US Stagflation Fears Triggered as Bitcoin Face Fed Policy Crisis

President Trump’s pricing policies create risks of stagflation in the American economy. This threatens both traditional markets and cryptocurrency prices because the federal reserve is faced with difficult political choices.

The new American tariff order under President Donald Trump seems to be reaching his last step. However, signs of emerging stagflation in the American industrial sector.

Economic data shows the warning of American stagflation

The Institute for Supply Management announced on Tuesday disappointing data. The US services for July reached 50.1, below 51.5 expectations. Although it is still above the 50 extension bar, which means that the services sector is developing, it fell 0.7 points compared to June 50.8.

In short, the economy of services in the United States is still growing, but much slower than expected, and it is dangerously close to shrinking.

The employment index fell to 46.4, down 0.8 points compared to the previous month. When it goes below 50, it means that companies cut jobs and that it marks the lowest level since March. Conversely, the price index jumped from 2.4 points to 69.9 – the highest since October 2022. When that exceeds 50, this means that prices increase rapidly.

This combination creates stagflation, where fewer jobs exist while prices are increasing simultaneously. For ordinary people, it is more difficult to find work while everything costs more. The decision -makers face an impossible choice between the fight against unemployment and the control of inflation.

For central banks, the fight against inflation requires rate increases, while stimulating growth requires rate reductions. Both problems cannot be solved simultaneously. In stagflation, central banks may find it difficult to reduce rates decisively.

More signs of stagflation will crush the cryptography market

This backdrop weighed strongly on the American financial markets on Tuesday. The Dow Jones dropped from 61.90 points (0.14%) to 44,111.74. The S&P 500 fell from 30.75 points (0.49%) to 6,299.19. The Nasdaq decreased by 137.03 points (0.65%) to close to 20,916.55. Bitcoin also dropped by around 1%.

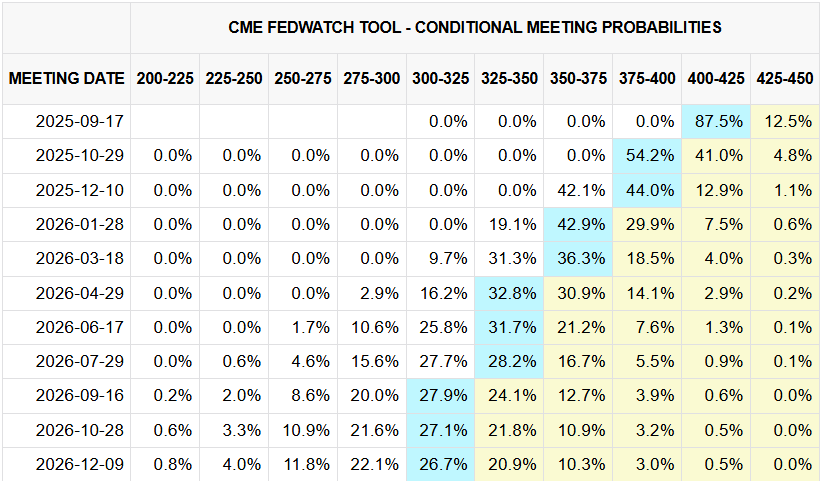

After the report of the July jobs, expectations changed for the federal reserve policy. The markets are now awaiting two rate drops this year instead of three. According to the Fedwatch tool of the CME group, the markets expect 25 points discounts in September and October.

The probability difference between a rate rate and a decrease in December is only 2%. However, if the stagflation signals are strengthened, this gap will probably widen.

This problem could have a significant impact on the prices of cryptography. Since the congress adopted the law on engineering on July 18, Bitcoin showed an increasing sensitivity to economic data. Most Altcoins followed the Bitcoin movement accordingly.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.