US Economic Indicators With Crypto Implication This Week

Cryptographic markets entering the second week of July, merchants and investors must monitor several American economic signals or economic indicators. These data points could influence their portfolios, potentially causing overvoltage or a drop in the price of Bitcoin (BTC).

The influence of American economic indicators on the Bitcoin price was significant in 2025, after a period of dissipation in 2024.

American economic indicators to be monitored this week

Although several American economic signals are published this week, only the following elements can be ready to stimulate the feeling of bitcoin and cryptography.

Consumer credit

The first American economic indicator to look at this week is due on Tuesday, which will follow borrowing trends while reflecting consumer confidence and spending power.

After the US consumer credit increased by $ 17.87 billion in April, economists planned an increase of $ 10 billion in May. If this prediction is correct, it would almost align itself with the reading of March 10.85 billion dollars.

Since the drop in credit levels suggests a lack of optimism on the market, a drop in credit to American consumers could divert the capital of traditional markets to speculative assets such as Bitcoin, consumers supplying economic growth.

More closely, stagnant or falling from credit often indicates caution, Bitcoin as an essential investment to hide against economic slowdown or Fiat instability.

FOMC minutes

The minutes of the Fed FOMC meeting are another American economic signal likely to cause volatility in the Bitcoin price. This data point on Wednesday comes after the Federal Open Market Committee (FOMC) decided to leave stable interest rates in May.

Following this decision, the American Labor Statistics Bureau (BLS) revealed that inflation increased at an annual rate of 2.4% in May, after 2.3% in annual sliding (Yoy) in April.

For the first time since January 2025, IPC inflation is back in May. In the United States, inflation remains greater than the target target of the Fed and mandate to obtain a maximum job.

“The committee seeks to achieve maximum employment and inflation at the rate of 2% in the longer term. Uncertainty about economic prospects has increased further,” said the American federal reserve in its release in May.

The Wednesday report offers merchants and investors a window on the management of monetary policy of the Federal Reserve (Fed). The minutes detailed discussions on interest rates, inflation and economic growth, probably influencing the feeling of the market.

A bellicist tone would suggest a more strict or less rate of rate reductions, which could see Bitcoin in the bottom of the pressure. A stronger US dollar would cause a potential drop in the price of bitcoin.

On the other hand, the FOMC signaling of a dominant perspective would suggest incoming rate cuts, which potentially increases the appetite for risks. Such a decision would lead to capital in the crypto, as cheaper borrowing encourages investments in high growth assets.

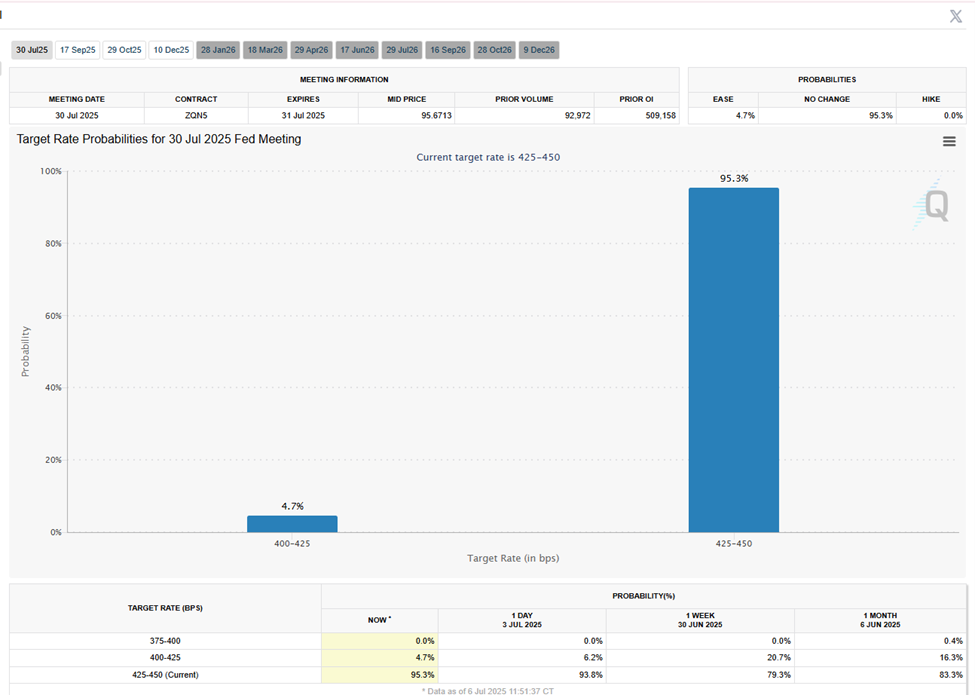

According to the CME Fedwatch tool, the interests of interest bet 95.3% of the Fed maintaining the stable interest rates at the next meeting on July 30.

Notwithstanding, the president of the FED, Jerome Powell, could reaffirm the previous comments on the resolution of premature rate drops despite the political decline of President Trump. Given the sensitivity of Bitcoin to liquidity, any unexpected pivot could arouse volatility.

Meanwhile, the president of the Fed, Jerome Powell, continues to blame President Trump’s prices for his refusal to reduce interest rates.

He defended the FOMC’s universal decision to stabilize the rate of federal funds. Powell cited the expected inflation bubbling the prices this summer of commercial policies. These constitute external sales taxes on imported goods and services.

Initial unemployment complaints

In addition, the first unemployment claims are on the surveillance list among the American economic signals of this week. This data point will highlight the number of American citizens who asked unemployment insurance for the first time last week.

Economists anticipate a modest increase to 235,000 last week after the 233,000 said for the week ending on June 28. This American economic indicator could infirmLance feeling like this American data on the labor market is gradually developing as the next Bitcoin macro.

Despite the expectation of a modest increase, the rise in allegations could point out an economic softening. This could stimulate Bitcoin because traders provide Fed rate drops later in the year. On the other hand, lower complaints can strengthen the dollar, putting pressure on cryptography prices.

Digital asset tax policy

Another data point that could influence the feeling of Bitcoin is the audience on digital asset tax policy on Wednesday, July 9.

That day, the House Ways & Means Oversight subcommittee will hold an audience on “making America the world capital of cryptography”. The country focuses on the construction of a 21st century fiscal policy framework for digital assets.

The general emphasis is on the affirmative stages necessary to place a fiscal policy framework on digital assets.

“No ceiling gains of crypto tax is the only way to make America the world capital of cryptography,” said a user.

Meanwhile, with these American economic signals in the pipeline, Bitcoin was negotiated at $ 109,150 when writing this article, up more than 1% in the last 24 hours.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.