US Interest Rate Decision, FOMC Meeting to Decide Crypto Trends

The cryptocurrency market has experienced a sharp increase and many purchasing activities after Donald Trump’s return to the White House. With the signing by Trump of several decrees supporting the cryptocurrency market, more and more people are interested in trading. Next week is important for the market because the meeting of the Open Market Federal Committee (FOMC) and decisions concerning interest rates, as well as other major economic news, will probably influence future market trends.

The markets remain stable and bullish despite Trump’s new policy

This week, everyone focused on the policy of the American president Trump after his entry into office, and it seems that the markets are doing quite well so far. Instead of causing concern, his announcements make people more optimistic. He spoke of significant investments in artificial intelligence (AI), contributions of significant changes to cryptography policy, maintenance of low interest rates and inflation control by reducing oil prices. This encouraged investors to take more risks, which allowed the S&P 500 to reach a new record.

Read also: Bitcoin prices 2025: will BTC exceed $ 109,000 and will he reach a new historic summit?

While we are entering a new week, several important events could shape future trends in the cryptocurrency market.

Season of 4th quarter results in the United States

Next week, large technological companies like Microsoft, Meta Platforms, Tesla and Apple should publish their results. Analysts predict that these major players, as well as three other large companies, will see their profits increase by more than 17 % over the next year, almost double the growth of 9 % expected for the 493 other companies.

Since these companies are highly valued, investors will likely seek more than the usual profits of profits and income.

American FOMC meeting

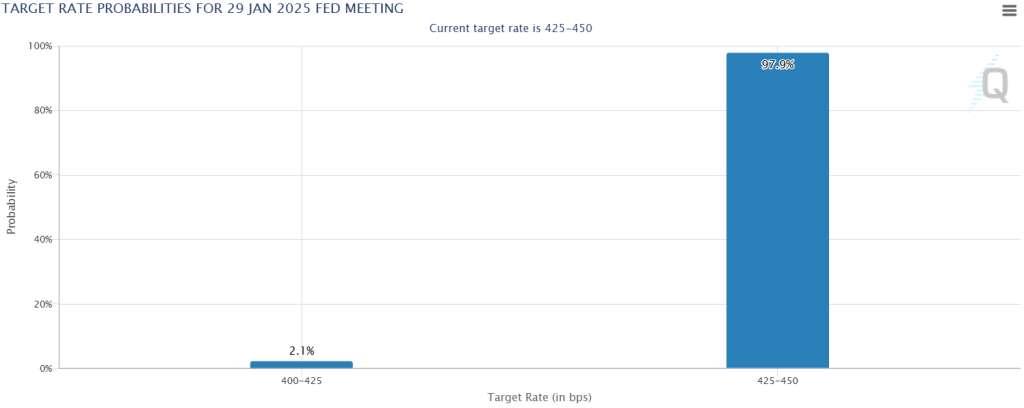

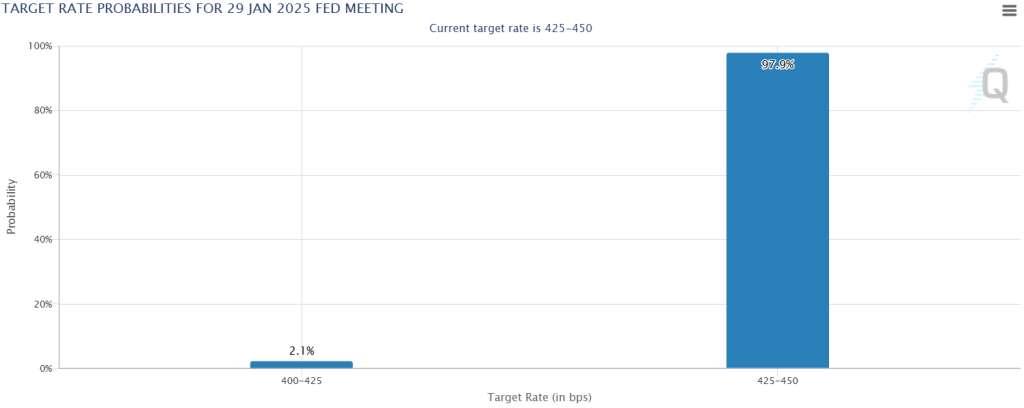

It is widely expected that the federal reserve maintains its main interest rate unchanged this Wednesday pending more information showing that inflation is declining.

During the World Economic Forum of Davos, in Switzerland, Trump said that he would insist on an immediate reduction in interest rates worldwide, returning to his frequent but ineffective pressures on the Fed during his first mandate. At the start of his second term, Trump has already tightened immigration and announced his intention to increase import taxes from February 1.

This creates uncertainty for the Fed, which makes it difficult to plan its monetary policy. The Fed will meet soon and should maintain the current interest rate between 4.25 %and 4.50 %, as recent data support a progressive approach to achieve its inflation target of 2 %.

The president of the FED, Jerome Powell, and his team are confronted with the challenge of balancing the current monetary policy with the uncertainties about the future and to decide what they must reveal on the prospects of the Fed.

PRICE CONSULTS PRICE CONSULT CONSUMPTION in the United States (PCE)

In November, the overall PCE prices in the United States increased by 2.4 % compared to last year, which represents an increase compared to the lowest over three years of 2.1 % observed in September. The PCE price index, which the FED uses to assess underlying inflation, has only increased by 0.1 %, the lowest increase in six months. This made it possible to maintain the basic annual rate of the PCE at 2.8 % in December, which was less than 2.9 % expected.

For the future, the Global PCE should reach 2.6 % over a year, which will be announced on Friday. The basic inflation rate of the PCE should also remain stable at 2.8 %.

Decision on interest rates of the European Central Bank (ECB)

The ECB is expected to reduce its interest rates by 0.25 % at its next January 30 meeting, bringing the rate to 2.75 %. This would be the fifth drop in rates since June 2024, intended to support economic growth.

Conclusion

With the Fed probably on a break, the ECB on the point of reducing its rates and the pro-Crypto signals of Trump still fresh, the crypto market seems to be positioned for a generally upward week. However, traders must prepare for volatility around the FOMC announcement and the publication of the main results of companies.