and September): The softness of the work can strengthen the case of the cuts.

For crypto merchants, these dates offer clues for the inflection points of the potential market. A confirmed fed pivot could trigger renewed purchase pressure, especially in bitcoin, ethereum and high liquidity altcoins.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.