Two Satoshi Era Wallets Move 20,000 Bitcoin After 14 Years of Silence

The cryptography market buzzes after two old Bitcoin wallets, holding 20,000 BTC, is suddenly again active after 14 years of “hibernation”.

This event not only drew attention due to the enormous value involved, but also sparked speculation about its meaning and impact on the market.

Sleeping $ 2 billion in bitcoin movements as the markets speculate

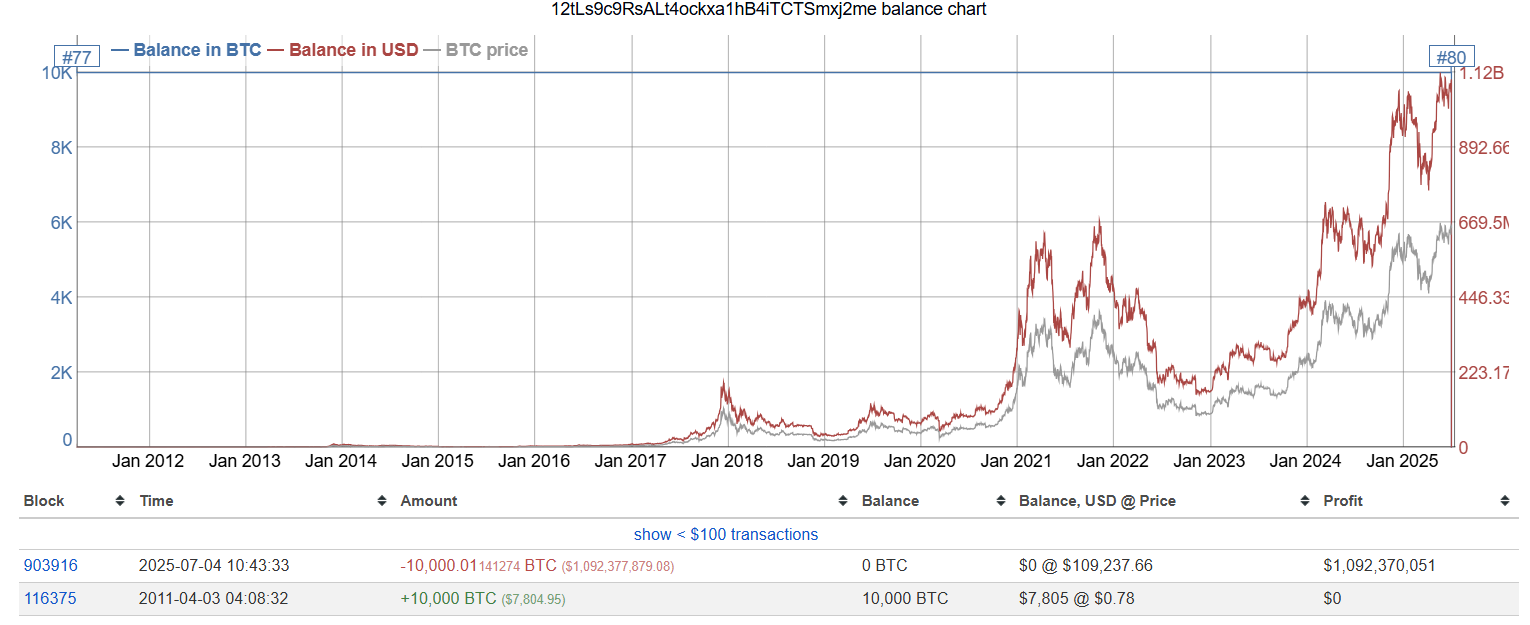

According to Lookonchain, one of these portfolios was created on April 3, 2011, when Bitcoin was at only $ 0.78. At the time, the owner bought 10,000 BTC at a total cost of less than $ 7,805.

This portfolio has not shown no activity for more than a decade. Then, early July 4, 2025, the entire balance of the BTC was moved.

On the same day, Lookonchain also detected another portfolio that had held 10,000 BTC since 2011, which has made a similar movement.

These two portfolios hold a total of 20,000 BTC with a total value of more than $ 2 billion and have transferred all their bitcoin to new addresses. These movements are rare for the wallets of “the Satoshi era”, referring to the early years of Bitcoin when Satoshi Nakamoto was active. These portfolios used the inherited format, which was common at the time but which is now rarely used.

The transfer of 20,000 BTCs occurred while the Bitcoin price has oscillated near record peaks, or about $ 110,000 per room. This added even more intrigue to the possible patterns of the owners.

Some X users have suggested that this could be a sign of the first investors (OG Hodlers) finally deciding to withdraw after having detained for more than a decade. After all, the price of Bitcoin has increased hundreds of thousands of times compared to the time they bought.

“$ 7,805 to $ 1.09 billion … This is the best investment decision of the century …”, said X Crypto Alpha.

