Two Signs Indicate Profit-Taking May End the 7-Week Rally

Bitcoin posted seven consecutive weeks of earnings, pushing its price more than $ 100,000. However, the new signals suggest that this increased sequence could soon end.

The identification of the precise moment of a price reversal is difficult. However, some signs may indicate an increase in risks, especially for investors who have not yet established solid positions.

Two panels indicate that profit can end the 7 -week rally

The first notable sign is that the portfolios with large sales have stopped accumulating and began to distribute their parts.

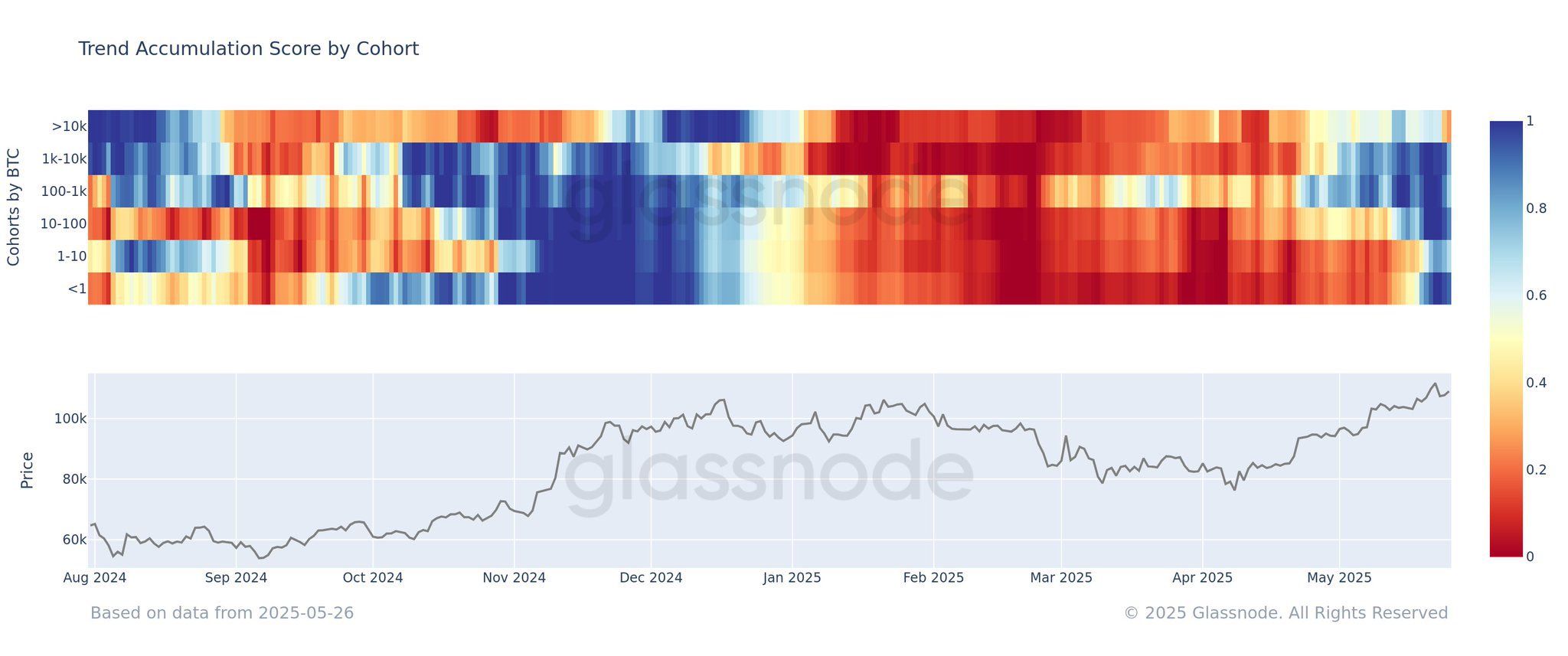

Glassnod data confirm this trend. In May, the accumulation score for portfolios containing more than 10,000 BTC rose from approximately 0.8 to less than 0.5. This change is visually represented by a color change from blue to orange.

“The portfolio group holding the most BTC has started to distribute,” said Thuan Capital.

In addition, the portfolios between 1 BTC and 10,000 BTC have lower accumulation behavior, as seen through blue tones that gradually set off. Only portfolios with less than 1 BTC show a clear passage from distribution to a strong accumulation, triggered by Bitcoin reaching a new summit of all time.

These data points reflect a tendency to profit from among major investors. At the same time, small retail investors seem to be motivated by the FOMO (fear of missing) when they pursue short -term opportunities.

