Trump’s EU Tariff Threat Sparks Crypto Liquidation and Corrections

President Donald Trump announced his intention to impose a 50% rate on all goods imported from the European Union, in force from June 1. The announcement caused a certain nervousness on the cryptography market, while the previous upward dynamics have been corrected.

The prices proposed come in response to what Trump described as persistent commercial imbalances and regulatory barriers. He accused the EU of maintaining unfair commercial practices that have harmed American companies.

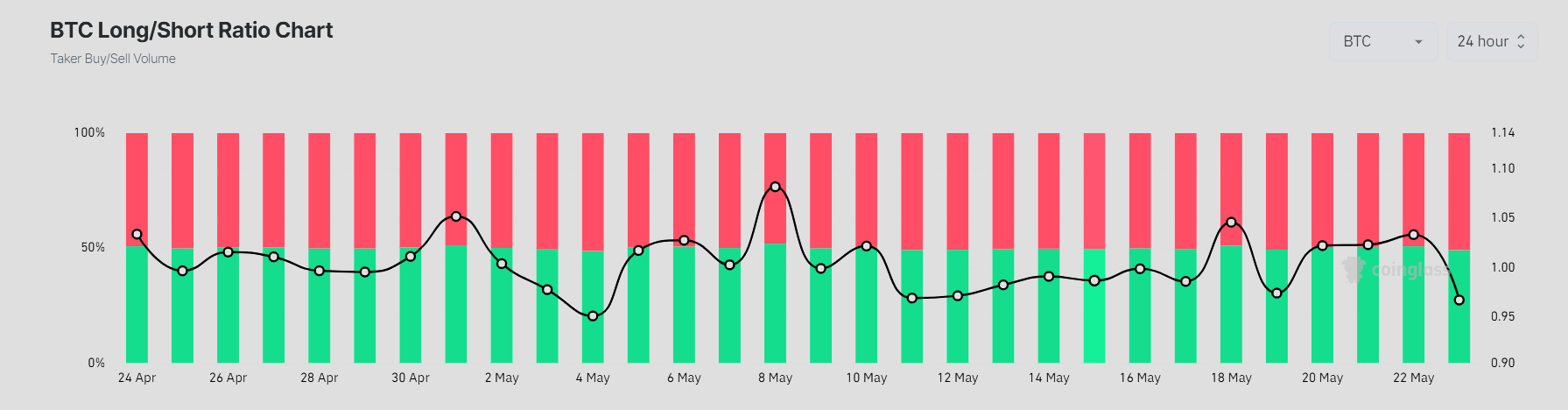

The long -term ratio shows the confusion of the market

Bitcoin dropped to $ 108,000 after the announcement, down compared to a session summit of $ 111,000. It has since given itself to around $ 109,000 but remains under pressure. The overall cryptography market is down 4% in the last 24 hours.

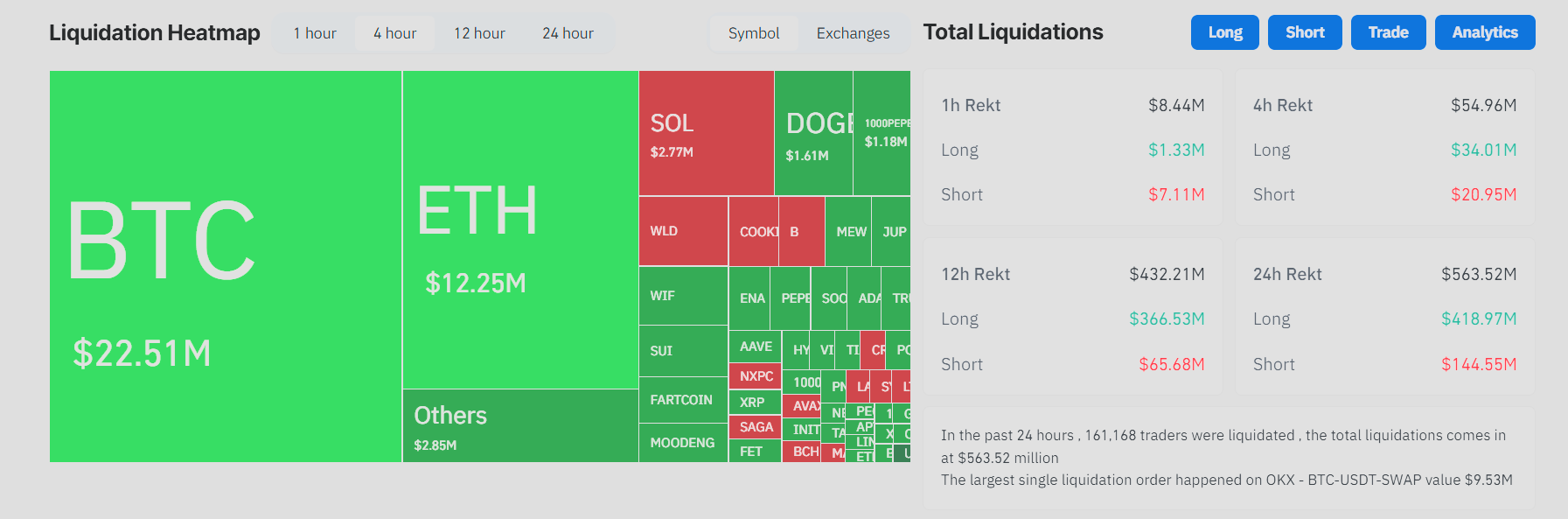

Coinglass data shows $ 64.13 million in cryptographic liquidations over the past four hours. Long positions represented $ 34.05 million, while uncovered positions represented $ 30.09 million.

Bitcoin alone experienced $ 24.4 million in liquidations, with Ethereum at $ 15.16 million.

Meanwhile, the Bitcoin long-short ratio remains almost equal, which shows short-term uncertainty in the direction of the market. Yesterday, long positions of Bitcoin dominated the graphics at 54%.

Solana, XRP and several altcoins have also experienced high volatility, reflecting increased volatility at all levels.

Most altcoins have experienced greater erasure in long positions, suggesting that retail merchants have been caught by the sudden change in policy.

Growing concern about macro-valatility

The American trade agreement earlier this month has provided an essential boost to the cryptography market. It was an indication that macroeconomic uncertainty could be assessed. However, Trump’s EU threats have injected renewed concerns.

Analysts warn that the tariff announcement could be the start of a broader economic disruption. European stock indices have dropped sharply and American technological actions also faced sales pressure.

In Crypto, the thermal liquidation card reflects a market captured between downward fear and attempts to retrace upwards.

The situation is fluid. If the tariff threat degenerates into a complete dispute, risk assets, including cryptocurrencies, can face additional opposite winds. The merchants carefully carefully watch or a sign of EU negotiation.

In the past 24 hours, 162,419 merchants have been liquidated, totaling $ 567.65 million. Although the crypto has often acted as a cover during traditional market stress, today’s movements show that it is not immune to world policy shocks.

Volatility can persist as frames of geopolitical uncertainty.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.