Other theories have emerged, including the idea that the portfolios could have been compromised, but there is no concrete evidence. The owners could also move their bitcoin to new wallets for better security or prepare for future transactions.

Whatever the reason, the price of Bitcoin on July 4 remained relatively stable, oscillating about $ 109,000 without major fluctuations.

Bitcoin currency days destroyed metric increases in the second quarter

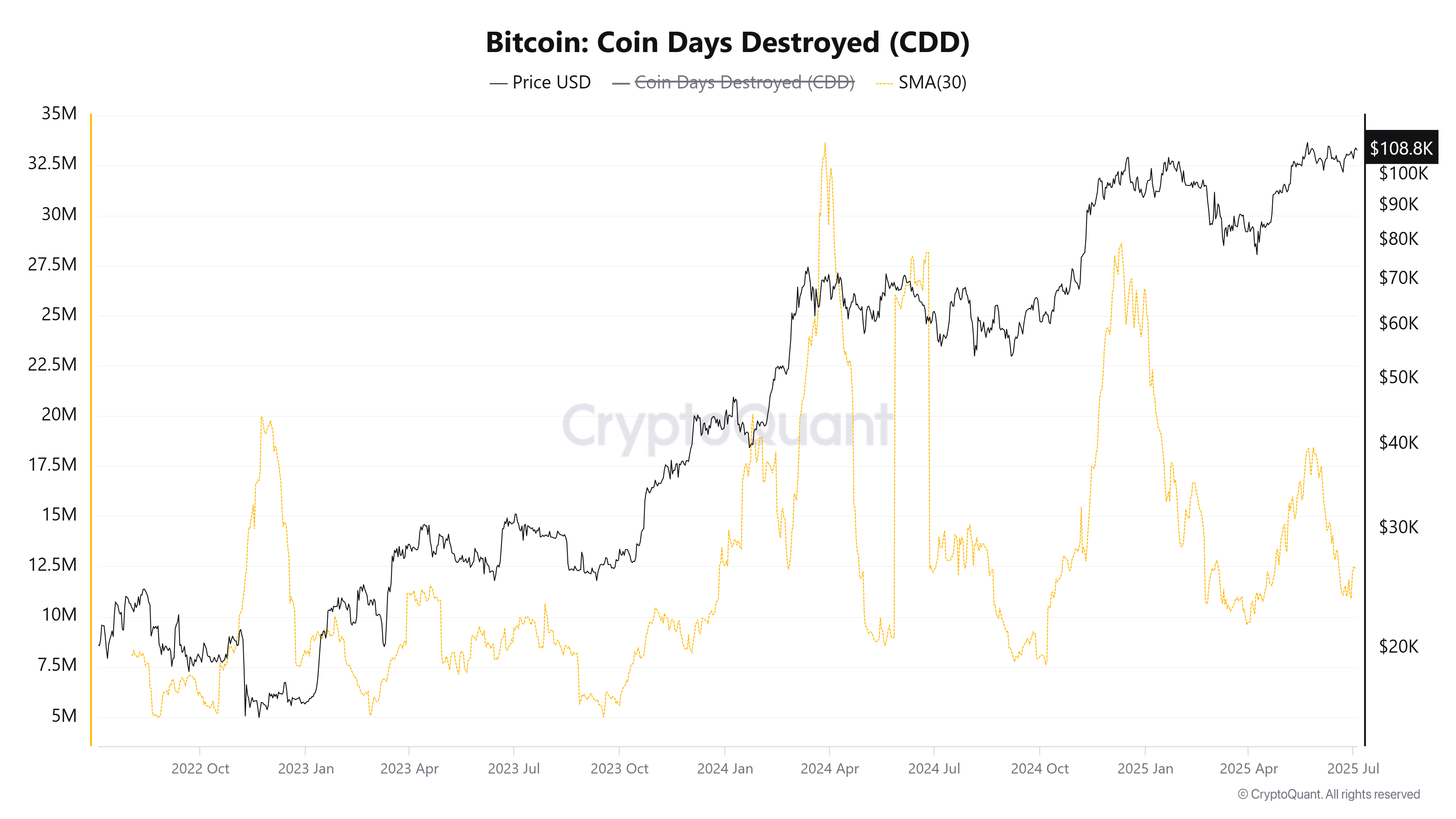

Destroyed currency days (CDD) are a metric on a chain that measures the real level of Bitcoin activity. He examines how long the parts remained “sleeping” before being spent.

A high CDD means that many “old” parts (with many days of accumulated parts) are moved.

Crypto data show that the CDD increased from 10 million to 17.5 million in the second quarter, before going back to 11 million in early July.

If the long -term Bitcoin whale wallets become active and the CDD increases sharply, this could considerably affect the price.

The portfolios of the Satoshi Post era move 20,000 bitcoin after 14 years of silence appeared first on Beincrypto.