Uniswap (UNI) Price Set for 30% Surge? Key Levels to Watch

Uni, the native token of a uniswap, seems bruise and is ready for a massive rise after a prolonged drop in prices and a downward market trend. This change of feeling has occurred while the global cryptography market began to undergo a price reversal and to train bullish price actions.

UNISWAP (UNI) Technical analysis and future levels

According to an expert technical analysis, the UNI seems to form a double -bottomed double -bottom price model on the daily time. So far, UNI’s daily graphic has shown two stockings, but the asset is still forming the second stage of the pattern.

In addition to this bullish scheme, the UNI has also formed a bullish divergence, where its relative force index (RSI) makes a low lower, signaling a potential price reversal.

Based on the action of recent prices and historical models, if UNI held above the level of $ 5.75, there is a strong possibility that it can initially rise by 15% to reach the décolleté of the double-bottom model at $ 7.15. However, if this bullish impulse continues and uni violates the neckline, closing a daily candle greater than $ 7.15, it could rally an additional 15%, reaching the level of $ 8.25 in the future.

The current price of the uni

At the time of the press, the UNI is negotiated nearly $ 6.21 and has earned more than 4% in the last 24 hours. However, during the same period, due to the reduction in the interests of merchants and investors, the volume of negotiation of the assets dropped by 25% compared to the day before.

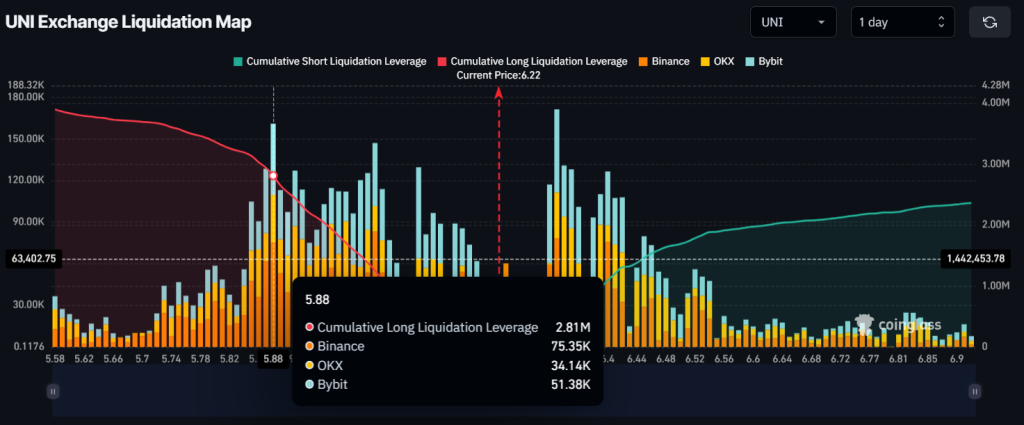

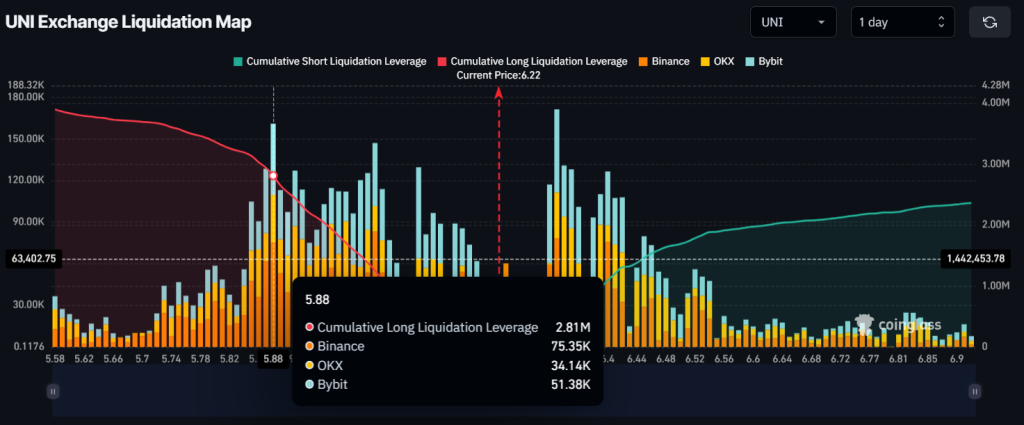

$ 2.80 million for a long position

With these bullish market prospects, intrajournal traders seem to follow the same amount of motion, as Coinglass Data reported.

The UNI Exchange Liquidation Card has revealed that traders are currently over $ 5.88 on the lower side and $ 6.33 on the upper side, with $ 2.81 million and $ 400,000 in long and short, respectively.

This strong and massive bet on the long side reveals the bullish feeling of traders.