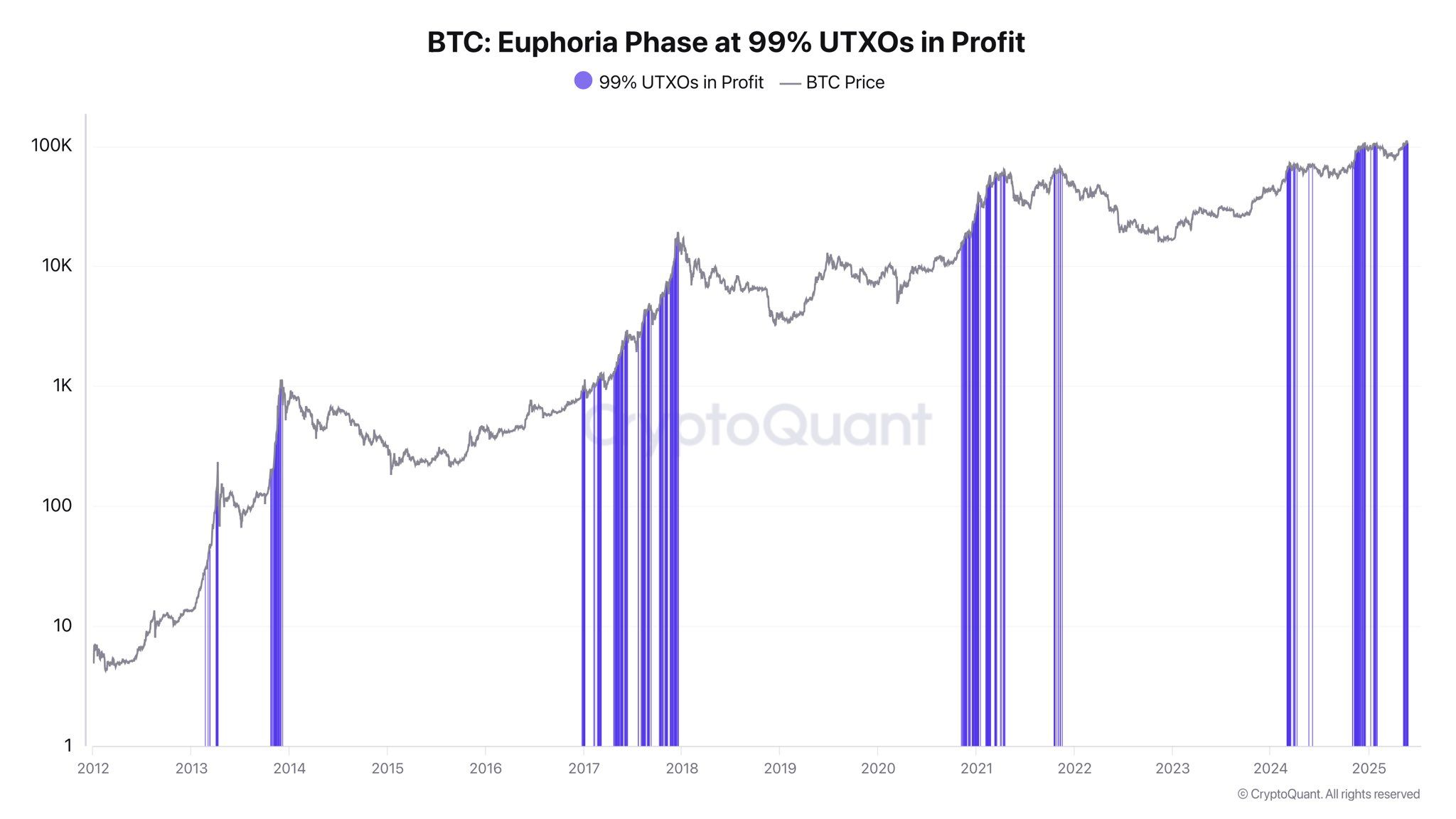

Another warning panel comes from unattained transaction outputs (UTXOS). UTXOs are a technical mechanism that guarantees that each individual BTC can only be spent once on the blockchain. They also provide a way to assess unpaid profits in all unattractive BTC.

Cryptoque data show that when 99% of UTXOs are in profit, this generally signals an overheating phase on the market. Historically, such phases often precede price corrections. Whether the correction is short or in the long term, this signal always highlights a growing risk for buyers.

“Right now, it is difficult to say that we are in a euphoric phase. The broader macroeconomic context and uncertainty surrounding the political direction of the Trump administration make it difficult for investors to completely reverse the risk.

For the moment, the Bitcoin rally has interrupted about $ 108,000. There is not yet a clear sign of a correction. Beincryptto reports a strong wave of bitcoin accumulation among companies around the world. Many experts remain optimistic about the future price of Bitcoin.

“A tidal wave of institutional demand is to reshape the dynamics of the Bitcoin market: the platforms for the management of wealth ready to deploy access to Bitcoin ETF, corporate treasury bills adding bitcoin to stimulate shareholders’ yields, and diversifying sovereigns of Bitcoin reserves to shake the geopolitical risk. Cement his role as a global value store, ”said the main investment strategist at Bitwise Asset Management at Beincrypto.

Consequently, although these short -term indicators can refer to a decline in current summits, they do not seem to affect the wider expectations of analysts for this year and this next one.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.